Answered step by step

Verified Expert Solution

Question

1 Approved Answer

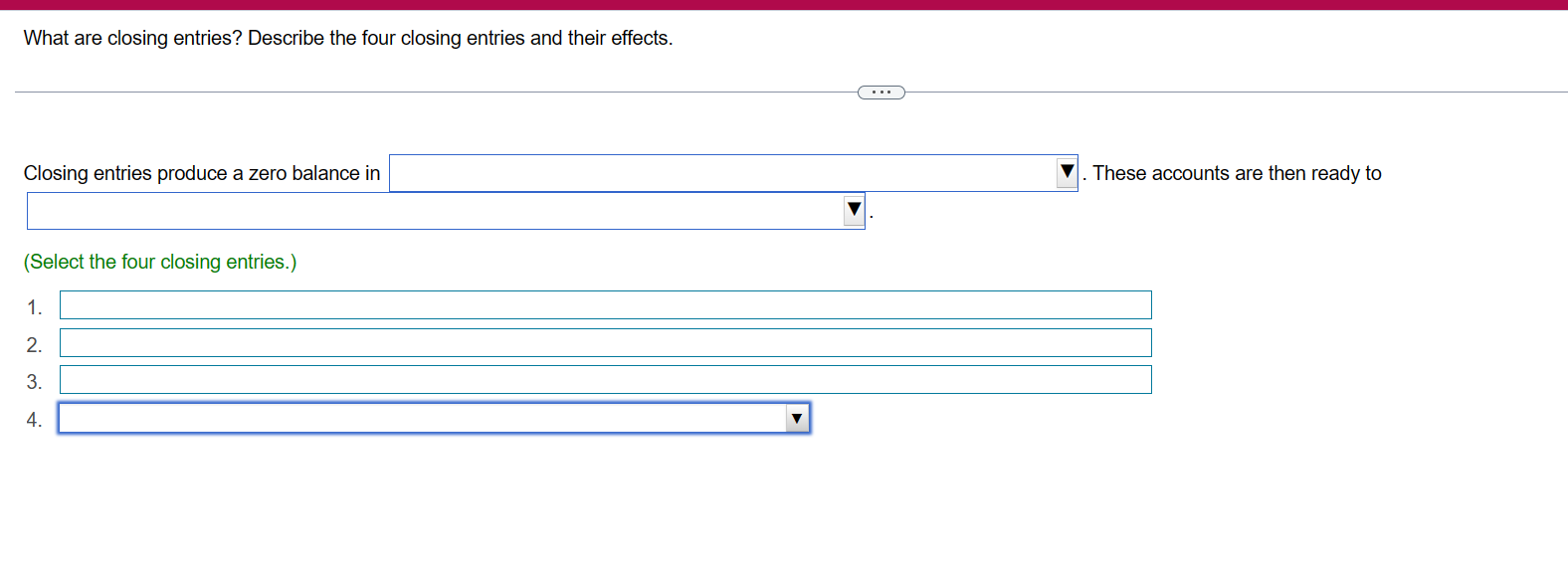

What are closing entries? Describe the four closing entries and their effects. Closing entries produce a zero balance in (Select the four closing entries.)

