What are the journal entires that need to be made based on the following instructions and information?

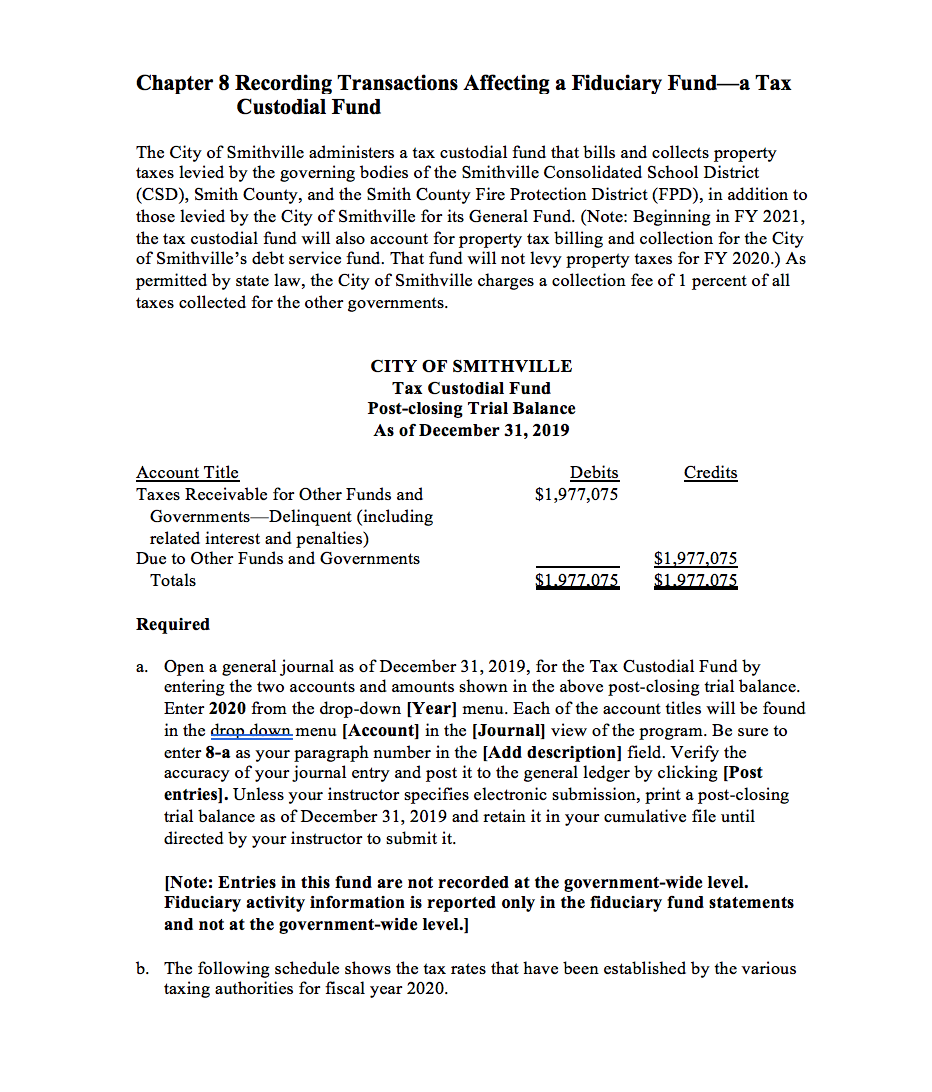

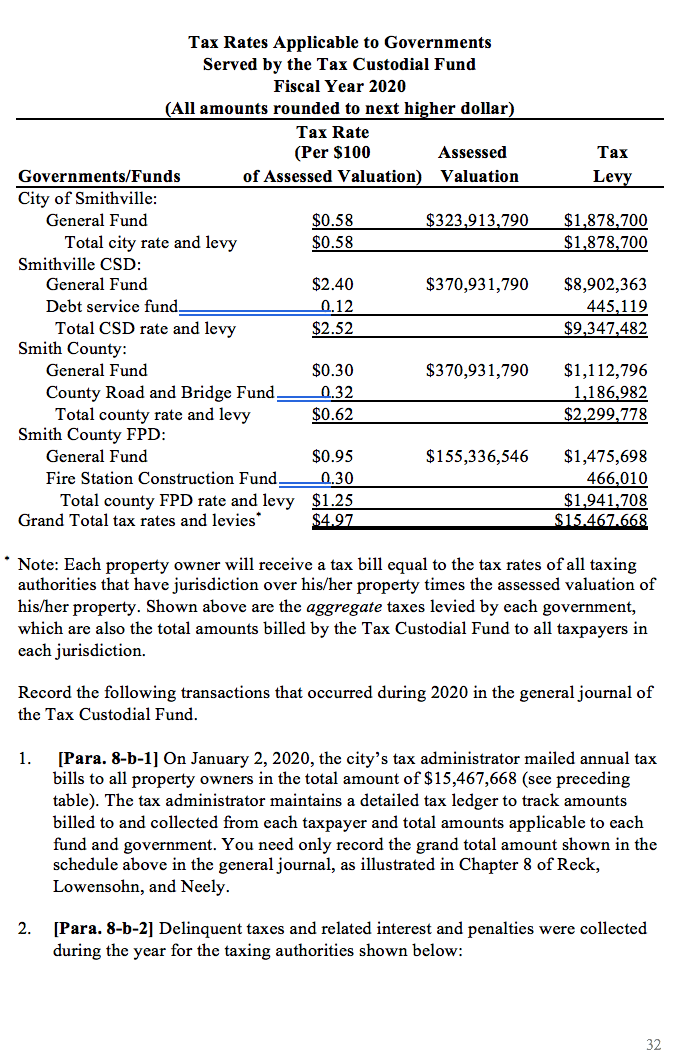

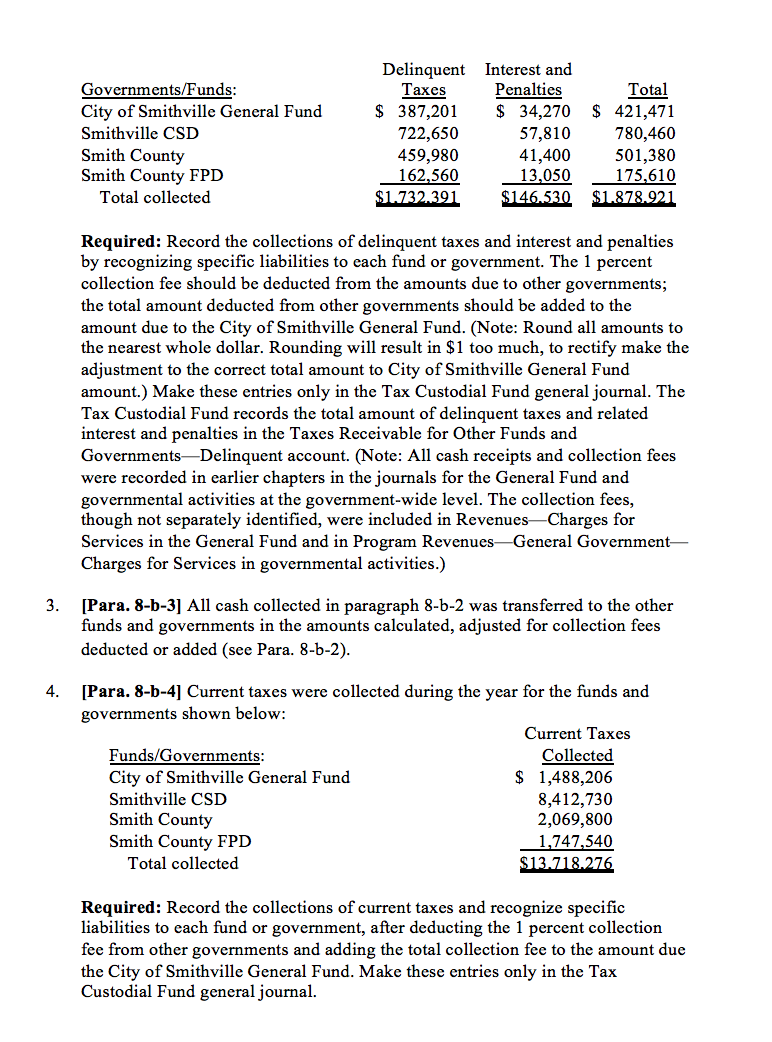

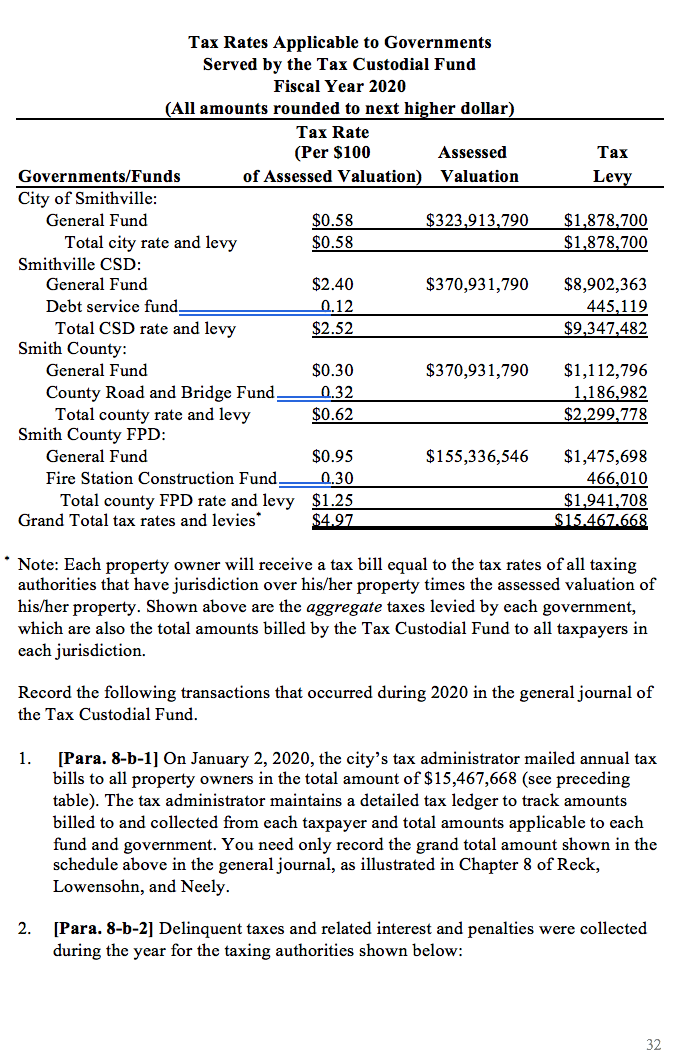

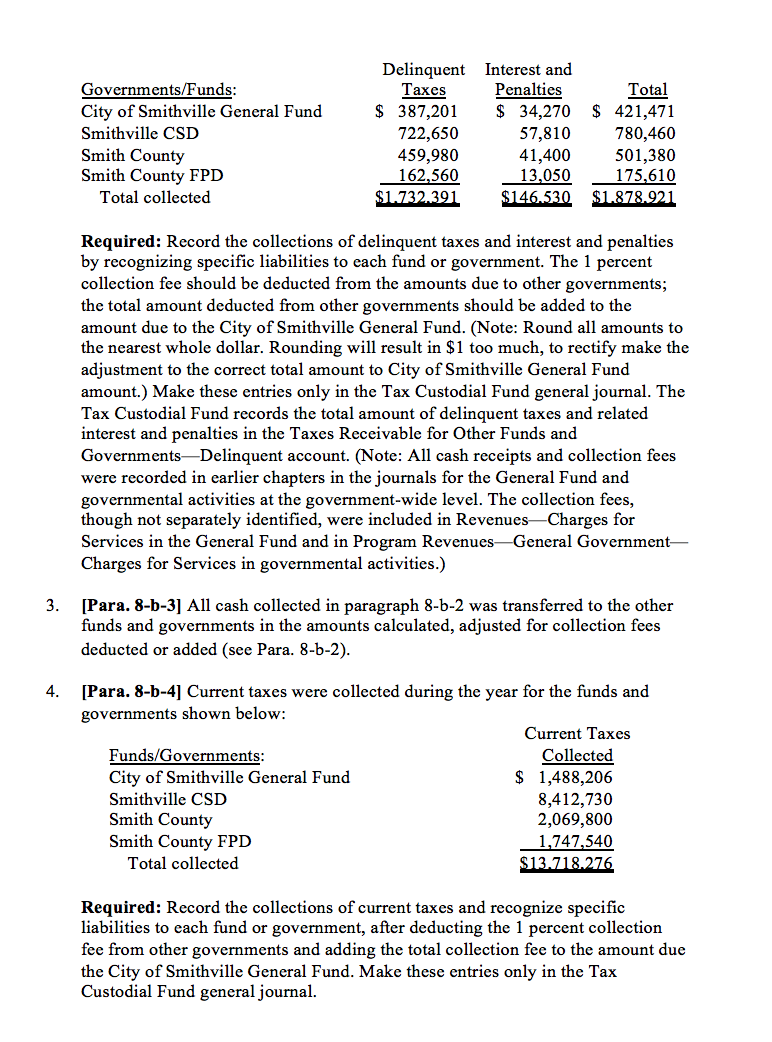

Chapter 8 Recording Transactions Affecting a Fiduciary Funda Tax Custodial Fund The City of Smithville administers a tax custodial fund that bills and collects property taxes levied by the governing bodies of the Smithville Consolidated School District (CSD), Smith County, and the Smith County Fire Protection District (FPD), in addition to those levied by the City of Smithville for its General Fund. (Note: Beginning in FY 2021, the tax custodial fund will also account for property tax billing and collection for the City of Smithville's debt service fund. That fund will not levy property taxes for FY 2020.) As permitted by state law, the City of Smithville charges a collection fee of 1 percent of all taxes collected for the other governments. CITY OF SMITHVILLE Tax Custodial Fund Post-closing Trial Balance As of December 31, 2019 Credits Debits $1,977,075 Account Title Taxes Receivable for Other Funds and GovernmentsDelinquent (including related interest and penalties) Due to Other Funds and Governments Totals $1.977.075 $1,977,075 $1.977.075 Required a. Open a general journal as of December 31, 2019, for the Tax Custodial Fund by entering the two accounts and amounts shown in the above post-closing trial balance. Enter 2020 from the drop-down (Year) menu. Each of the account titles will be found in the drop down menu [Account] in the [Journal] view of the program. Be sure to enter 8-a as your paragraph number in the [Add description] field. Verify the accuracy of your journal entry and post it to the general ledger by clicking (Post entries). Unless your instructor specifies electronic submission, print a post-closing trial balance as of December 31, 2019 and retain it in your cumulative file until directed by your instructor to submit it. [Note: Entries in this fund are not recorded at the government-wide level. Fiduciary activity information is reported only in the fiduciary fund statements and not at the government-wide level.] b. The following schedule shows the tax rates that have been established by the various taxing authorities for fiscal year 2020. Tax Levy $1,878,700 $1,878,700 Tax Rates Applicable to Governments Served by the Tax Custodial Fund Fiscal Year 2020 (All amounts rounded to next higher dollar) Tax Rate (Per $100 Assessed Governments/Funds of Assessed Valuation) Valuation City of Smithville: General Fund $0.58 $323,913,790 Total city rate and levy $0.58 Smithville