What are the answers required?

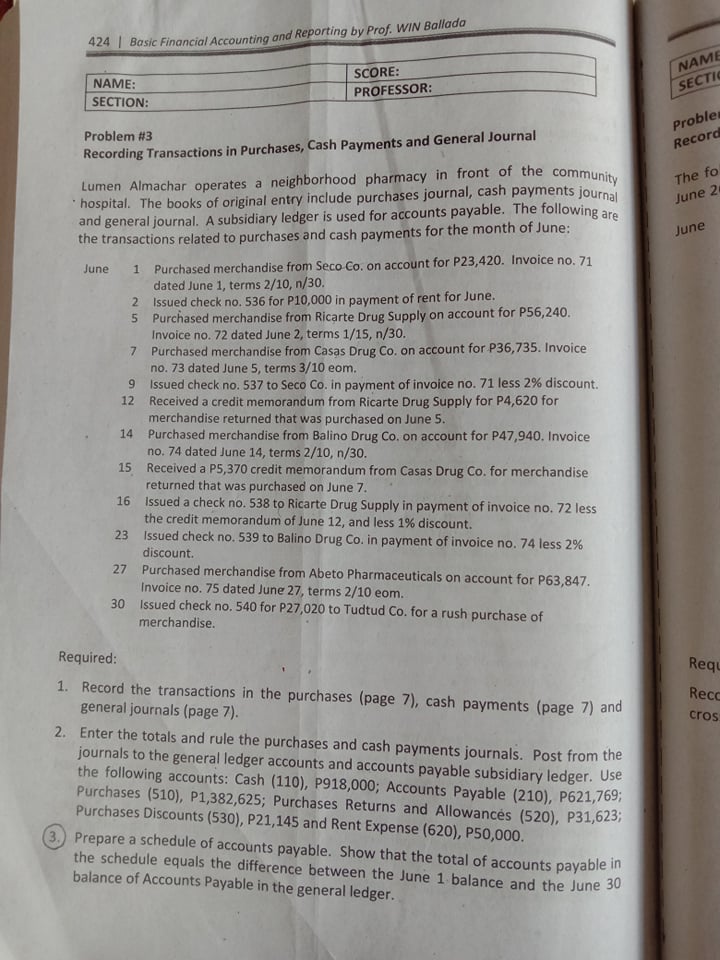

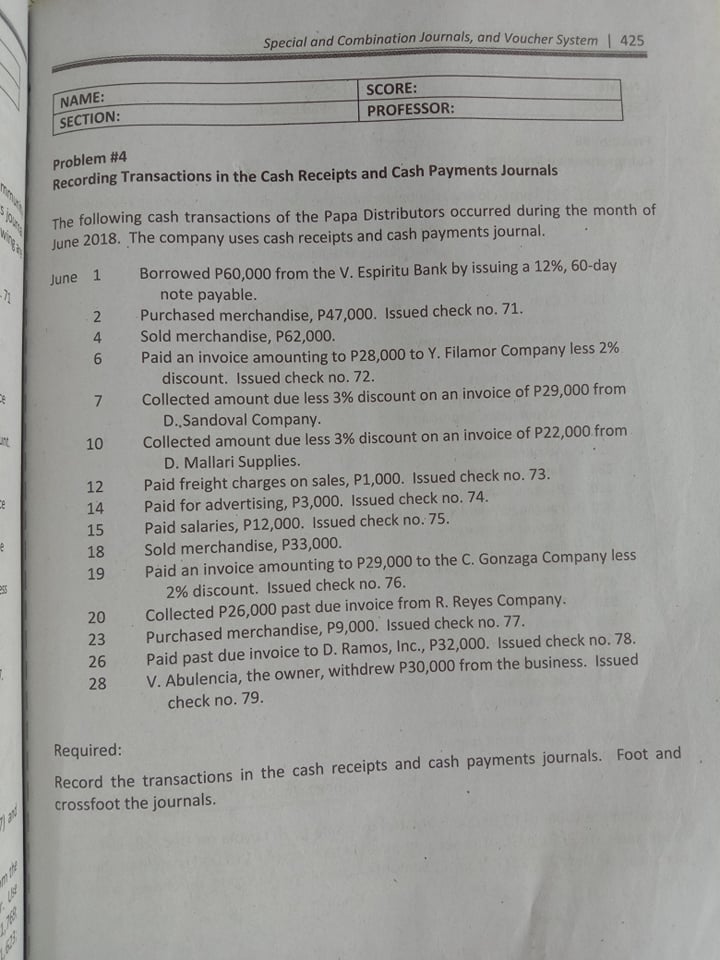

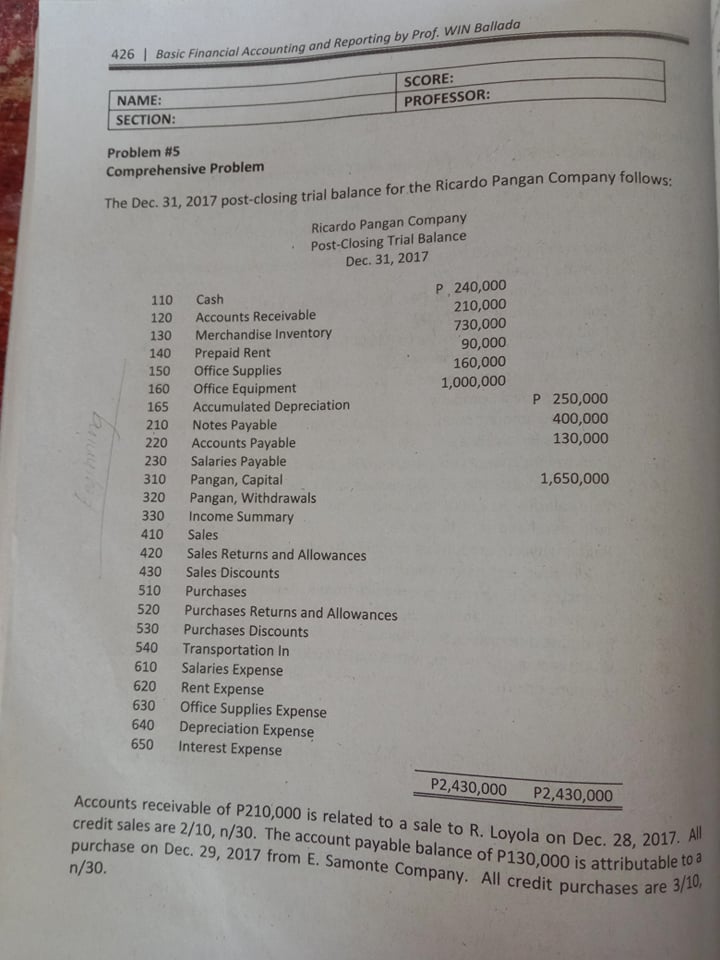

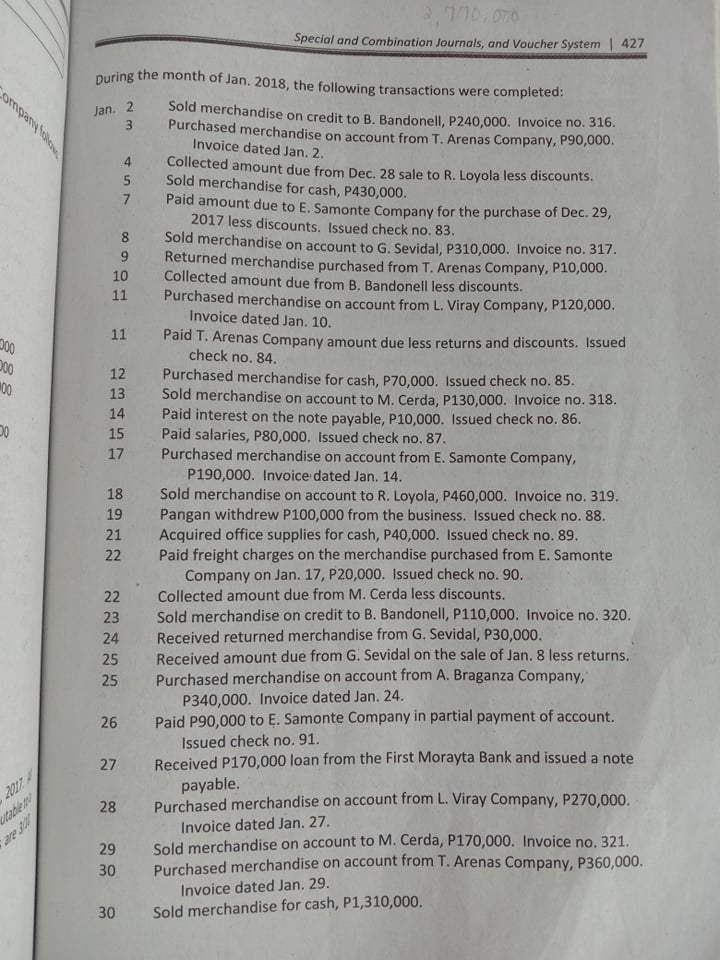

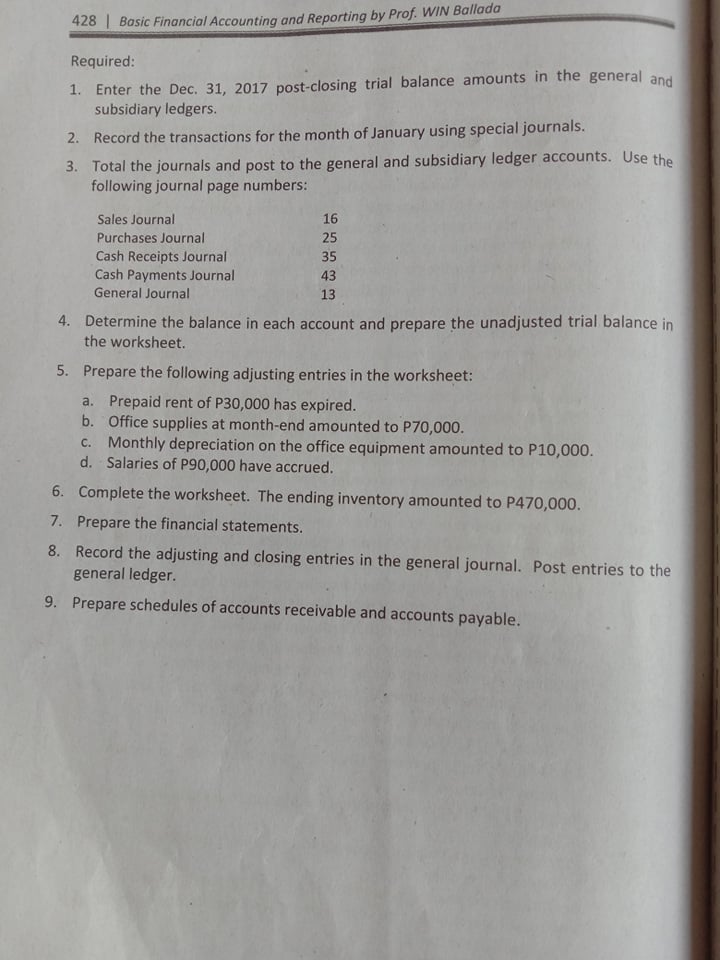

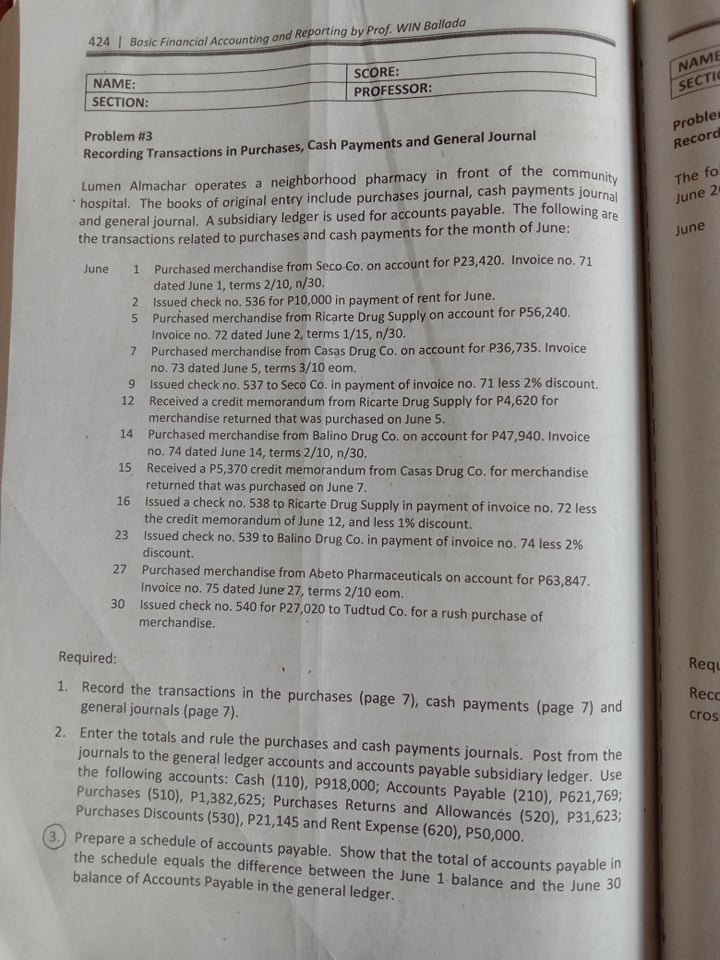

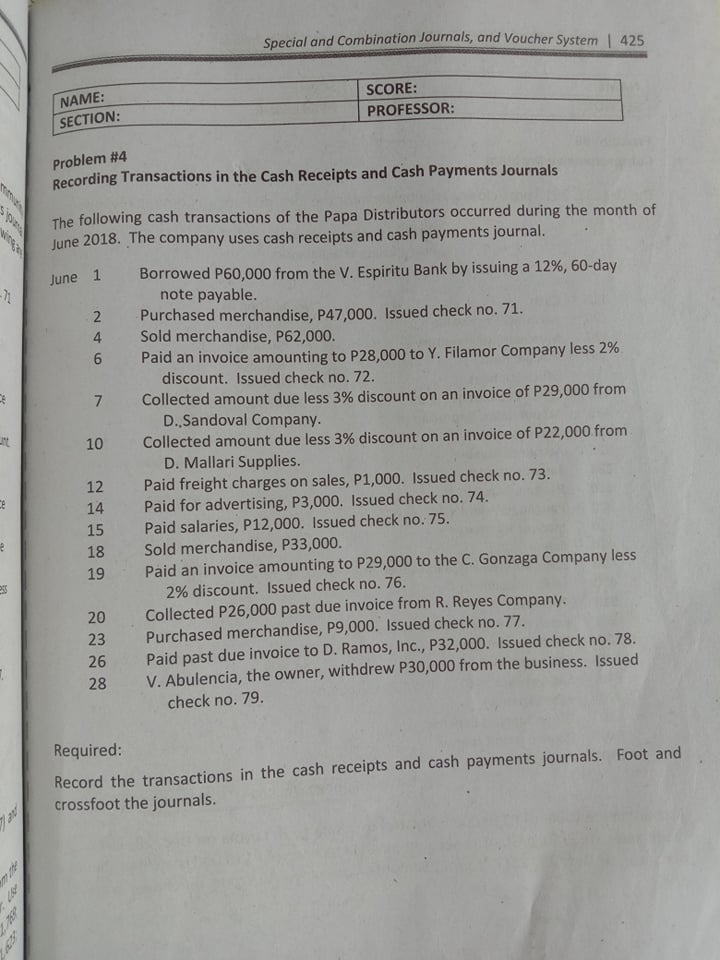

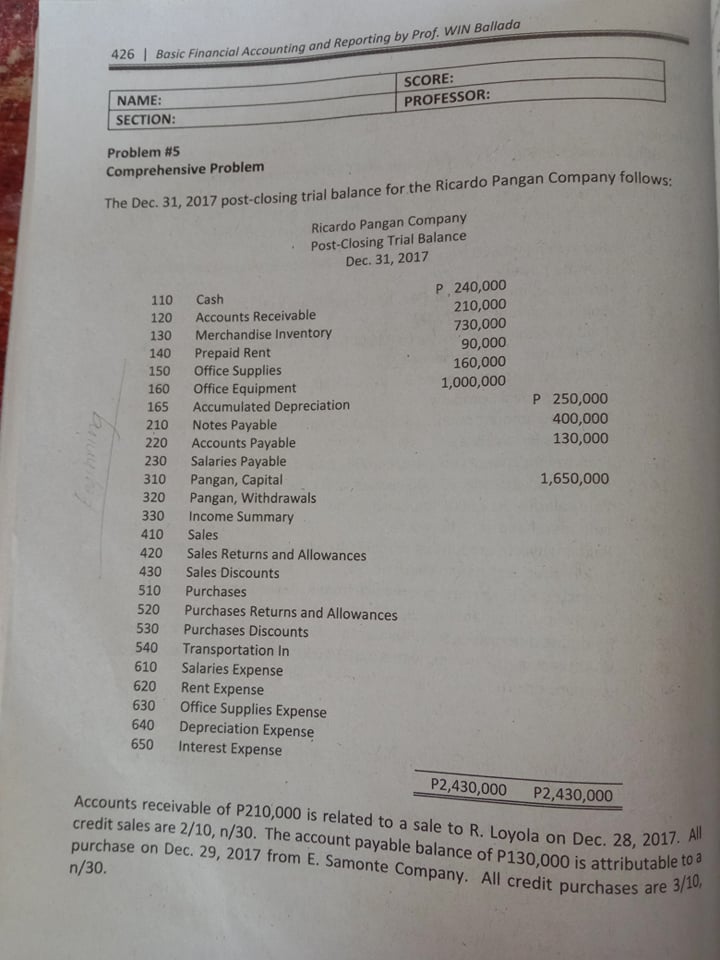

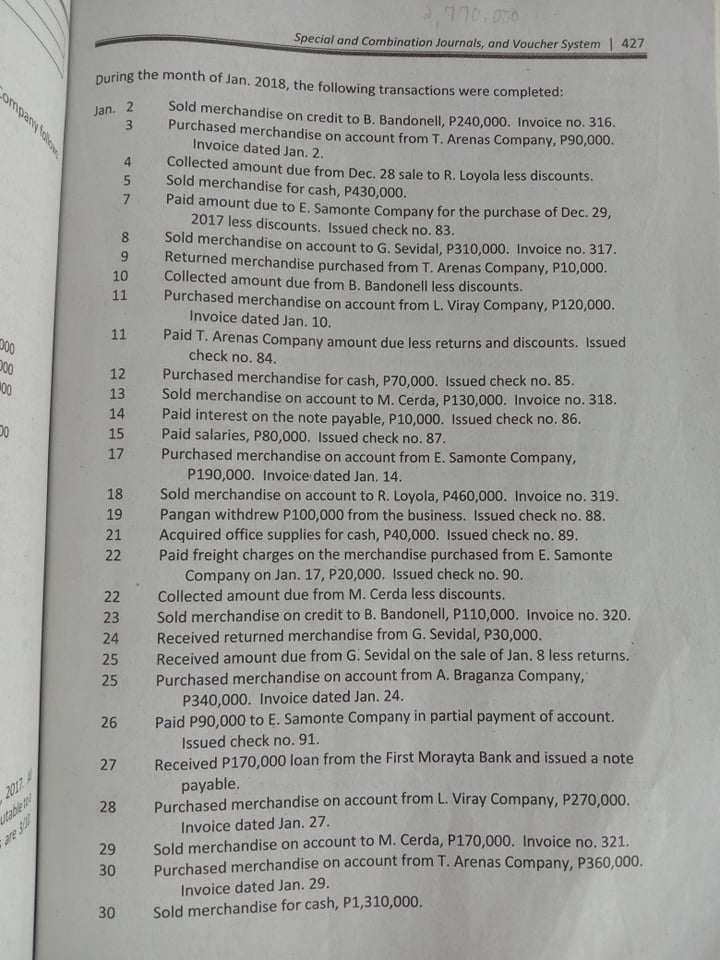

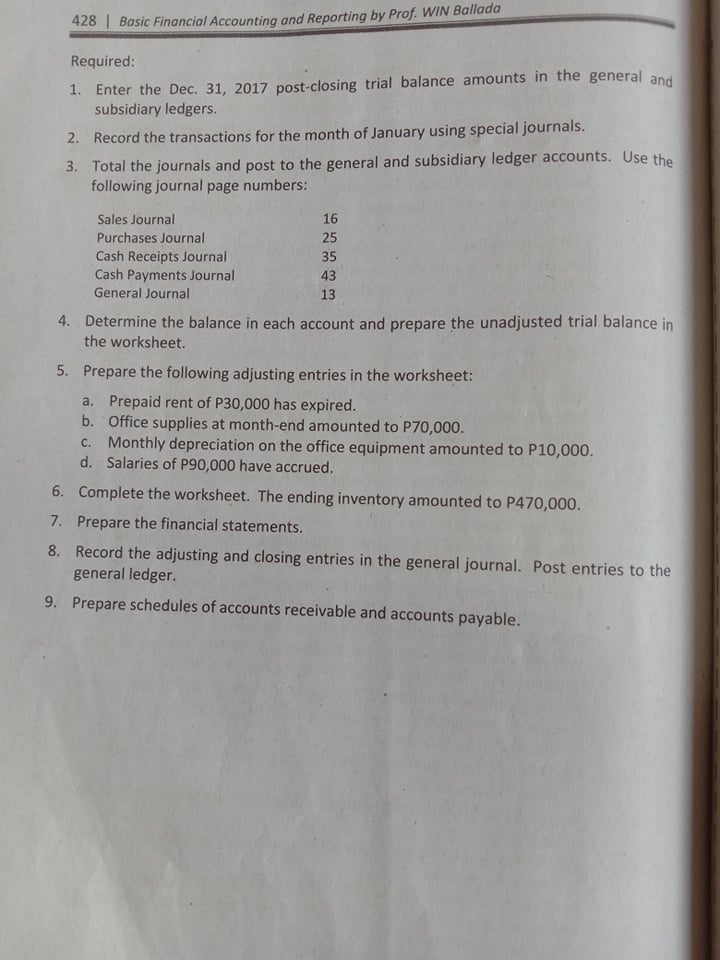

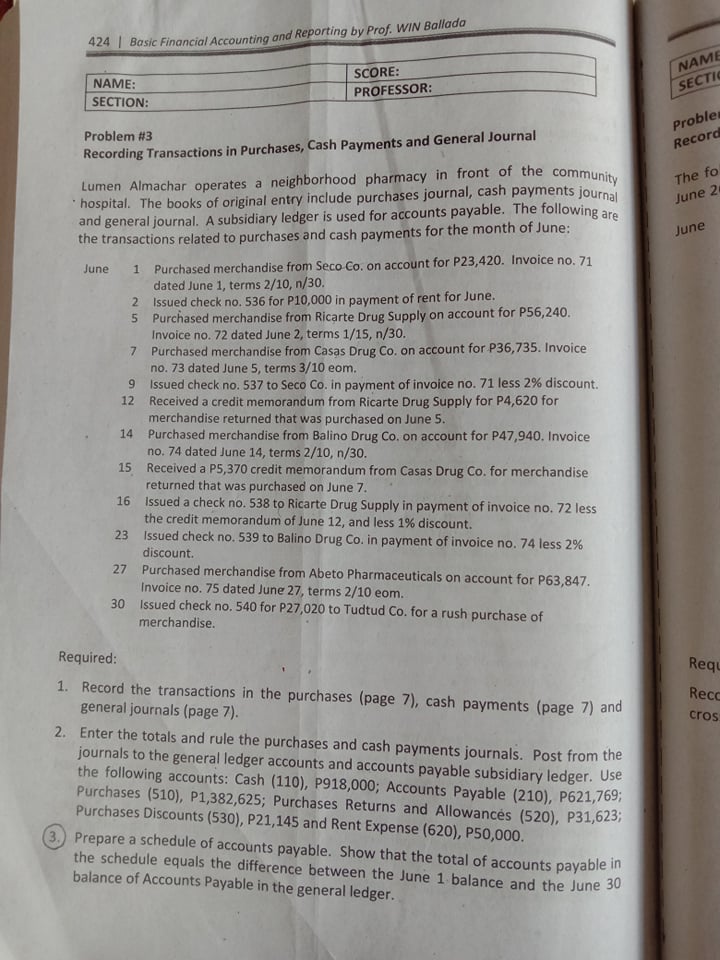

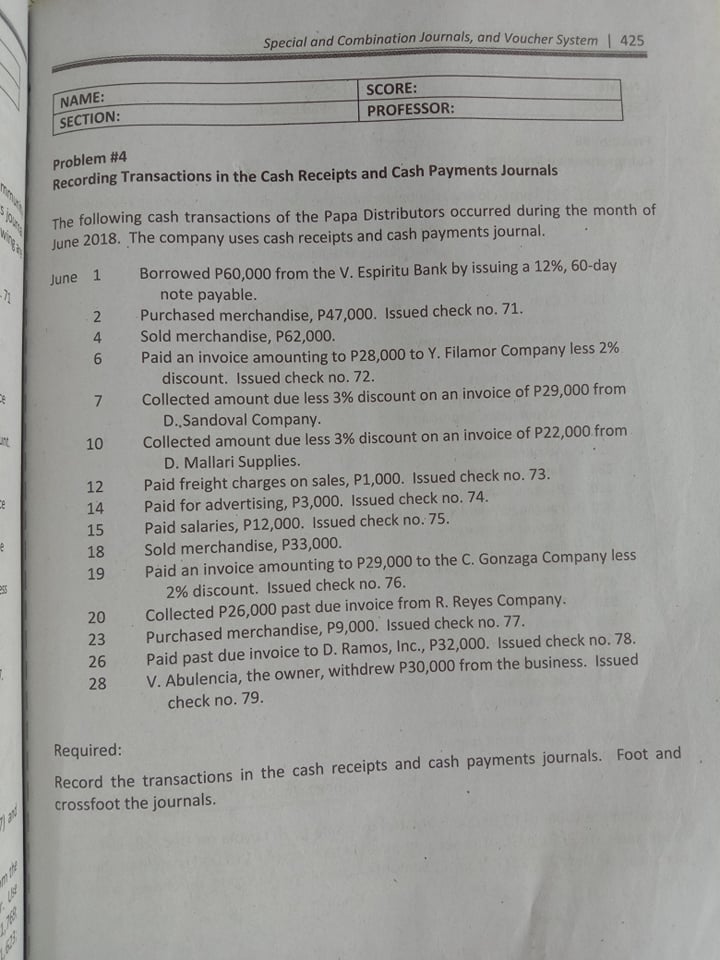

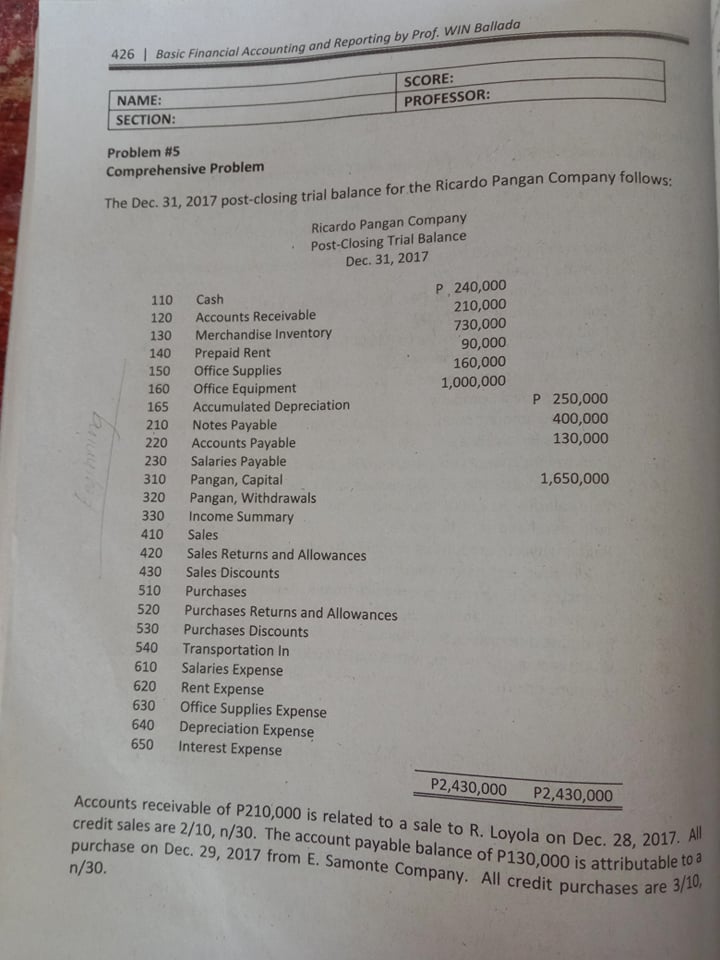

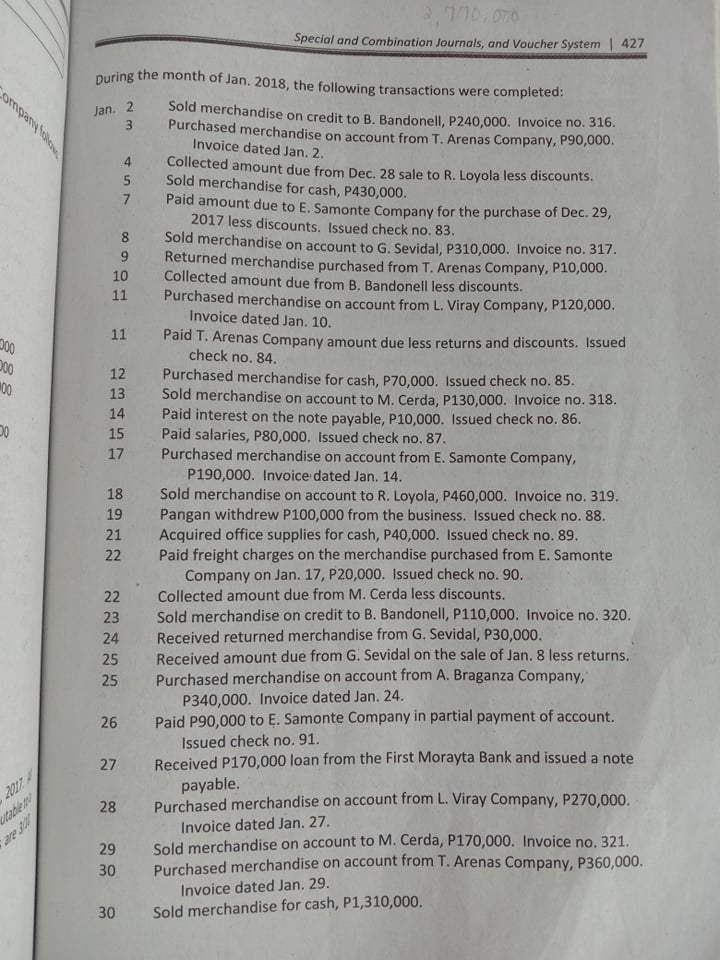

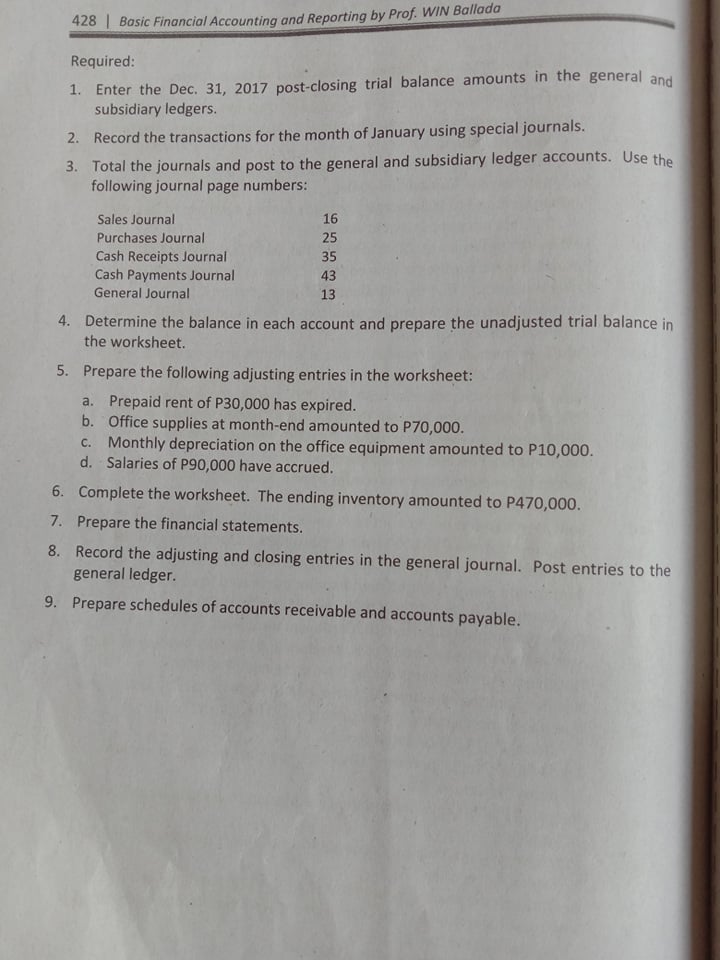

424 | Basic Financial Accounting and Reporting by Prof. WIN Ballada NAM SCORE: SECTI NAME: PROFESSOR: SECTION: Proble Problem #3 Record Recording Transactions in Purchases, Cash Payments and General Journal The fo Lumen Almachar operates a neighborhood pharmacy in front of the community hospital. The books of original entry include purchases journal, cash payments journal June 2 and general journal. A subsidiary ledger is used for accounts payable. The following are June the transactions related to purchases and cash payments for the month of June: June 1 Purchased merchandise from Seco Co. on account for P23,420. Invoice no. 71 dated June 1, terms 2/10, n/30. 