Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What amount of cash would be required to pay for direct material purchase? A manufacturing company is preparing the schedules that comprise its master budget.

What amount of cash would be required to pay for direct material purchase?

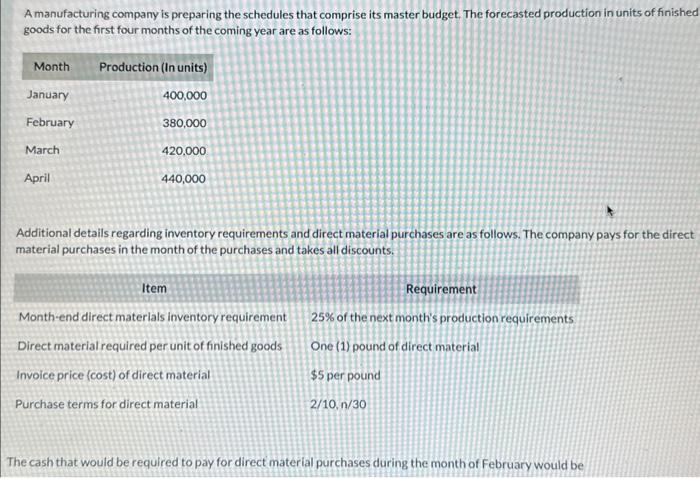

A manufacturing company is preparing the schedules that comprise its master budget. The forecasted production in units of finished goods for the first four months of the coming year are as follows: Month January February March April Production (In units) 400,000 380,000 420.000 440,000 Additional details regarding inventory requirements and direct material purchases are as follows. The company pays for the direct material purchases in the month of the purchases and takes all discounts. Item Month-end direct materials inventory requirement Direct material required per unit of finished goods Invoice price (cost) of direct material Purchase terms for direct material Requirement 25% of the next month's production requirements One (1) pound of direct material $5 per pound 2/10,n/30 The cash that would be required to pay for direct material purchases during the month of February would be

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Required Material for February 380000 units 1 pound per unit 380000 pounds Required Mater...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started