Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What am I missing in these? The required is for all of the questions, since it is connected. Thank you! Help Save& Exit Submit Required

What am I missing in these? The required is for all of the questions, since it is connected. Thank you!

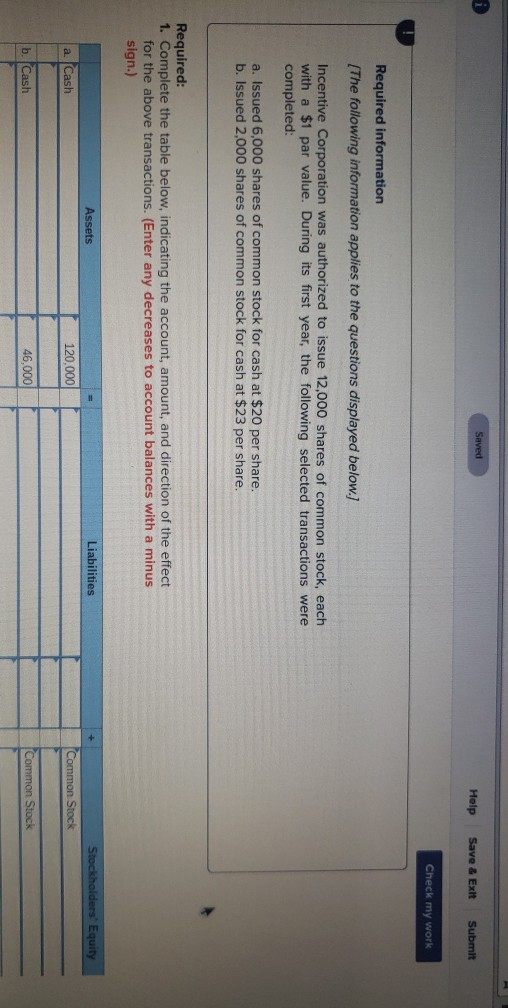

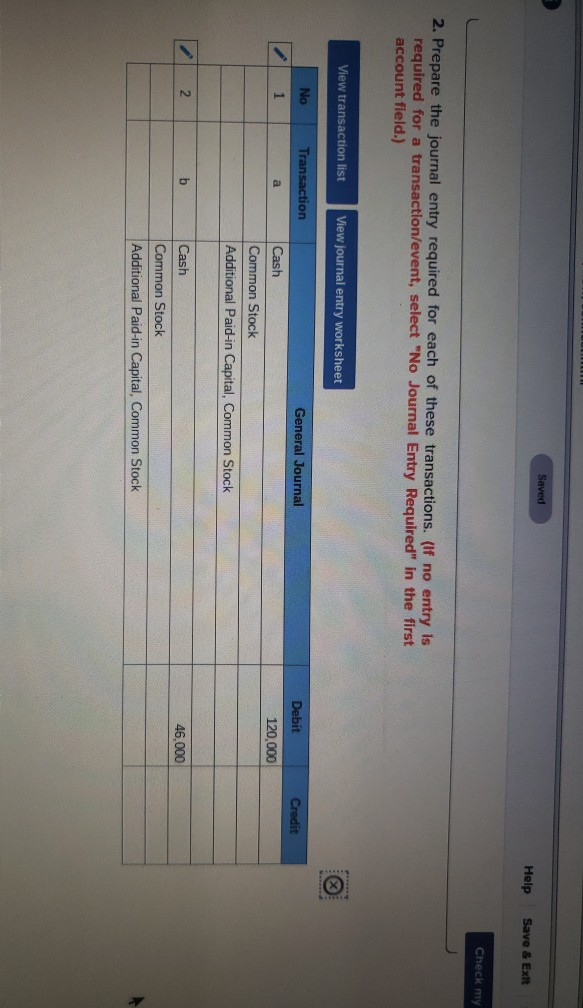

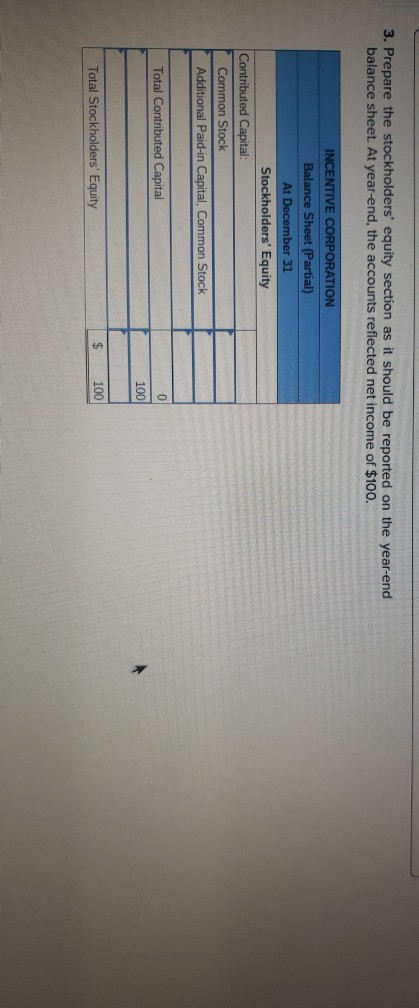

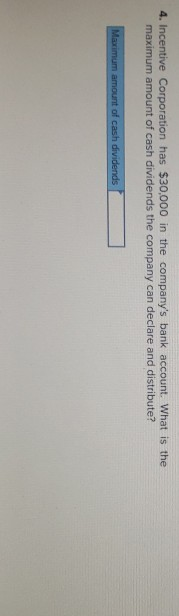

Help Save& Exit Submit Required information The following information applies to the questions displayed below7 Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $1 par value. During its first year, the following selected transactions were completed: a. Issued 6,000 shares of common stock for cash at $20 per share. b. Issued 2,000 shares of common stock for cash at $23 per share. Required: 1. Complete the table below, indicating the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) Liabilities a. 120,000 b. Cash 46.000 Help Save & Exit Check my 2. Prepare the journal entry required for each of these transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list l entry worksheet No Trans General Journal Cash 120,000 Stock Additional Paid-in Capital, Common Stock 46,000 Cash Common Stock Additional Paid-in Capital, Common Stock 2 3. Prepare the stockholders' equity section as it should be reported on the year-end balance sheet. At year-end, the accounts reflected net income of $100. INCENTIVE ON Balance Sheet (Partial) At ber 31 Stockholders' Equity Contri Common Stock Additional Paid-in Capital, Common Stock 100 $100 Total Stockholders' Equity 4. Incentive Corporation has $30,000 in the company's bank account. What is the maximum amount of cash dividends the company can declare and distributeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started