Answered step by step

Verified Expert Solution

Question

1 Approved Answer

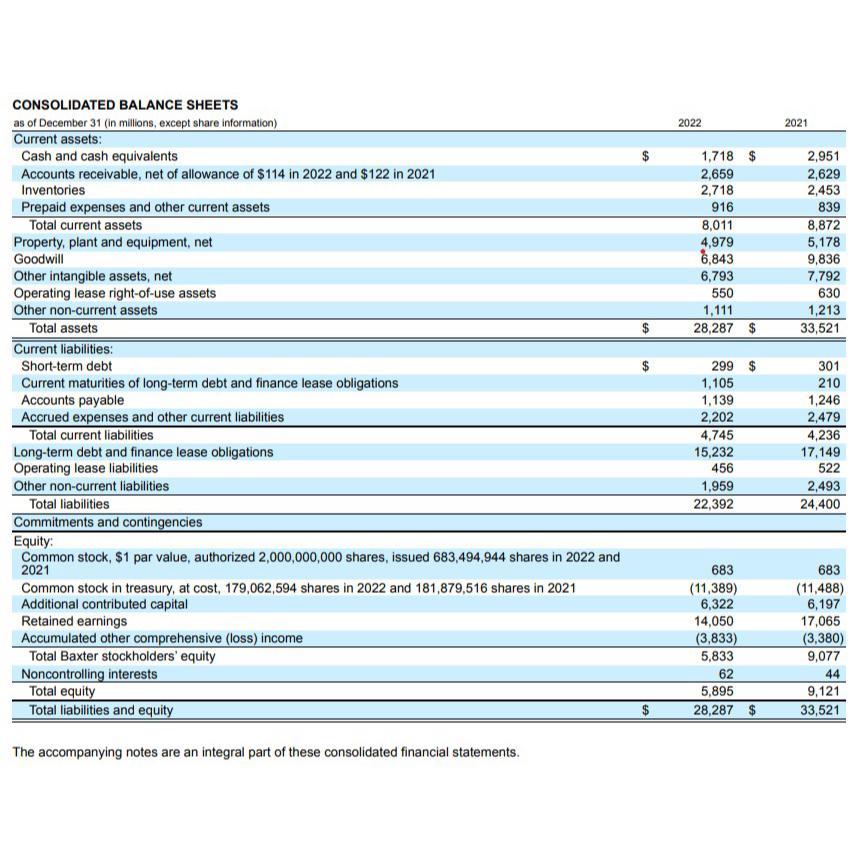

What are Baxters major assets? Calculate the proportions of current and long - term assets to total assets as of December 3 1 ,

What are Baxters major assets? Calculate the proportions of current and longterm assets to total assets as of December Do these proportions seem appropriate for a company such as Baxter? Discuss why or why not.

CONSOLIDATED BALANCE SHEETS as of December 31 (in millions, except share information) Current assets: Cash and cash equivalents Accounts receivable, net of allowance of $114 in 2022 and $122 in 2021 Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Goodwill Other intangible assets, net Operating lease right-of-use assets Other non-current assets Total assets Current liabilities: Short-term debt Current maturities of long-term debt and finance lease obligations Accounts payable Accrued expenses and other current liabilities Total current liabilities Long-term debt and finance lease obligations Operating lease liabilities Other non-current liabilities Total liabilities Commitments and contingencies Equity: Common stock, $1 par value, authorized 2,000,000,000 shares, issued 683,494,944 shares in 2022 and 2021 Common stock in treasury, at cost, 179,062,594 shares in 2022 and 181,879,516 shares in 2021 Additional contributed capital Retained earnings Accumulated other comprehensive (loss) income Total Baxter stockholders' equity Noncontrolling interests Total equity Total liabilities and equity The accompanying notes are an integral part of these consolidated financial statements. 2022 1,718 $ 2,659 2,718 916 8,011 4,979 6,843 6,793 550 1,111 28,287 $ 299 $ 1,105 1,139 2,202 4,745 15,232 456 1,959 22,392 683 (11,389) 6,322 14,050 (3,833) 5,833 62 5,895 28,287 $ 2021 2,951 2,629 2,453 839 8,872 5,178 9,836 7,792 630 1,213 33,521 301 210 1,246 2,479 4,236 17,149 522 2,493 24,400 683 (11,488) 6,197 17,065 (3,380) 9,077 44 9,121 33,521

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The image youve provided is a consolidated balance sheet for a company as of December 31st 2022 To answer the questions posed I will need to calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started