Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are priced in for the evaluation of the short term rates. Explain which way the market goes? What are possible formulas you can derive

What are priced in for the evaluation of the short term rates. Explain which way the market goes?

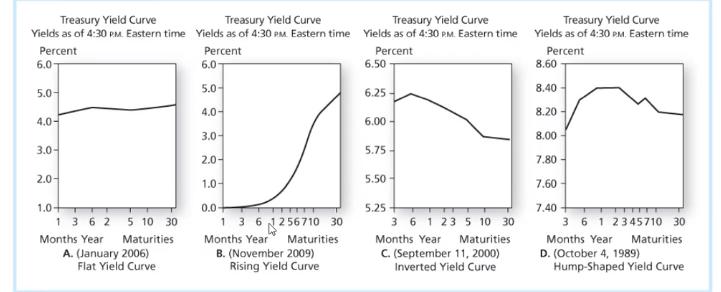

Treasury Yield Curve Treasury Yield Curve Treasury Yield Curve Yields as of 4:30 PM. Eastern time Yields as of 4:30 PM Eastern time Yields as of 4:30 PM. Eastern time Percent Percent Percent 6.0 6.0 5.0- 4.0- 5.0 4.0- 3.0- 2.0- 1.0- 1 3 6 2 5 10 30 Months Year Maturities A. (January 2006) Flat Yield Curve 3.0- 2.0- 1.0- 0.0- 1 3 6 1256710 30 Months Year Maturities B. (November 2009) Rising Yield Curve 6.50 6.25- 6.00- 5.75- 5.50- 5.25 3 6 1 23 5 10 30 Months Year Maturities C. (September 11, 2000) Inverted Yield Curve Treasury Yield Curve Yields as of 4:30 PM. Eastern time Percent 8.60 8.40 8.20- 8.00 7.80- 7.60- 7.40 3 6 1 2345710 30 Months Year Maturities D. (October 4, 1989) Hump-Shaped Yield Curve ETT

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The provided Treasury Yield Curve illustrates the yields interest rates of US government Treasury securities across various maturities as of a specific time 430 PM Eastern time The yield curve is a gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started