Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What am I doing wrong? Can you help me with the one's marked wrong? Required stockholders' equity was $ 2 3 6 , 0 0

What am I doing wrong? Can you help me with the one's marked wrong? Required

stockholders' equity was $ at January

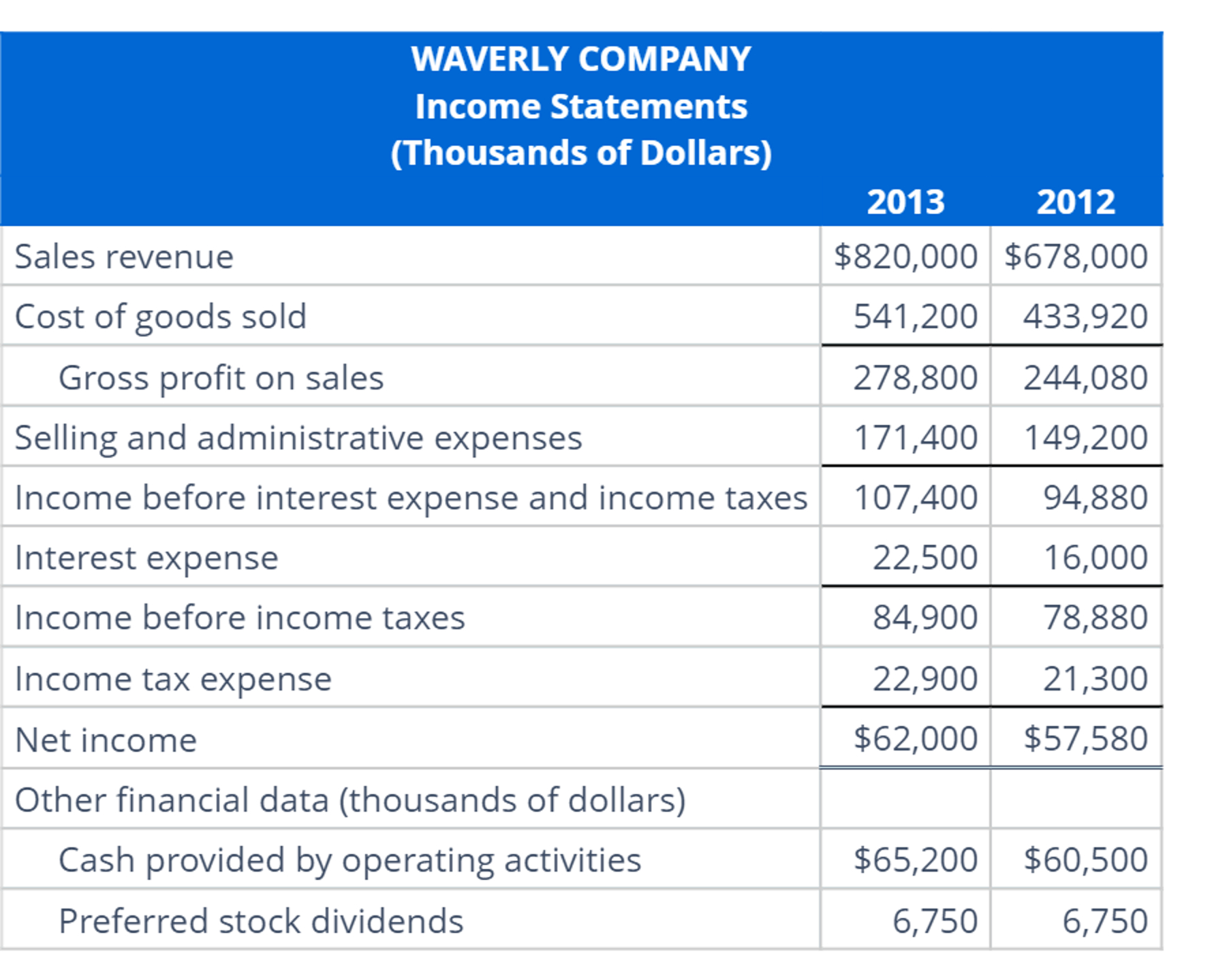

b Calculate commonsize percentages for each year's income statement.

Round answers to two decimal places. Ratios from Comparative and CommonSize Data

Consider the following financial statements for Waverly Company. During management obtained additional bond financing to enlarge its production facilities. The company faced higher production costs

during the year for such things as fuel, materials, and freight. Because of temporary government price controls, a planned price increase on products was delayed several months.

As a holder of both common and preferred stock, you decide to analyze the financial statements:

Operating cash flow to current liabilities ratio for

Inventory turnover ratio

Return on assets

Return on common stockholder equity and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started