CSD: General Fund $2.40 $370,931,790 Debt service fund. Total CSD rate and levy $2.52 Smith County: General Fund $0.30 $370,931,790 County Road and Bridge Fund 0.32 Total county rate and levy $0.62 Smith County FPD: General Fund $0.95 $155,336,546 Fire Station Construction Fund 0.30 Total county FPD rate and levy $1.25 Grand Total tax rates and levies $4.97 0.12 $8,902,363 445,119 $9,347,482 $1,112,796 1,186,982 $2,299,778 $1,475,698 466,010 $1,941,708 $15.467.668 Note: Each property owner will receive a tax bill equal to the tax rates of all taxing authorities that have jurisdiction over his/her property times the assessed valuation of his/her property. Shown above are the aggregate taxes levied by each government, which are also the total amounts billed by the Tax Custodial Fund to all taxpayers in each jurisdiction. Record the following transactions that occurred during 2020 in the general journal of the Tax Custodial Fund. 1. Para. 8-b-1] On January 2, 2020, the city's tax administrator mailed annual tax bills to all property owners in the total amount of $15,467,668 (see preceding table). The tax administrator maintains a detailed tax ledger to track amounts billed to and collected from each taxpayer and total amounts applicable to each fund and government. You need only record the grand total amount shown in the schedule above in the general journal, as illustrated in Chapter 8 of Reck, Lowensohn, and Neely. 2. [Para. 8-6-2] Delinquent taxes and related interest and penalties were collected during the year for the taxing authorities shown below: Governments/Funds: City of Smithville General Fund Smithville CSD Smith County Smith County FPD Total collected Delinquent Interest and Taxes Penalties $ 387,201 $ 34,270 722,650 57,810 459,980 41,400 162,560 13,050 $1.732.391 $146.530 Total $ 421,471 780,460 501,380 175,610 $1.878.921 Required: Record the collections of delinquent taxes and interest and penalties by recognizing specific liabilities to each fund or government. The 1 percent collection fee should be deducted from the amounts due to other governments; the total amount deducted from other governments should be added to the amount due to the City of Smithville General Fund. (Note: Round all amounts to the nearest whole dollar. Rounding will result in $1 too much, to rectify make the adjustment to the correct total amount to City of Smithville General Fund amount.) Make these entries only in the Tax Custodial Fund general journal. The Tax Custodial Fund records the total amount of delinquent taxes and related interest and penalties in the Taxes Receivable for Other Funds and Governments-Delinquent account. (Note: All cash receipts and collection fees were recorded in earlier chapters in the journals for the General Fund and governmental activities at the government-wide level. The collection fees, though not separately identified, were included in Revenues-Charges for Services in the General Fund and in Program RevenuesGeneral Government- Charges for Services in governmental activities.) 