Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the journal entries for the following information: a) Pine recorded $3,000 of depreciation on the equipment. b) Pine prepared a closing entry to

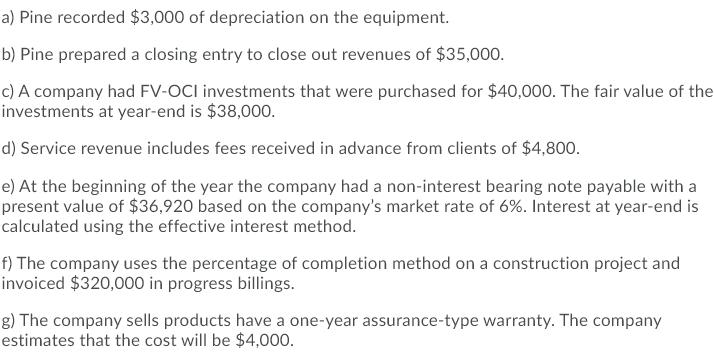

What are the journal entries for the following information:

a) Pine recorded $3,000 of depreciation on the equipment. b) Pine prepared a closing entry to close out revenues of $35,000. c) A company had FV-OCI investments that were purchased for $40,000. The fair value of the investments at year-end is $38,000. d) Service revenue includes fees received in advance from clients of $4,800. e) At the beginning of the year the company had a non-interest bearing note payable with a present value of $36,920 based on the company's market rate of 6%. Interest at year-end is calculated using the effective interest method. f) The company uses the percentage of completion method on a construction project and invoiced $320,000 in progress billings. g) The company sells products have a one-year assurance-type warranty. The company estimates that the cost will be $4,000.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Depreciation Expense Accumulated Depreciation Debit Depreciation Expense 3000 Cre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started