Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what action would you recommend Thiago Silva is a new trainee in the foreign exchange services department of a major Brazilian bank. He is considering

what action would you recommend

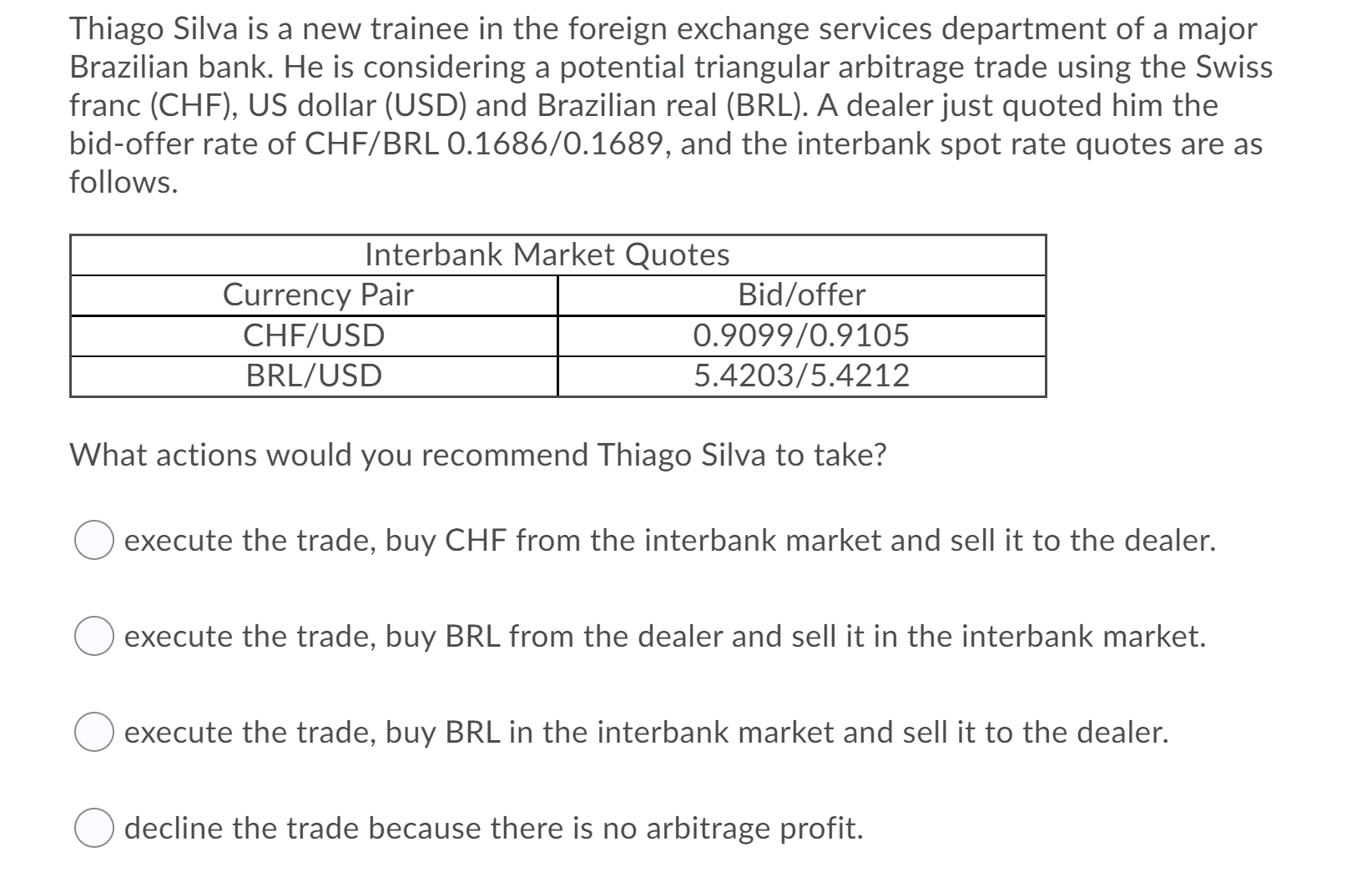

Thiago Silva is a new trainee in the foreign exchange services department of a major Brazilian bank. He is considering a potential triangular arbitrage trade using the Swiss franc (CHF), US dollar (USD) and Brazilian real (BRL). A dealer just quoted him the bid-offer rate of CHF/BRL 0.1686/0.1689, and the interbank spot rate quotes are as follows. Interbank Market Quotes Currency Pair Bid/offer CHF/USD 0.9099/0.9105 BRL/USD 5.4203/5.4212 What actions would you recommend Thiago Silva to take? execute the trade, buy CHF from the interbank market and sell it to the dealer. execute the trade, buy BRL from the dealer and sell it in the interbank market. execute the trade, buy BRL in the interbank market and sell it to the dealer. decline the trade because there is no arbitrage profitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started