3. [Para. 8-b-3] All cash collected in paragraph 8-6-2 was transferred to the other funds and governments in the amounts calculated, adjusted for collection fees deducted or added (see Para. 8-6-2). 4. [Para. 8-1-4] Current taxes were collected during the year for the funds and governments shown below: Current Taxes Funds/Governments: Collected City of Smithville General Fund $ 1,488,206 Smithville CSD 8,412,730 Smith County 2,069,800 Smith County FPD 1,747,540 Total collected $13.718.276 Required: Record the collections of current taxes and recognize specific liabilities to each fund or government, after deducting the 1 percent collection fee from other governments and adding the total collection fee to the amount due the City of Smithville General Fund. Make these entries only in the Tax Custodial Fund general journal. 5. [Para. 8-b-5] All cash collected in paragraph 8-6-4 was transferred to the other funds and governments, adjusted for collection fees deducted or added. (Note: For simplicity, Chapter 4 of Smithville did not address this collection of fees by the custodial fund.) [Para. 8-6-6] Make a year-end aggregate journal entry to reflect the additions and deductions made to net position for the reporting period. Required: Using debits, record deductions for the amount of the administrative fee, and all funds transferred to other governments and funds in paragraphs 8-6-2 and 8-6-4. Additions should be credited for all property tax collections made for other governments. Recall that amounts related to the City of Smithville General Fund are not included in the journal entry because the city does not hold a net position in the fiduciary fund since it is administering the fund. [Para. 8-b-7] Make the year-end journal entry to reclassify all uncollected current taxes as delinquent. Add to the receivable amount interest and penalties of 6 percent on the reclassified amount (round amount to nearest whole dollar). The interest and penalties portion of the total amount should be debited to Taxes Receivable for Other Funds and Governments-Delinquent and credited to Due to Other Funds and Governments. You need only record the aggregate amounts reclassified in the general journal; the tax administrator will update the detailed tax ledger records for these reclassifications. c. Post the journal entries for all the preceding transactions. Prepare closing entries to close the additions and