Answered step by step

Verified Expert Solution

Question

1 Approved Answer

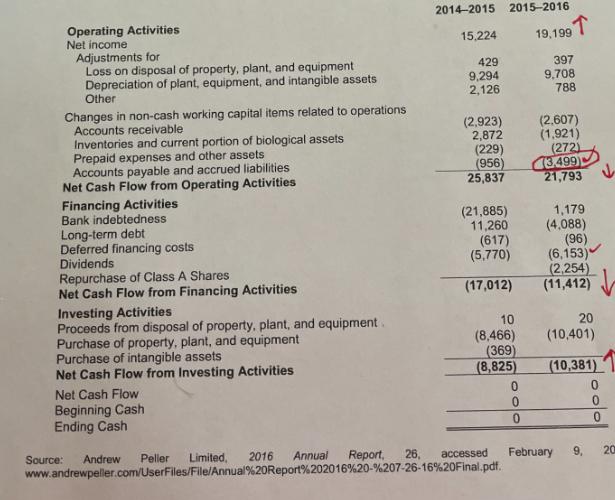

What are the key drivers creat the difference in net cash flow for Andrew peller limited from 2015 to 2016? Operating Activities Net income Adjustments

What are the key drivers creat the difference in net cash flow for Andrew peller limited from 2015 to 2016?

Operating Activities Net income Adjustments for Loss on disposal of property, plant, and equipment Depreciation of plant, equipment, and intangible assets Other 2014-2015 2015-2016 15,224 19,199 429 9,294 397 9,708 2,126 788 Changes in non-cash working capital items related to operations Accounts receivable. (2,923) (2,607) Inventories and current portion of biological assets 2,872 (1,921) Prepaid expenses and other assets (229) (272) Accounts payable and accrued liabilities (956) 3.499) Net Cash Flow from Operating Activities Financing Activities Bank indebtedness Long-term debt Deferred financing costs Dividends 25,837 21,793 (21,885) 1,179 11,260 (4.088) (617) (96) (5,770) (6,153) Repurchase of Class A Shares (2,254) Net Cash Flow from Financing Activities (17,012) (11,412) Investing Activities Proceeds from disposal of property, plant, and equipment. 10 20 Purchase of property, plant, and equipment (8,466) (10,401) Purchase of intangible assets (369) Net Cash Flow from Investing Activities Net Cash Flow Beginning Cash Ending Cash (8,825) (10,381) 0 0 0 0 0 Source: Andrew Peller Limited, 2016 Annual Report, 26, accessed February 9, 20 www.andrewpeller.com/UserFiles/File/Annual%20Report%202016%20-%207-26-16%20Final.pdf.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started