Answered step by step

Verified Expert Solution

Question

1 Approved Answer

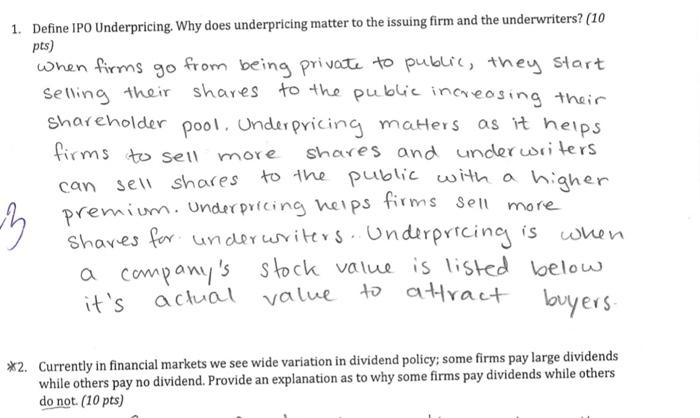

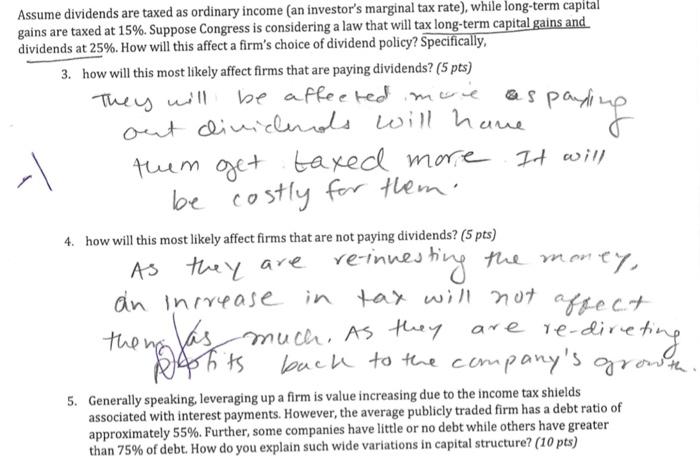

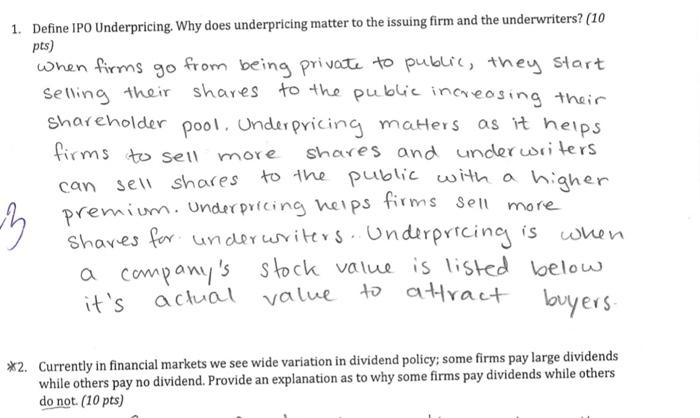

What are the correct answers for these firms to sell 1. Define IPO Underpricing. Why does underpricing matter to the issuing firm and the underwriters?

What are the correct answers for these

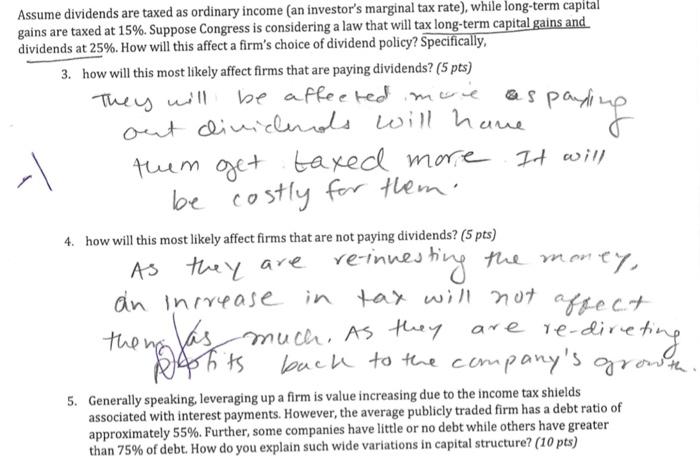

firms to sell 1. Define IPO Underpricing. Why does underpricing matter to the issuing firm and the underwriters? (10 pts) when firms go from being private to public, they start selling their shares to the public increasing their shareholder pool. Underpricing matters as it helps more shares and under writers sell shares can to the public with a higher premium. Underpricing herps firms sell more Shares for underwriters. Underpricing is when a company's stock value is listed below it's actual value to attract 5 buyers *2. Currently in financial markets we see wide variation in dividend policy; some firms pay large dividends while others pay no dividend. Provide an explanation as to why some firms pay dividends while others do not (10 pts) as payli Assume dividends are taxed as ordinary income an investor's marginal tax rate), while long-term capital gains are taxed at 15%. Suppose Congress is considering a law that will tax long-term capital gains and dividends at 25%. How will this affect a firm's choice of dividend policy? Specifically, 3. how will this most likely affect firms that are paying dividends? (5 pts) They will be affected more out dividends will have them get taxed more more It will be costly for them. 4. how will this most likely affect firms that are not paying dividends? (5 pts) As they are an increase in tax will not affect re-innesting the money Jas much. As they Dosts back to the company's growth the malas are re-direting 5. Generally speaking, leveraging up a firm is value increasing due to the income tax shields associated with interest payments. However, the average publicly traded firm has a debt ratio of approximately 55%. Further, some companies have little or no debt while others have greater than 75% of debt. How do you explain such wide variations in capital structure? (10 pts) firms to sell 1. Define IPO Underpricing. Why does underpricing matter to the issuing firm and the underwriters? (10 pts) when firms go from being private to public, they start selling their shares to the public increasing their shareholder pool. Underpricing matters as it helps more shares and under writers sell shares can to the public with a higher premium. Underpricing herps firms sell more Shares for underwriters. Underpricing is when a company's stock value is listed below it's actual value to attract 5 buyers *2. Currently in financial markets we see wide variation in dividend policy; some firms pay large dividends while others pay no dividend. Provide an explanation as to why some firms pay dividends while others do not (10 pts) as payli Assume dividends are taxed as ordinary income an investor's marginal tax rate), while long-term capital gains are taxed at 15%. Suppose Congress is considering a law that will tax long-term capital gains and dividends at 25%. How will this affect a firm's choice of dividend policy? Specifically, 3. how will this most likely affect firms that are paying dividends? (5 pts) They will be affected more out dividends will have them get taxed more more It will be costly for them. 4. how will this most likely affect firms that are not paying dividends? (5 pts) As they are an increase in tax will not affect re-innesting the money Jas much. As they Dosts back to the company's growth the malas are re-direting 5. Generally speaking, leveraging up a firm is value increasing due to the income tax shields associated with interest payments. However, the average publicly traded firm has a debt ratio of approximately 55%. Further, some companies have little or no debt while others have greater than 75% of debt. How do you explain such wide variations in capital structure? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started