2 Issued check no. 536 for P10,000 in payment of rent for June. 5 Purchased merchandise from Ricarte Drug Supply on account for P56,240. Invoice no. 72 dated June 2, terms 1/15, n/30. 7 Purchased merchandise from Casas Drug Co. on account for P36,735. Invoice no. 73 dated June 5, terms 3/10 com. 9 Issued check no. 537 to Seco Co. in payment of invoice no. 71 less 2% discount. 12 Received a credit memorandum from Ricarte Drug Supply for P4,620 for merchandise returned that was purchased on June 5. 14 Purchased merchandise from Balino Drug Co. on account for P47,940. Invoice no. 74 dated June 14, terms 2/10, n/30. Received a P5,370 credit memorandum from Casas Drug Co. for merchandise returned that was purchased on June 7. 16 Issued a check no. 538 to Ricarte Drug Supply in payment of invoice no. 72 less the credit memorandum of June 12, and less 1% discount. 23 Issued check no. 539 to Balino Drug Co. in payment of invoice no. 74 less 2% discount. 27 Purchased merchandise from Abeto Pharmaceuticals on account for P63,847. Invoice no. 75 dated June 27, terms 2/10 com. 30 Issued check no. 540 for P27,020 to Tudtud Co. for a rush purchase of merchandise. Required: Requ 1. Record the transactions in the purchases (page 7), cash payments (page 7) and Rec general journals (page 7). cros 2. Enter the totals and rule the purchases and cash payments journals. Post from the journals to the general ledger accounts and accounts payable subsidiary ledger. Use the following accounts: Cash (110), P918,000; Accounts Payable (210), P621,769; Purchases (510), P1,382,625; Purchases Returns and Allowances (520), P31,623; Purchases Discounts (530), P21,145 and Rent Expense (620), P50,000. Prepare a schedule of accounts payable. Show that the total of accounts payable in the schedule equals the difference between the June 1 balance and the June 30 balance of Accounts Payable in the general ledger.Special and Combination Journals, and Voucher System | 425 NAME: SCORE: SECTION: PROFESSOR: Problem #4 Recording Transactions in the Cash Receipts and Cash Payments Journals The following cash transactions of the Papa Distributors occurred during the month of June 2018. The company uses cash receipts