Answered step by step

Verified Expert Solution

Question

1 Approved Answer

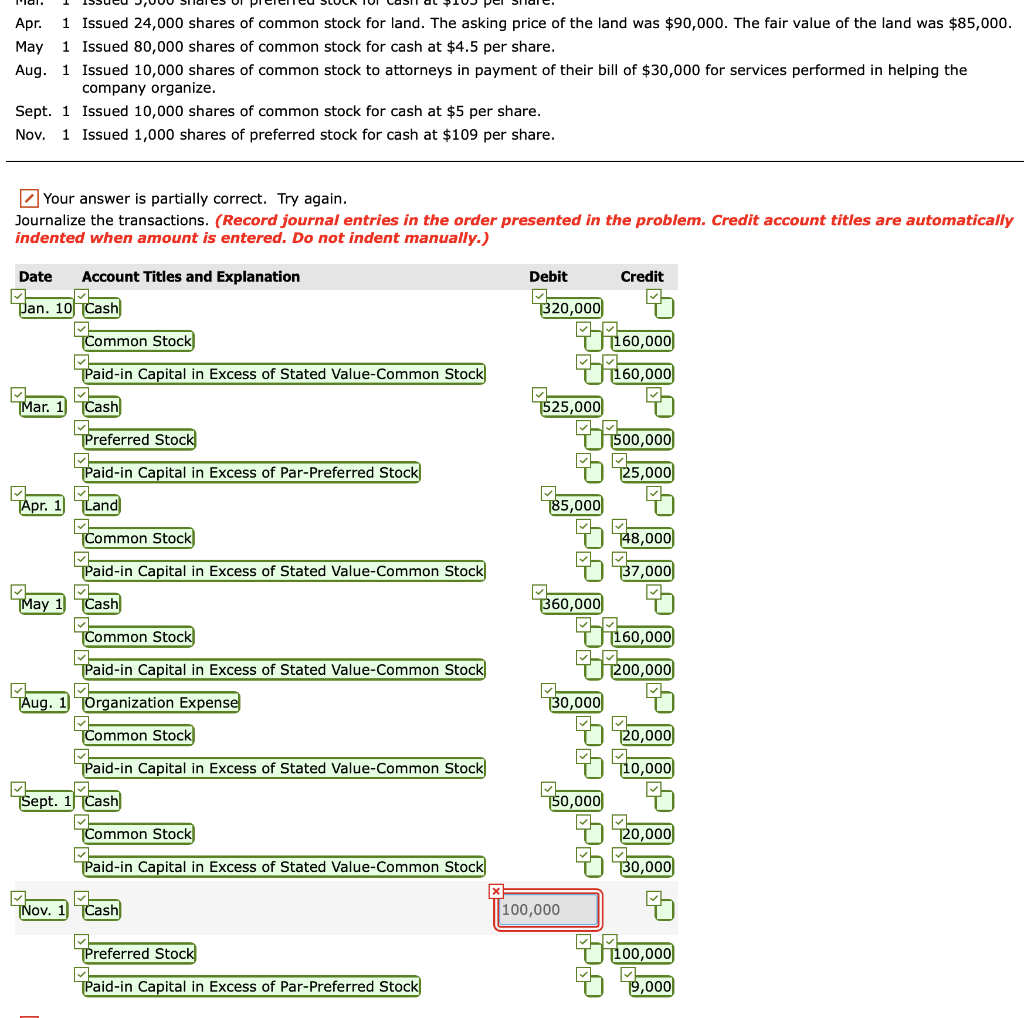

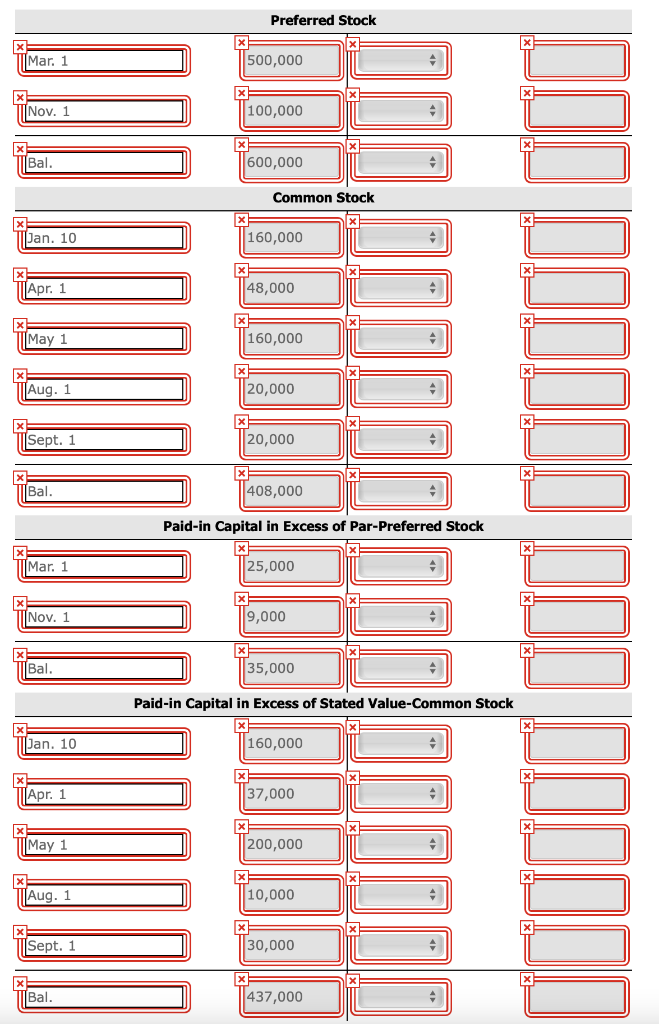

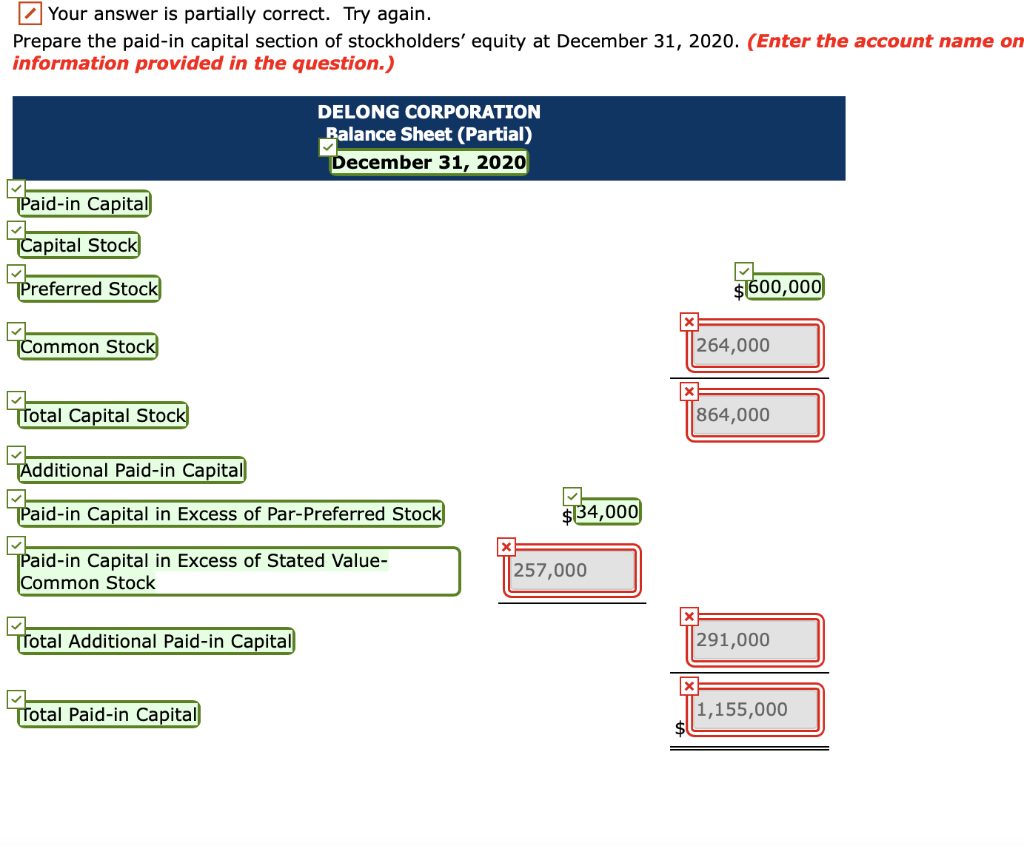

What am I doing wrong in the second and third sections? Please help Problem 13-01A a-c DeLong Corporation was organized on January 1, 2020. It

What am I doing wrong in the second and third sections? Please help

Problem 13-01A a-c

DeLong Corporation was organized on January 1, 2020. It is authorized to issue 10,000 shares of 8%, $100 par value preferred stock, and 500,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year.

| Jan. | 10 | Issued 80,000 shares of common stock for cash at $4 per share. | |

| Mar. | 1 | Issued 5,000 shares of preferred stock for cash at $105 per share. | |

| Apr. | 1 | Issued 24,000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land was $85,000. | |

| May | 1 | Issued 80,000 shares of common stock for cash at $4.5 per share. | |

| Aug. | 1 | Issued 10,000 shares of common stock to attorneys in payment of their bill of $30,000 for services performed in helping the company organize. | |

| Sept. | 1 | Issued 10,000 shares of common stock for cash at $5 per share. | |

| Nov. | 1 | Issued 1,000 shares of preferred stock for cash at $109 per share.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started