deductions accounts. Export a post-closing trial balance for 2020 to prepare a statement of fiduciary net position for the Tax Custodial Fund (for an example of a custodial fund statement, see the last column of Illustration 8-6 of the textbook). You should deduct the city's General Fund portion of delinquent taxes receivable and related interest and penalties receivable from the amounts recorded as Taxes Receivable for Other Funds and Governments-Delinquent. The same amount should be deducted from the liability account Due to Other Funds and Governments. The city's General Fund portion of these account balances must be deducted as only the amounts applicable to other governments can be reported in a fiduciary fund statement. Taxes receivable and interest and penalties receivable that are applicable to the city itself were reported in the General Fund balance sheet that you prepared in Chapter 4 of this project. d. Use the exported pre-closing 2020 trial balance to prepare a statement of changes in fiduciary net position for the Tax Custodial Fund (for an example of a custodial fund statement, see the last column of Illustration 8-7 of the textbook). [Note: Retain the post-closing trial balance as of December 31, 2020, the statement of fiduciary net position, and the statement of changes in fiduciary net position in your cumulative folder, unless your instructor requests electronic 34 2010 by MeGrau Hill Edition This ie ronrietar material solely for authorized instructor uge Not authorized for sale or Chapter 8 Recording Transactions Affecting a Fiduciary Funda Tax Custodial Fund The City of Smithville administers a tax custodial fund that bills and collects property taxes levied by the governing bodies of the Smithville Consolidated School District (CSD), Smith County, and the Smith County Fire Protection District (FPD), in addition to those levied by the City of Smithville for its General Fund. (Note: Beginning in FY 2021, the tax custodial fund will also account for property tax billing and collection for the City of Smithville's debt service fund. That fund will not levy property taxes for FY 2020.) As permitted by state law, the City of Smithville charges a collection fee of 1 percent of all taxes collected for the other governments. CITY OF SMITHVILLE Tax Custodial Fund Post-closing Trial Balance As of December 31, 2019 Credits Debits $1,977,075 Account Title Taxes Receivable for Other Funds and GovernmentsDelinquent (including related interest and penalties) Due to Other Funds and Governments Totals $1.977.075 $1,977,075 $1.977.075 Required a. Open a general journal as of December 31, 2019, for the Tax Custodial Fund by entering the two accounts and amounts shown in the above post-closing