and cash payments journal. June 1 Borrowed P60,000 from the V. Espiritu Bank by issuing a 12%, 60-day note payable. Purchased merchandise, P47,000. Issued check no. 71. Sold merchandise, P62,000. Paid an invoice amounting to P28,000 to Y. Filamor Company less 2% discount. Issued check no. 72. 7 Collected amount due less 3% discount on an invoice of P29,000 from D., Sandoval Company. 10 Collected amount due less 3% discount on an invoice of P22,000. from D. Mallari Supplies. 12 Paid freight charges on sales, P1,000. Issued check no. 73. 14 Paid for advertising, P3,000. Issued check no. 74. 15 Paid salaries, P12,000. Issued check no. 75. 18 Sold merchandise, P33,000. 19 Paid an invoice amounting to P29,000 to the C. Gonzaga Company less 2% discount. Issued check no. 76. 20 Collected P26,000 past due invoice from R. Reyes Company. 23 Purchased merchandise, P9,000. Issued check no. 77. 26 Paid past due invoice to D. Ramos, Inc., P32,000. Issued check no. 78. 28 V. Abulencia, the owner, withdrew P30,000 from the business. Issued check no. 79. Required: Record the transactions in the cash receipts and cash payments journals. Foot and crossfoot the journals.426 | Basic