Question: On January 1, 2014, Pert Company purchased 85% of the outstanding common stock of Sales Company for $341,000. On that date, Sales Company's stockholders'

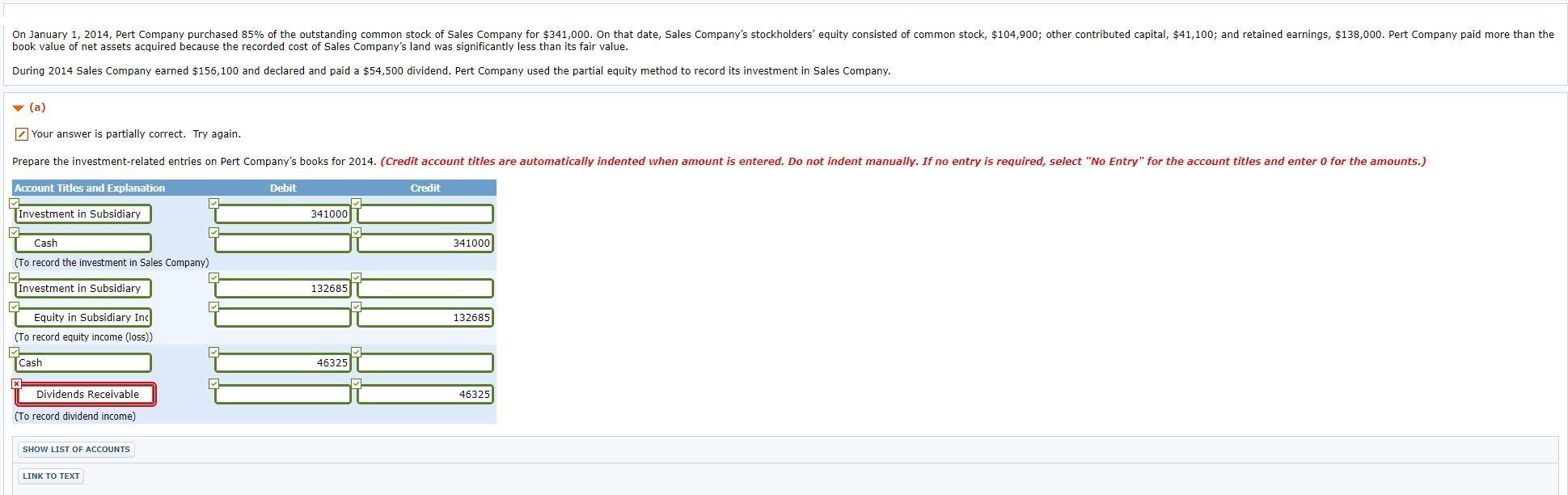

On January 1, 2014, Pert Company purchased 85% of the outstanding common stock of Sales Company for $341,000. On that date, Sales Company's stockholders' equity consisted of common stock, $104,900; other contributed capital, $41,100; and retained earnings, $138,000. Pert Company paid more than the book value of net assets acquired because the recorded cost of Sales Company's land was significantly less than its fair value. During 2014 Sales Company earned $156,100 and declared and paid a $54,500 dividend. Pert Company used the partial equity method to record its investment in Sales Company. v (a) Z Your answer is partially correct. Try again. Prepare the investment-related entries on Pert Company's books for 2014. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Investment in Subsidiary 341000 Cash 341000 (To record the investment in Sales Company) Investment in Subsidiary 132685 Equity in Subsidiary Inc 132685 (To record equity income (loss) Cash 46325 Dividends Receivable 46325 (To record dividend income) SHOW LIST OF ACCOUNTS LINK O XT v (b) Z Your answer is partially correct. Try again. Prepare the workpaper eliminating entries for a workpaper on December 31, 2014. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is reguired, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,125.) Account Titles and Explanation Debit Credit Equity in Subsidiary Incom 132685 Dividends Declared - Si 46325 Investment in Subsidiai 86360 (To record equity income (loss) and dividend income) Common Stock Subsidiar 104900 [other Contributed Capital 41100 Retained Earnings - Subsic 138000 Difference between Implie 117176 Investment in Subsidial 341000 Noncontrolling Interest 60176 (To eliminate investment in subsidiary and create noncontrolling interest) Goodwill 117176 Difference between Imp 117176 (To eliminate excess of the book value of equity acquired.) SHOW LIST OF ACCOUNTS LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

a ... View full answer

Get step-by-step solutions from verified subject matter experts