trial balance. Enter 2020 from the drop-down (Year) menu. Each of the account titles will be found in the drop down menu [Account] in the [Journal] view of the program. Be sure to enter 8-a as your paragraph number in the [Add description] field. Verify the accuracy of your journal entry and post it to the general ledger by clicking (Post entries). Unless your instructor specifies electronic submission, print a post-closing trial balance as of December 31, 2019 and retain it in your cumulative file until directed by your instructor to submit it. [Note: Entries in this fund are not recorded at the government-wide level. Fiduciary activity information is reported only in the fiduciary fund statements and not at the government-wide level.] b. The following schedule shows the tax rates that have been established by the various taxing authorities for fiscal year 2020. Tax Levy $1,878,700 $1,878,700 Tax Rates Applicable to Governments Served by the Tax Custodial Fund Fiscal Year 2020 (All amounts rounded to next higher dollar) Tax Rate (Per $100 Assessed Governments/Funds of Assessed Valuation) Valuation City of Smithville: General Fund $0.58 $323,913,790 Total city rate and levy $0.58 Smithville CSD: General Fund $2.40 $370,931,790 Debt service fund. Total CSD rate and levy $2.52 Smith County: General Fund $0.30 $370,931,790 County Road and Bridge Fund 0.32 Total county rate and levy $0.62 Smith County FPD: General Fund $0.95 $155,336,546 Fire Station Construction Fund 0.30 Total county FPD rate and levy $1.25 Grand Total tax rates and levies $4.97 0.12 $8,902,363 445,119 $9,347,482 $1,112,796 1,186,982 $2,299,778 $1,475,698 466,010 $1,941,708 $15.467.668 Note: Each property owner will receive a tax bill equal to the tax rates of all taxing authorities that have jurisdiction over his/her property times the assessed valuation of his/her property. Shown above are the aggregate taxes levied by each government, which are also the total amounts billed by the Tax Custodial Fund to all taxpayers in each jurisdiction. Record the following transactions that occurred during 2020 in the general journal of the Tax Custodial Fund. 1. Para. 8-b-1] On January 2, 2020, the city's tax administrator mailed annual tax bills to all property owners in the total amount of $15,467,668 (see preceding table). The tax administrator maintains a detailed tax ledger to track amounts billed to and collected from each taxpayer and total amounts applicable to each fund and government. You need only record the grand total amount shown in the schedule above in the general journal, as illustrated in Chapter 8 of Reck, Lowensohn, and Neely. 