Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the right answers? Mean Green Co., is a publicly traded firm with 5 million shares outstanding. The firm has $30 million of debt

What are the right answers?

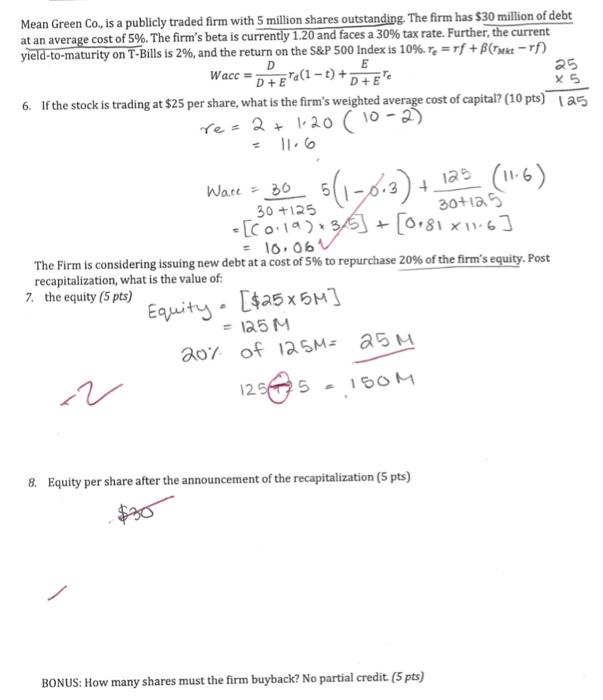

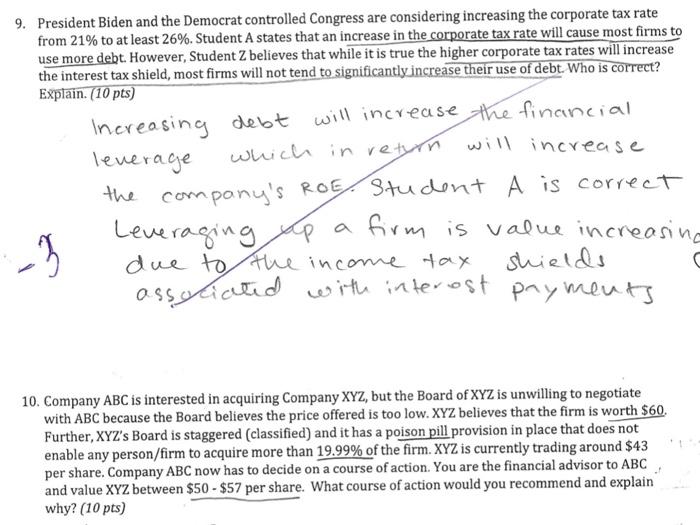

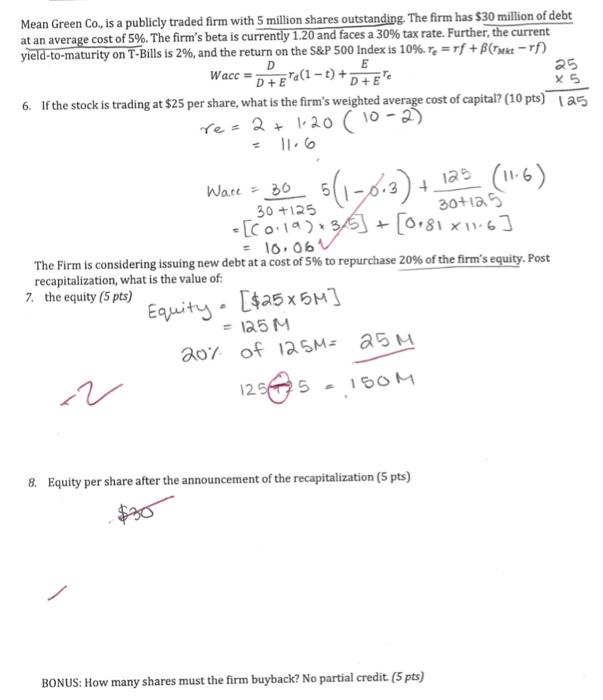

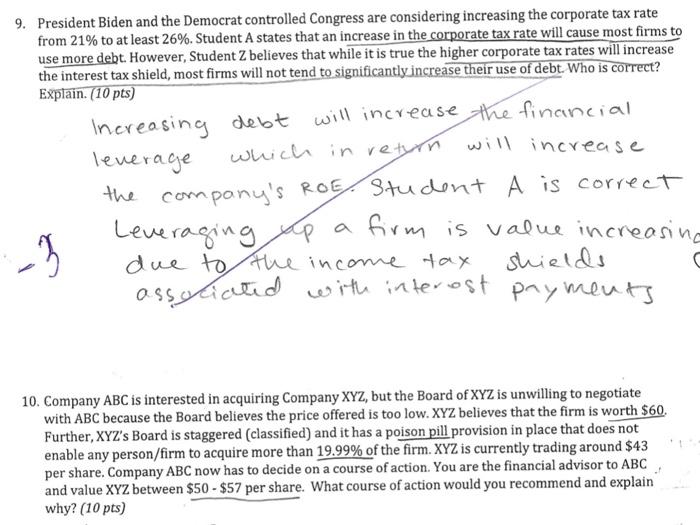

Mean Green Co., is a publicly traded firm with 5 million shares outstanding. The firm has $30 million of debt at an average cost of 5%. The firm's beta is currently 1.20 and faces a 30% tax rate. Further, the current yield-to-maturity on T-Bills is 2%, and the return on the S&P 500 Index is 10%. Te Erf + Buke - rf) D E 25 Wacc = D + "a(1 t) + x5 6. If the stock is trading at $25 per share, what is the firm's weighted average cost of capital? (10 pts) 125 re- 2 + 1.20 (10-2) D+E" 1a Ware = 30 6(1-0.3) + + (11.6) 30 +125 30+125 - [C019)13163 +0.81 11:6] = 10.064 The Firm is considering issuing new debt at a cost of 5% to repurchase 20% of the firm's equity. Post recapitalization, what is the value of: 7. the equity (5 pts) ] = 125 M 20% of 125M= 25M Equity [$25x5M] 125675 // 150M 8. Equity per share after the announcement of the recapitalization (5 pts) BONUS: How many shares must the firm buyback? No partial credit. (5 pts) 9. President Biden and the Democrat controlled Congress are considering increasing the corporate tax rate from 21% to at least 26%. Student A states that an increase in the corporate tax rate will cause most firms to use more debt. However, Student Z believes that while it is true the higher corporate tax rates will increase the interest tax shield, most firms will not tend to significantly increase their use of debt. Who is correct? Explain. (10 pts) Increasing debt will increase the financial leverage which in return will increase the company's ROE. Student A is correct Leveraging up a firm is