Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the major sources and uses of cash? How did operating cash flows compare with accrual income? Which do you think is more

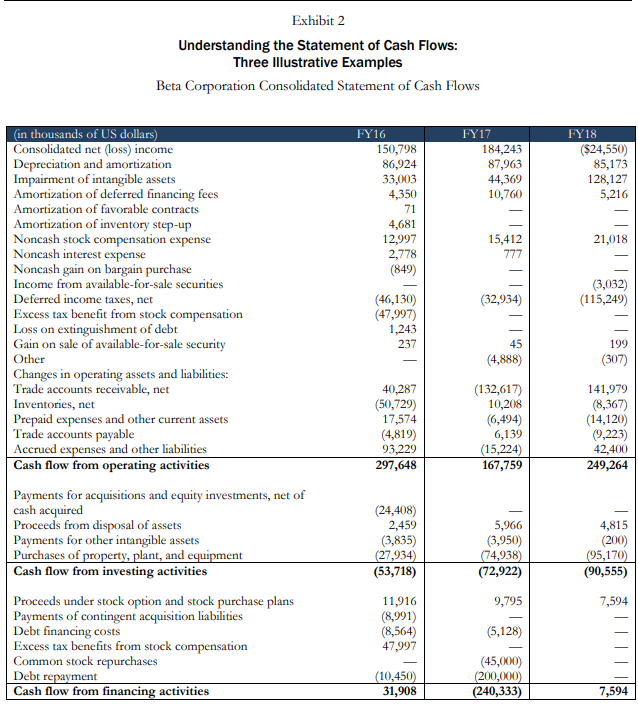

What are the major sources and uses of cash? How did operating cash flows compare with accrual income? Which do you think is more representative of the operating performance of the firm? What are the principal items that cause a difference between net income and the change in cash? Did the entity generate enough cash from operations to cover its capital expenditures and dividend payments to shareholders? If so, what did the company do with its excess free cash flow? If not, where did the company obtain the cash used to pay for its capital expenditures and dividends? How did capital expenditures compare with depreciation? Why is this a meaningful comparison? What other meaningful comparisons within the statement of cash flows can you imagine? What additional information about the firm's cash flows would you like to know? Given this information, how do you feel about the liquidity and solvency of the company? Rate the company from 1 (very strong) to 5 (bankruptcy imminent). Do you have any idea what company is represented or its industry? Exhibit 2 Understanding the Statement of Cash Flows: Three Illustrative Examples Beta Corporation Consolidated Statement of Cash Flows (in thousands of US dollars) Consolidated net (loss) income Depreciation and amortization Impairment of intangible assets Amortization of deferred financing fees Amortization of favorable contracts Amortization of inventory step-up Noncash stock compensation expense FY16 FY17 FY18 150,798 184,243 ($24,550) 86,924 87,963 85,173 33,003 44,369 128,127 4,350 10,760 5,216 71 4,681 12,997 15,412 21,018 Noncash interest expense 2,778 777 Noncash gain on bargain purchase (849) Income from available-for-sale securities Deferred income taxes, net (46,130) (32,934) (3,032) (115,249) Excess tax benefit from stock compensation (47,997) Loss on extinguishment of debt 1,243 Gain on sale of available-for-sale security Other 237 45 199 (4,888) (307) Changes in operating assets and liabilities: Trade accounts receivable, net Inventories, net 40,287 (50,729) (132,617) 141,979 10,208 (8,367) Prepaid expenses and other current assets 17,574 (6,494) (14,120) Trade accounts payable (4,819) 6,139 (9,223) Accrued expenses and other liabilities 93,229 (15,224) 42,400 Cash flow from operating activities 297,648 167,759 249,264 Payments for acquisitions and equity investments, net of cash acquired (24,408) Proceeds from disposal of assets 2,459 5,966 4,815 Payments for other intangible assets (3,835) (3,950) (200) Purchases of property, plant, and equipment (27,934) (74,938) (95,170) Cash flow from investing activities (53,718) (72,922) (90,555) Proceeds under stock option and stock purchase plans 11,916 9,795 7,594 Payments of contingent acquisition liabilities (8,991) Debt financing costs (8,564) (5,128) Excess tax benefits from stock compensation 47,997 Common stock repurchases (45,000) - Debt repayment (10,450) (200,000) Cash flow from financing activities 31,908 (240,333) 7,594

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started