2. [Para. 8-6-2] Delinquent taxes and related interest and penalties were collected during the year for the taxing authorities shown below: Governments/Funds: City of Smithville General Fund Smithville CSD Smith County Smith County FPD Total collected Delinquent Interest and Taxes Penalties $ 387,201 $ 34,270 722,650 57,810 459,980 41,400 162,560 13,050 $1.732.391 $146.530 Total $ 421,471 780,460 501,380 175,610 $1.878.921 Required: Record the collections of delinquent taxes and interest and penalties by recognizing specific liabilities to each fund or government. The 1 percent collection fee should be deducted from the amounts due to other governments; the total amount deducted from other governments should be added to the amount due to the City of Smithville General Fund. (Note: Round all amounts to the nearest whole dollar. Rounding will result in $1 too much, to rectify make the adjustment to the correct total amount to City of Smithville General Fund amount.) Make these entries only in the Tax Custodial Fund general journal. The Tax Custodial Fund records the total amount of delinquent taxes and related interest and penalties in the Taxes Receivable for Other Funds and Governments-Delinquent account. (Note: All cash receipts and collection fees were recorded in earlier chapters in the journals for the General Fund and governmental activities at the government-wide level. The collection fees, though not separately identified, were included in Revenues-Charges for Services in the General Fund and in Program RevenuesGeneral Government- Charges for Services in governmental activities.) 3. [Para. 8-b-3] All cash collected in paragraph 8-6-2 was transferred to the other funds and governments in the amounts calculated, adjusted for collection fees deducted or added (see Para. 8-6-2). 4. [Para. 8-1-4] Current taxes were collected during the year for the funds and governments shown below: Current Taxes Funds/Governments: Collected City of Smithville General Fund $ 1,488,206 Smithville CSD 8,412,730 Smith County 2,069,800 Smith County FPD 1,747,540 Total collected $13.718.276 Required: Record the collections of current taxes and recognize specific liabilities to each fund or government, after deducting the 1 percent collection fee from other governments and adding the total collection fee to the amount due the City of Smithville General Fund. Make these entries only in the Tax Custodial Fund general journal. 