Financial Accounting and Reporting by Prof. WIN Ballada SCORE: NAME: PROFESSOR: SECTION: Problem #5 Comprehensive Problem The Dec. 31, 2017 post-closing trial balance for the Ricardo Pangan Company follows: Ricardo Pangan Company Post-Closing Trial Balance Dec. 31, 2017 P , 240,000 110 Cash 210,000 120 Accounts Receivable 730,000 130 Merchandise Inventory 90,000 140 Prepaid Rent 160,000 150 Office Supplies 160 Office Equipment 1,000,000 P 250,000 165 Accumulated Depreciation 210 Notes Payable 400,000 220 Accounts Payable 130,000 Levinning 230 Salaries Payable 310 Pangan, Capital 1,650,000 320 Pangan, Withdrawals 330 Income Summary 410 Sales 420 Sales Returns and Allowances 430 Sales Discounts 510 Purchases 520 Purchases Returns and Allowances 530 Purchases Discounts 540 Transportation In 610 Salaries Expense 520 Rent Expense 630 Office Supplies Expense 640 Depreciation Expense 650 Interest Expense P2,430,000 P2,430,000 Accounts receivable of P210,000 is related to a sale to R. Loyola on Dec. 28, 2017. All credit sales are 2/10, n/30. The account payable balance of P130,000 is attributable to a n/30. purchase on Dec. 29, 2017 from E. Samonte Company. All credit