Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the answers for part 4 part 5 and part 6? Intro Lattice Semiconductor is thinking of buying a new machine for $150,000 that

What are the answers for part 4 part 5 and part 6?

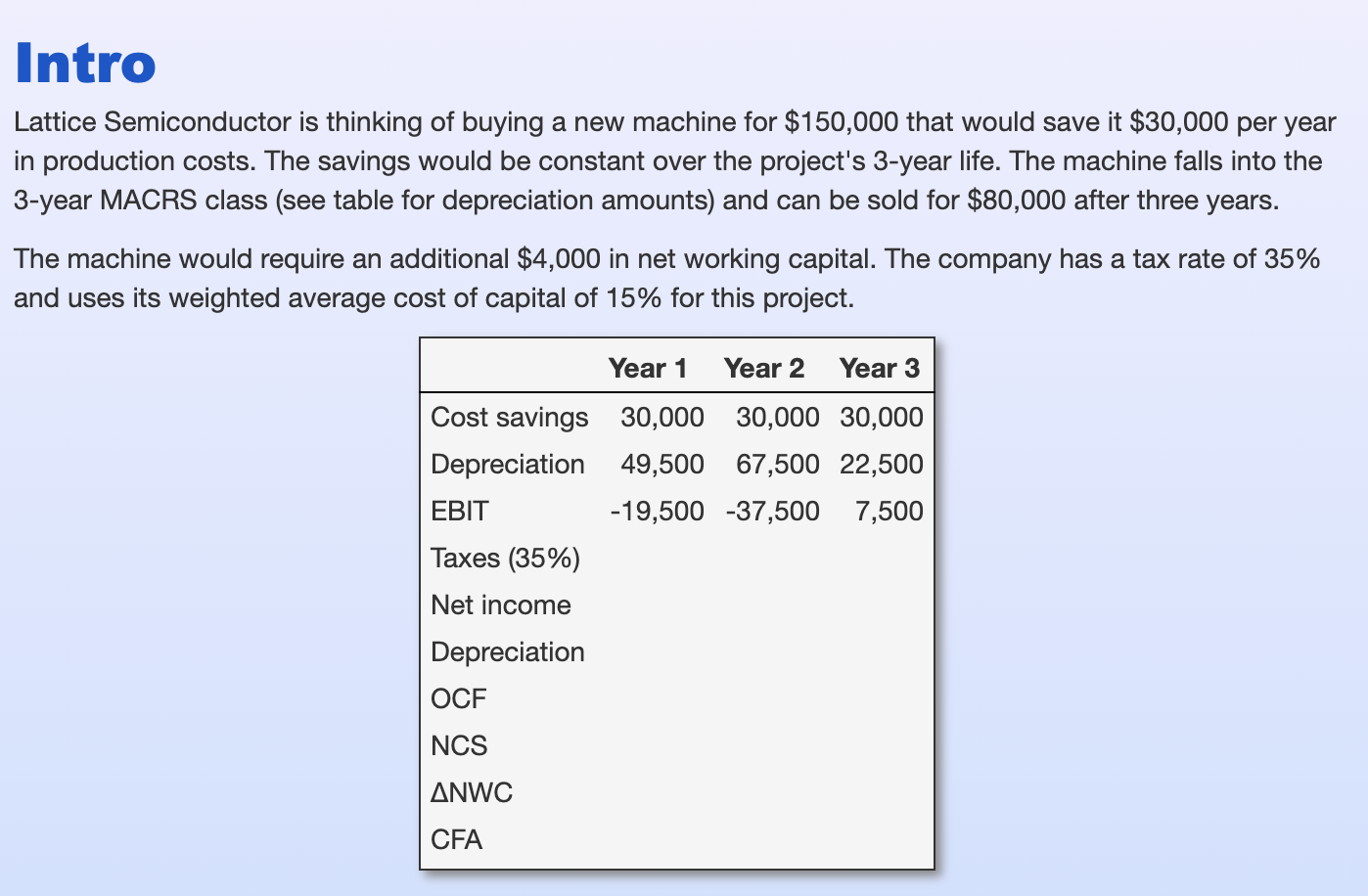

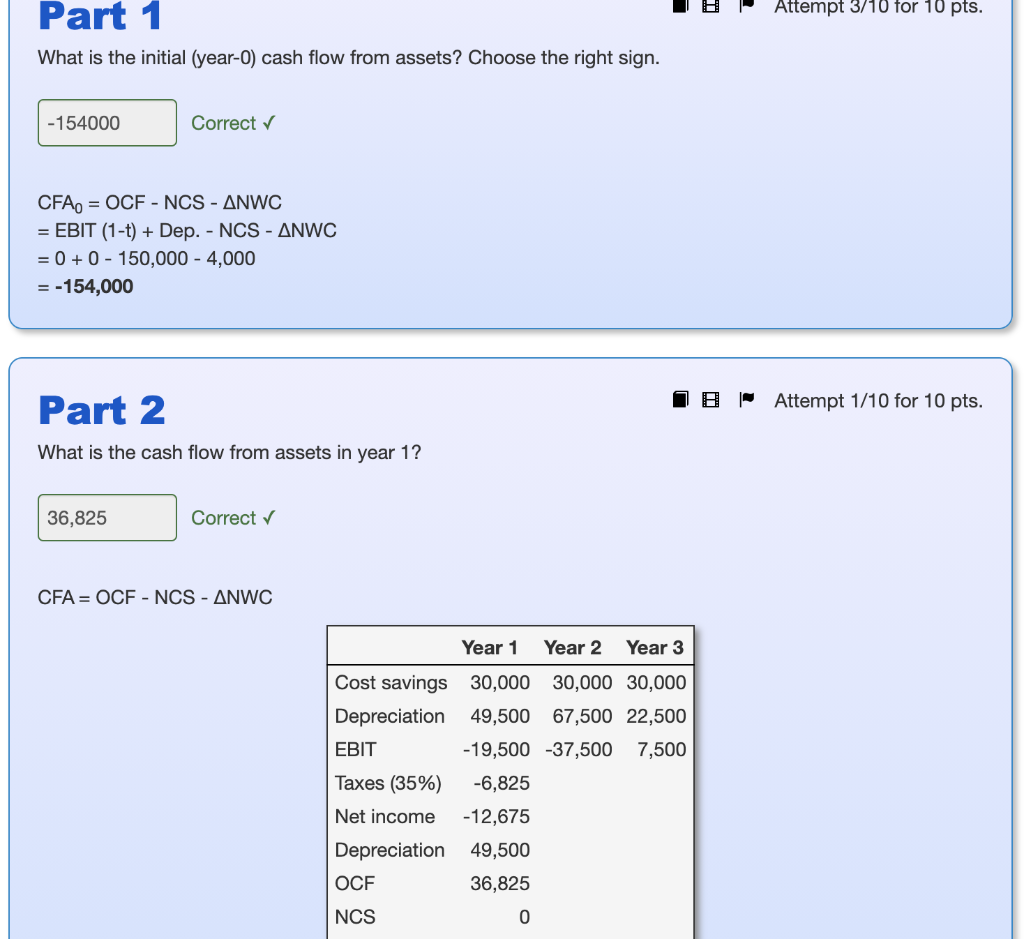

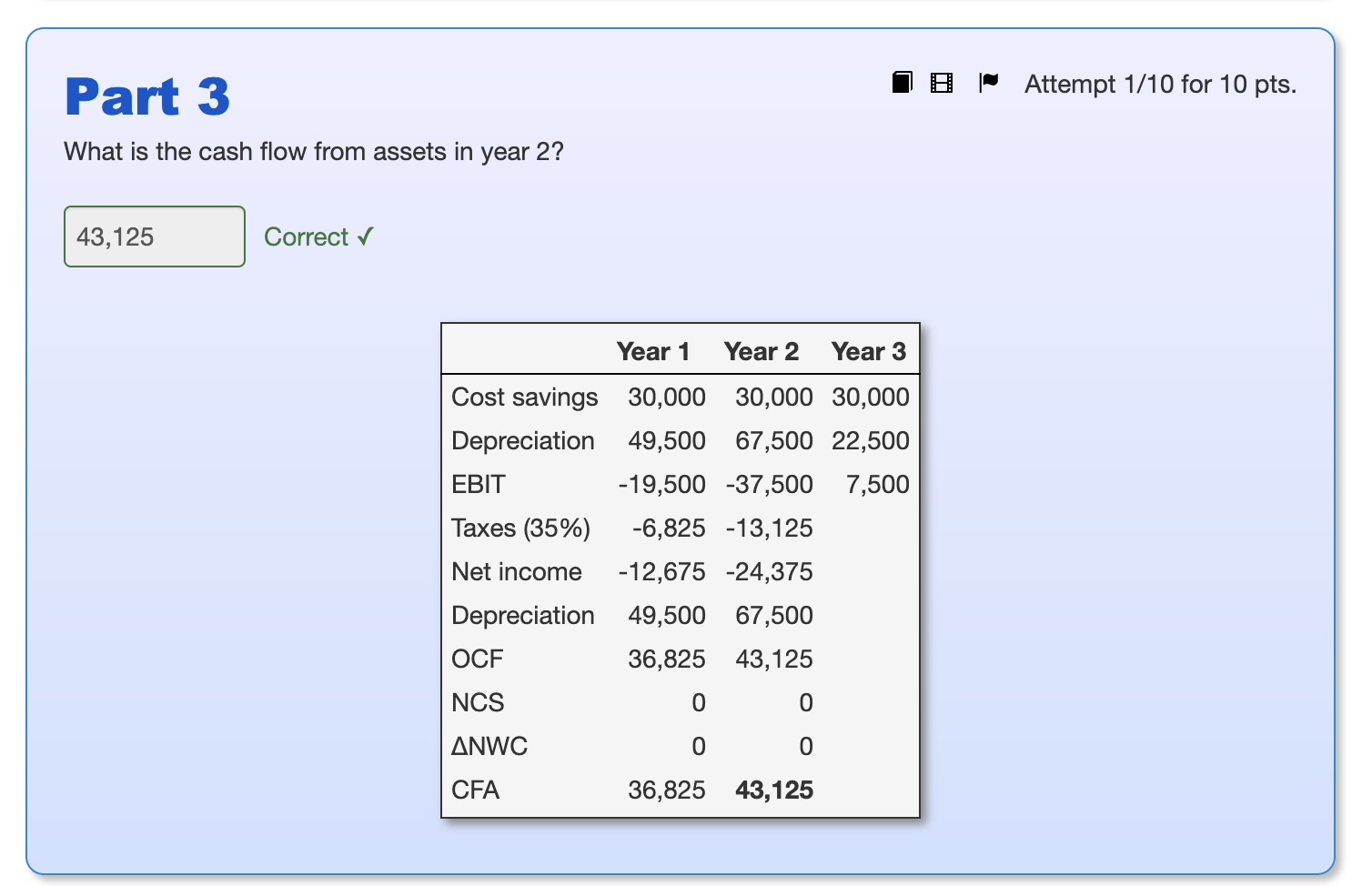

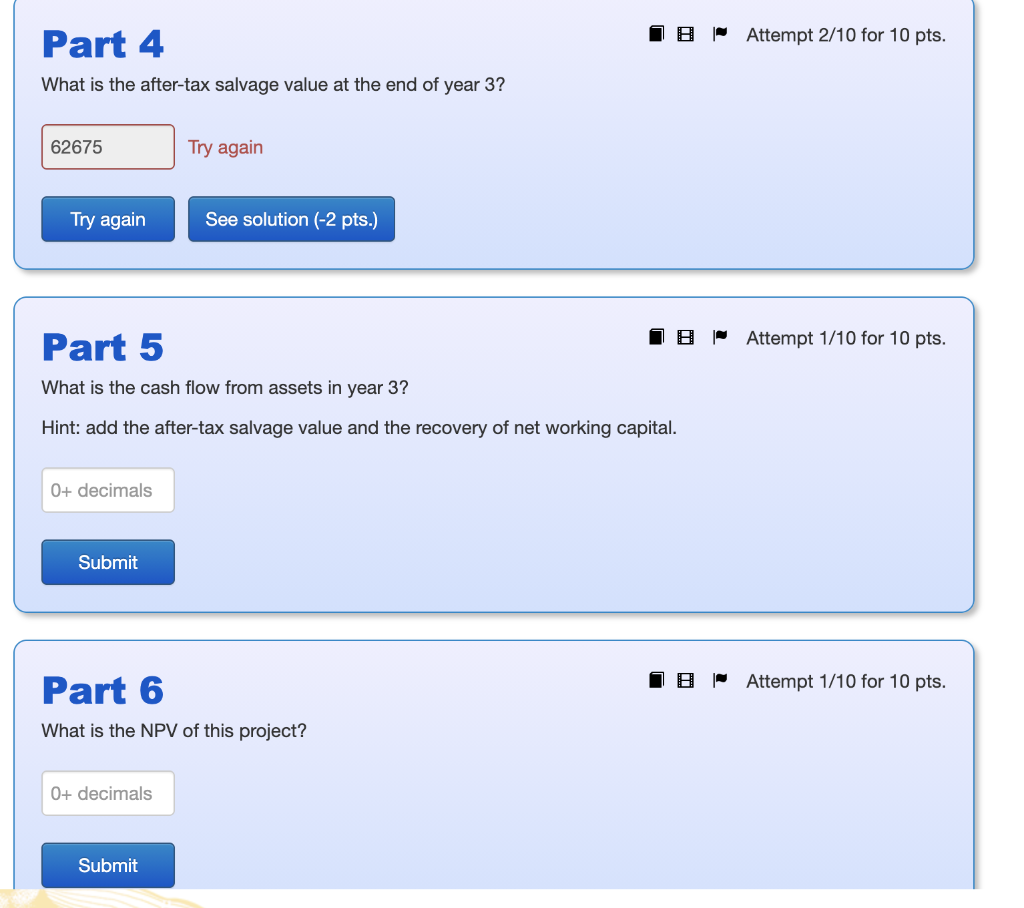

Intro Lattice Semiconductor is thinking of buying a new machine for $150,000 that would save it $30,000 per year in production costs. The savings would be constant over the project's 3-year life. The