Question: What are some examples of diversifiable risks? In other words, name some risks specific to individual companies that do not affect the stock market

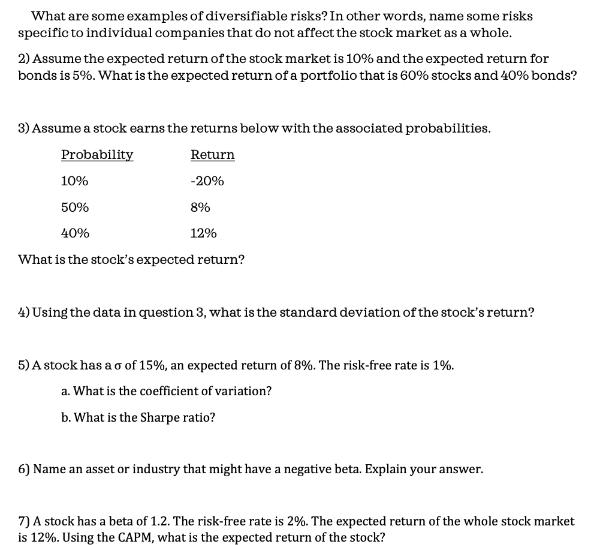

What are some examples of diversifiable risks? In other words, name some risks specific to individual companies that do not affect the stock market as a whole. 2) Assume the expected return of the stock market is 10% and the expected return for bonds is 5%. What is the expected return of a portfolio that is 60% stocks and 40% bonds? 3) Assume a stock earns the returns below with the associated probabilities. Probability Return -20% 10% 50% 40% What is the stock's expected return? 8% 12% 4) Using the data in question 3, what is the standard deviation of the stock's return? 5) A stock has a o of 15%, an expected return of 8%. The risk-free rate is 1%. a. What is the coefficient of variation? b. What is the Sharpe ratio? 6) Name an asset or industry that might have a negative beta. Explain your answer. 7) A stock has a beta of 1.2. The risk-free rate is 2%. The expected return of the whole stock market is 12%. Using the CAPM, what is the expected return of the stock?

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

1 Some examples of diversifiable risks are companyspecific events such as management changes lawsuit... View full answer

Get step-by-step solutions from verified subject matter experts