Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what ? 1. Bob and Dan both live in Kansas. They bought their wives $15,000 diamond earrings for Christmas. Bob paid sales tax on his

what ?

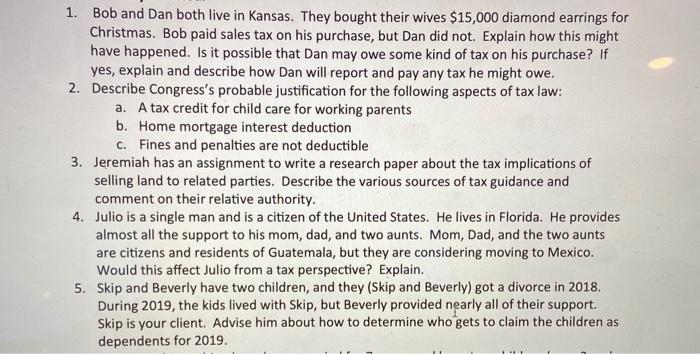

1. Bob and Dan both live in Kansas. They bought their wives $15,000 diamond earrings for Christmas. Bob paid sales tax on his purchase, but Dan did not. Explain how this might have happened. Is it possible that Dan may owe some kind of tax on his purchase? If yes, explain and describe how Dan will report and pay any tax he might owe. 2. Describe Congress's probable justification for the following aspects of tax law: a. A tax credit for child care for working parents b. Home mortgage interest deduction C. Fines and penalties are not deductible 3. Jeremiah has an assignment to write a research paper about the tax implications of selling land to related parties. Describe the various sources of tax guidance and comment on their relative authority. 4. Julio is a single man and is a citizen of the United States. He lives in Florida. He provides almost all the support to his mom, dad, and two aunts. Mom, Dad, and the two aunts are citizens and residents of Guatemala, but they are considering moving to Mexico. Would this affect Julio from a tax perspective? Explain. 5. Skip and Beverly have two children, and they (Skip and Beverly) got a divorce in 2018. During 2019, the kids lived with Skip, but Beverly provided nearly all of their support. Skip is your client Advise him about how to determine who gets to claim the children as dependents for 2019 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started