5. [Para. 8-b-5] All cash collected in paragraph 8-6-4 was transferred to the other funds and governments, adjusted for collection fees deducted or added. (Note: For simplicity, Chapter 4 of Smithville did not address this collection of fees by the custodial fund.) [Para. 8-6-6] Make a year-end aggregate journal entry to reflect the additions and deductions made to net position for the reporting period. Required: Using debits, record deductions for the amount of the administrative fee, and all funds transferred to other governments and funds in paragraphs 8-6-2 and 8-6-4. Additions should be credited for all property tax collections made for other governments. Recall that amounts related to the City of Smithville General Fund are not included in the journal entry because the city does not hold a net position in the fiduciary fund since it is administering the fund. [Para. 8-b-7] Make the year-end journal entry to reclassify all uncollected current taxes as delinquent. Add to the receivable amount interest and penalties of 6 percent on the reclassified amount (round amount to nearest whole dollar). The interest and penalties portion of the total amount should be debited to Taxes Receivable for Other Funds and Governments-Delinquent and credited to Due to Other Funds and Governments. You need only record the aggregate amounts reclassified in the general journal; the tax administrator will update the detailed tax ledger records for these reclassifications. c. Post the journal entries for all the preceding transactions. Prepare closing entries to close the additions and deductions accounts. Export a post-closing trial balance for 2020 to prepare a statement of fiduciary net position for the Tax Custodial Fund (for an example of a custodial fund statement, see the last column of Illustration 8-6 of the textbook). You should deduct the city's General Fund portion of delinquent taxes receivable and related interest and penalties receivable from the amounts recorded as Taxes Receivable for Other Funds and Governments-Delinquent. The same amount should be deducted from the liability account Due to Other Funds and Governments. The city's General Fund portion of these account balances must be deducted as only the amounts applicable to other governments can be reported in a fiduciary fund statement. Taxes receivable and interest and penalties receivable that are applicable to the city itself were reported in the General Fund balance sheet that you prepared in Chapter 4 of this project. d. Use the exported pre-closing 2020 trial balance to prepare a statement of changes in fiduciary net position for the Tax Custodial Fund (for an example of a custodial fund statement, see the last column of Illustration 8-7 of the textbook). [Note: Retain the post-closing trial balance as of December 31, 2020, the statement of fiduciary net position, and the statement of changes in fiduciary net position in your cumulative folder, unless your instructor requests electronic 34 2010 by MeGrau Hill Edition This ie ronrietar material solely for authorized instructor uge Not authorized for sale or