machine falls into the 3-year MACRS class (see table for depreciation amounts) and can be sold for $80,000 after three years. The machine would require an additional $4,000 in net working capital. The company has a tax rate of 35% and uses its weighted average cost of capital of 15% for this project. Year 1 Year 2 Year 3 Cost savings 30,000 30,000 30,000 Depreciation 49,500 67,500 22,500 EBIT -19,500 -37,500 7,500 Taxes (35%) Net income Depreciation OCF NCS ANWC CFA Attempt 3/10 for 10 pts. Part 1 What is the initial (year-0) cash flow from assets? Choose the right sign. -154000 Correct CFA) = OCF - NCS - ANWC = EBIT (1-t) + Dep. - NCS - ANWC = 0 +0 - 150,000 - 4,000 = -154,000 Attempt 1/10 for 10 pts. Part 2 What is the cash flow from assets in year 1? 36,825 Correct CFA = OCF - NCS - ANWC Year 1 Year 2 Year 3 Cost savings 30,000 30,000 30,000 Depreciation 49,500 67,500 22,500 EBIT -19,500 -37,500 7,500 Taxes (35%) -6,825 Net income -12,675 Depreciation 49,500 OCF 36,825 NCS 0 Part 3 Attempt 1/10 for 10 pts. What is the cash flow from assets in year 2? 43,125 Correct Year 1 Year 2 Year 3 Cost savings Depreciation EBIT Taxes (35%) Net income Depreciation OCF NCS ANWC CFA 30,000 30,000 30,000 49,500 67,500 22,500 -19,500 -37,500 7,500 -6,825 -13,125 -12,675 -24,375 49,500 67,500 36,825 43,125 0 0 0 0 36,825 43,125 Attempt 2/10 for 10 pts. Part 4 What is the after-tax salvage value at the end of year 3? 62675 Try again Try again See solution (-2 pts.) Part 5 1 B Attempt 1/10 for 10 pts. What is the cash flow from assets in year 3? Hint: add the after-tax salvage value and the recovery of net working capital. 0+ decimals Submit 18 Attempt 1/10 for 10 pts. Part 6 What is the NPV of this project? 0+ decimals SubmitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started