Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the equivalent units of production for materials? What are the equivalent units of production for labor and overhead? What is the transferred in

What are the equivalent units of production for materials?

What are the equivalent units of production for labor and overhead?

What is the transferred in unit cost adjusted already for the normal loss?

What is the total cost assigned to the ending inventory?

What is the total transferred out cost?

What are the equivalent units of production for labor and overhead?

What is the transferred in unit cost adjusted already for the normal loss?

What is the total cost assigned to the ending inventory?

What is the total transferred out cost?

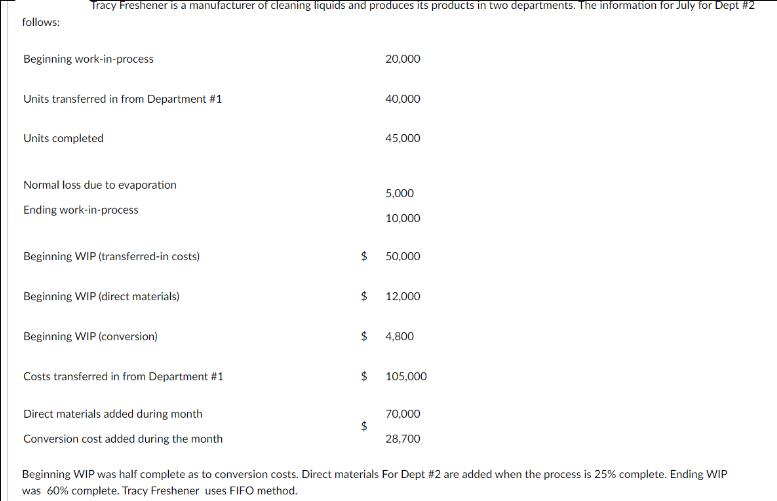

follows: Tracy Freshener is a manufacturer of cleaning liquids and produces its products in two departments. The information for July for Dept #2 Beginning work-in-process Units transferred in from Department #1 Units completed Normal loss due to evaporation Ending work-in-process Beginning WIP (transferred-in costs) Beginning WIP (direct materials) Beginning WIP (conversion) Costs transferred in from Department #1 Direct materials added during month Conversion cost added during the month $ $ $ $ $ 20,000 40,000 45,000 5,000 10,000 50,000 12,000 4,800 105,000 70,000 28,700 Beginning WIP was half complete as to conversion costs. Direct materials For Dept # 2 are added when the process is 25% complete. Ending WIP was 60% complete. Tracy Freshener uses FIFO method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 Calculate Equivalent Units of Production Equivalent Units of Production for materials Beginning WIP Transferredin Costs 20000 units Units Trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started