purchases are 3/102 770, 078 Special and Combination Journals, and Voucher System | 427 puring the month of Jan. 2018, the following transactions were completed: Jan. 2 Sold merchandise on credit to B. Bandonell, P240,000. Invoice no. 316. Purchased merchandise on account from T. Arenas Company, P90,000. Invoice dated Jan. 2. Collected amount due from Dec. 28 sale to R. Loyola less discounts. Sold merchandise for cash, P430,000. Paid amount due to E. Samonte Company for the purchase of Dec. 29, 2017 less discounts. Issued check no. 83. Sold merchandise on account to G. Sevidal, P310,000. Invoice no. 317. 10 Returned merchandise purchased from T. Arenas Company, P10,000. Collected amount due from B. Bandonell less discounts. 11 Purchased merchandise on account from L. Viray Company, P120,000. Invoice dated Jan. 10. 11 Paid T. Arenas Company amount due less returns and discounts. Issued check no. 84. 12 Purchased merchandise for cash, P70,000. Issued check no. 85. 13 Sold merchandise on account to M. Cerda, P130,000. Invoice no. 318. 14 Paid interest on the note payable, P10,000. Issued check no. 86. 15 Paid salaries, P80,000. Issued check no. 87. 17 Purchased merchandise on account from E. Samonte Company, P190,000. Invoice dated Jan. 14. 18 Sold merchandise on account to R. Loyola, P460,000. Invoice no. 319. 19 Pangan withdrew P100,000 from the business. Issued check no. 88. 21 Acquired office supplies for cash, P40,000. Issued check no. 89. 22 Paid freight charges on the merchandise purchased from E. Samonte Company on Jan. 17, P20,000. Issued check no. 90. 22 Collected amount due from M. Cerda less discounts. 23 Sold merchandise on credit to B. Bandonell, P110,000. Invoice no. 320. 24 Received returned merchandise from G. Sevidal, P30,000. 25 Received amount due from G. Sevidal on the sale of Jan. 8 less returns. 25 Purchased merchandise on account from A. Braganza Company, P340,000. Invoice dated Jan. 24. 26 Paid P90,000 to E. Samonte Company in partial payment of account. Issued check no. 91. 27 Received P170,000 loan from the First Morayta Bank and issued a note 2017. payable. utabe try 28 Purchased merchandise on account from L. Viray Company, P270,000. Invoice dated Jan. 27. 29 Sold merchandise on account to M. Cerda, P170,000. Invoice no. 321. 30 Purchased merchandise on account from T. Arenas Company, P360,000. Invoice dated Jan. 29. 30 Sold merchandise for cash, P1,310,000.428 | Basic Financial Accounting and Reporting by Prof. WIN Ballada Required: 1. Enter the Dec. 31, 2017 post-closing trial balance amounts in the general and subsidiary ledgers. 2. Record the transactions for the month of January using special journals. 3. Total the journals and post to the general and subsidiary ledger accounts. Use the following journal page numbers: Sales Journal 16 Purchases Journal 25 Cash Receipts Journal 35 Cash Payments Journal 43 General Journal 13 4. Determine the balance in each account and prepare the unadjusted trial balance in the worksheet. 5. Prepare the following adjusting entries in the worksheet: a. Prepaid rent of P30,000 has expired. b. Office supplies at month-end amounted to P70,000. c. Monthly depreciation on the office equipment amounted to P10,000. d. Salaries of P90,000 have accrued. 6. Complete the worksheet. The ending inventory amounted to P470,000. 7. Prepare the financial statements. 8. Record the adjusting and closing entries in the general journal. Post entries to the general ledger. 9. Prepare schedules of accounts receivable and accounts payable