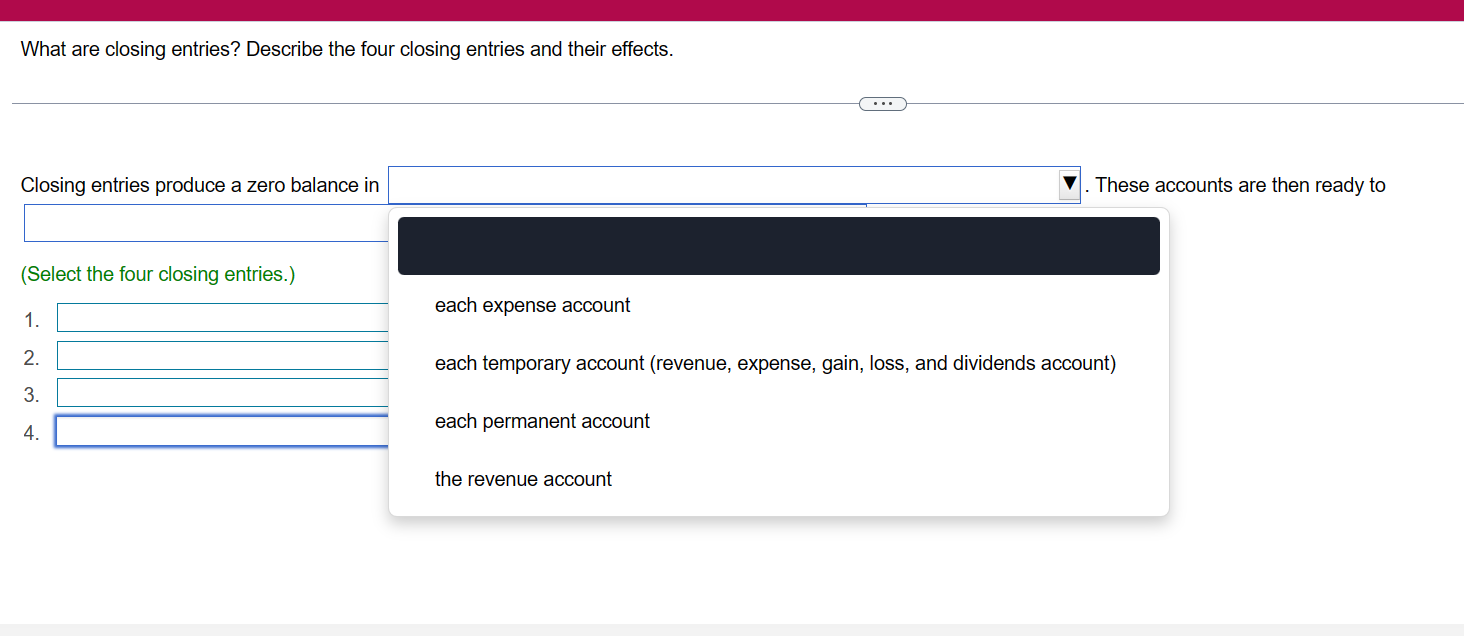

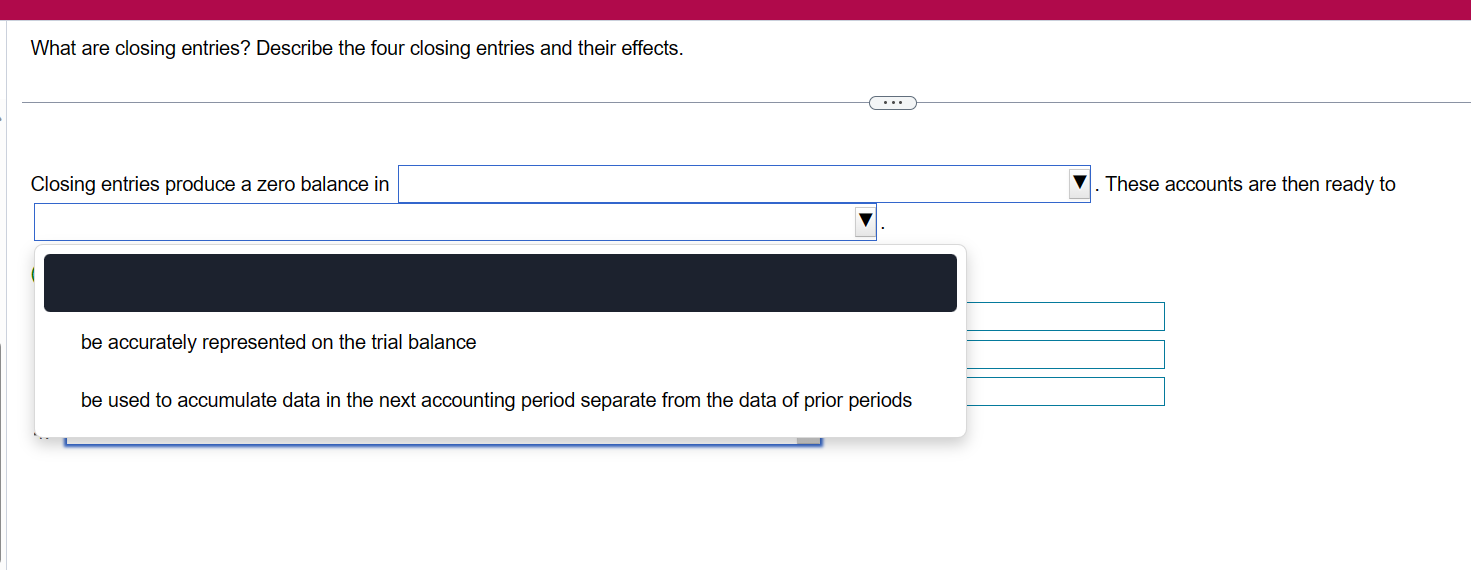

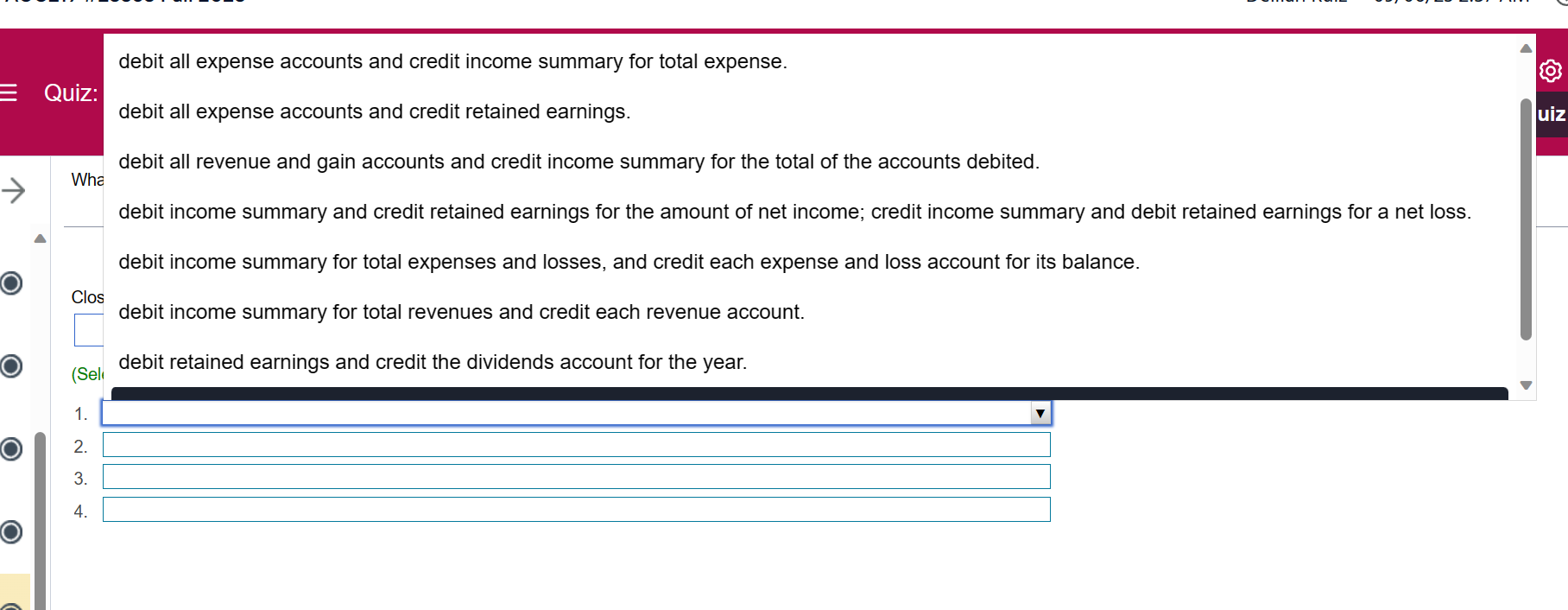

What are closing entries? Describe the four closing entries and their effects. Closing entries produce a zero balance in (Select the four closing entries.) 1. 2. 3. 4. These accounts are then ready to What are closing entries? Describe the four closing entries and their effects. Closing entries produce a zero balance in (Select the four closing entries.) 1. 2. 3. 4. each expense account each temporary account (revenue, expense, gain, loss, and dividends account) each permanent account These accounts are then ready to the revenue account What are closing entries? Describe the four closing entries and their effects. Closing entries produce a zero balance in be accurately represented on the trial balance be used to accumulate data in the next accounting period separate from the data of prior periods These accounts are then ready to = Quiz: Wha Clos (Sel 1. 2. 3. 4. debit all expense accounts and credit income summary for total expense. debit all expense accounts and credit retained earnings. debit all revenue and gain accounts and credit income summary for the total of the accounts debited. debit income summary and credit retained earnings for the amount of net income; credit income summary and debit retained earnings for a net loss. debit income summary for total expenses and losses, and credit each expense and loss account for its balance. debit income summary for total revenues and credit each revenue account. debit retained earnings and credit the dividends account for the year. uiz debit income summary for total revenues and credit each revenue account. debit all expense accounts and credit income summary for total expense. debit all expense accounts and credit retained earnings. debit all revenue and gain accounts and credit income summary for the total of the accounts debited. debit income summary and credit retained earnings for the amount of net income; credit income summary and debit retained earnings for a net loss. debit income summary for total expenses and losses, and credit each expense and loss account for its balance. s debit income summary for total revenues and credit each revenue account. debit retained earnings and credit the dividends account for the year. debit retained earnings for the amount of net income and credit income summary. a el O ui

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear step by step manner Step 1 Closing Entries Closing Entries are the prepared to close the income expense loss and profits to the income summery a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started