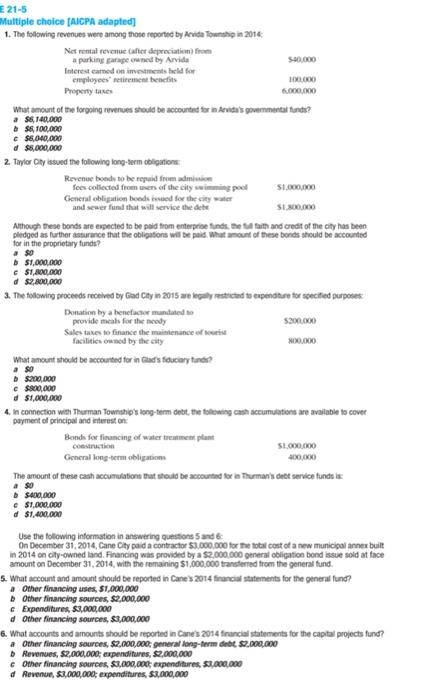

What amount of the forgoing revenues stovid be accounted for in Aevidas govemmentat funds? as s,140000 as siou, 000 e ss.040,000 d ss,000,000 2. Tapior Cly issued the following long-term obligations: Revenue boedv to be refaid finum admiuken foes collected froen wen of the city swinning poel $1,000,000 Gencral obligation boedk kwued for the siey water and seaer fund that will vervise the debe 31,30000 Athough tese bonds are expected to be pad trom enterproe finds the fa faith and oredt of the ofy has been pledged as further assurance that the obligatons wil be paid. What anount of these bonds should be accounted for in the proprietary funds? a 80 b 51,000,000 e 51,800,000 d 52,800,000 3. The fodswing proceeds received by Gad Caty in 2015 are legely restictad to eapendture for sgecfied purposes: Dotkation by a heneficker mumated to provide makls for the neody Sales taxes to finance the maithenance of motu facilities emest by the sity No0000 What amount should be accounted for in Clads fouciay find?? at $0 - 5220,000 c seove00 di 51,000,000 4. In connoction with Thurman Townshipls long-term dett, the folcuing cash aceurnulations are available to cover payment of peincipal and interest on. Bonds for fisancing of water treinimen plant coestructionGonerallongtotimobligationst.000.000sopo.000 The anount of these cash accumblationt that should be accourtad for in Thurman is dete serice funds ix: at $9 b sinotade e $1,000000 d $1,400,000 Use the following information in answering questons 5 and 6 : On December 31, 2014, Cane City paid a contractor 51 , 000.000 for the totat cost of a new municigal annex built in 2014 on city-owned land. Financing was provided by a 52,000.000 generat obligation bond issue soid at tace amount on December 31 , 2014, with the romaining $1,000,000 tranederred trom the general fund. 5. What acoount and amount should be reported in Cane s 2014 financial stafements for the general fund? a Other financing ases, $1,000,000 - Other financing sourees, $2,000,000 6 Expenditures, $3,000,000 a Other finaneing sources, 53,000,000 6. What accounts and amounts should be reported in Cane s 2014 fnancial statements for the capital projects fund? a Other financing sources, 52,000,000; generat long-term debt $2000,000 - Revenues, $2,000,000; expenditures, $2,000,000 c Other financing spurces, 52,000,000, expenditures, st ava a00 df Revenue, 53,000,000; expenditures, $3,000,000 What amount of the forgoing revenues stovid be accounted for in Aevidas govemmentat funds? as s,140000 as siou, 000 e ss.040,000 d ss,000,000 2. Tapior Cly issued the following long-term obligations: Revenue boedv to be refaid finum admiuken foes collected froen wen of the city swinning poel $1,000,000 Gencral obligation boedk kwued for the siey water and seaer fund that will vervise the debe 31,30000 Athough tese bonds are expected to be pad trom enterproe finds the fa faith and oredt of the ofy has been pledged as further assurance that the obligatons wil be paid. What anount of these bonds should be accounted for in the proprietary funds? a 80 b 51,000,000 e 51,800,000 d 52,800,000 3. The fodswing proceeds received by Gad Caty in 2015 are legely restictad to eapendture for sgecfied purposes: Dotkation by a heneficker mumated to provide makls for the neody Sales taxes to finance the maithenance of motu facilities emest by the sity No0000 What amount should be accounted for in Clads fouciay find?? at $0 - 5220,000 c seove00 di 51,000,000 4. In connoction with Thurman Townshipls long-term dett, the folcuing cash aceurnulations are available to cover payment of peincipal and interest on. Bonds for fisancing of water treinimen plant coestructionGonerallongtotimobligationst.000.000sopo.000 The anount of these cash accumblationt that should be accourtad for in Thurman is dete serice funds ix: at $9 b sinotade e $1,000000 d $1,400,000 Use the following information in answering questons 5 and 6 : On December 31, 2014, Cane City paid a contractor 51 , 000.000 for the totat cost of a new municigal annex built in 2014 on city-owned land. Financing was provided by a 52,000.000 generat obligation bond issue soid at tace amount on December 31 , 2014, with the romaining $1,000,000 tranederred trom the general fund. 5. What acoount and amount should be reported in Cane s 2014 financial stafements for the general fund? a Other financing ases, $1,000,000 - Other financing sourees, $2,000,000 6 Expenditures, $3,000,000 a Other finaneing sources, 53,000,000 6. What accounts and amounts should be reported in Cane s 2014 fnancial statements for the capital projects fund? a Other financing sources, 52,000,000; generat long-term debt $2000,000 - Revenues, $2,000,000; expenditures, $2,000,000 c Other financing spurces, 52,000,000, expenditures, st ava a00 df Revenue, 53,000,000; expenditures, $3,000,000