value increasine due to the income tax shields C assaliated with interest payments 3 10. Company ABC is interested in acquiring Company XYZ, but the Board of XYZ is unwilling to negotiate with ABC because the Board believes the price offered is too low.XYZ believes that the firm is worth $60. Further, XYZ's Board is staggered (classified) and it has a poison pill provision in place that does not enable any person/firm to acquire more than 19.99% of the firm. XYZ is currently trading around $43 per share. Company ABC now has to decide on a course of action. You are the financial advisor to ABC and value XYZ between $50 - $57 per share. What course of action would you recommend and explain why? (10 pts) . Mean Green Co., is a publicly traded firm with 5 million shares outstanding. The firm has $30 million of debt at an average cost of 5%. The firm's beta is currently 1.20 and faces a 30% tax rate. Further, the current yield-to-maturity on T-Bills is 2%, and the return on the S&P 500 Index is 10%. Te Erf + Buke - rf) D E 25 Wacc = D + "a(1 t) + x5 6. If the stock is trading at $25 per share, what is the firm's weighted average cost of capital? (10 pts) 125 re- 2 + 1.20 (10-2) D+E" 1a Ware = 30 6(1-0.3) + + (11.6) 30 +125 30+125 - [C019)13163 +0.81 11:6] = 10.064 The Firm is considering issuing new debt at a cost of 5% to repurchase 20% of the firm's equity. Post recapitalization, what is the value of: 7. the equity (5 pts) ] = 125 M 20% of 125M= 25M Equity [$25x5M] 125675 // 150M 8. Equity per share after the announcement of the recapitalization (5 pts) BONUS: How many shares must the firm buyback? No partial credit. (5 pts) 9. President Biden and the Democrat controlled Congress are considering increasing the corporate tax rate from 21% to at least 26%. Student A states that an increase in the corporate tax rate will cause most firms to use more debt. However, Student Z believes that while it is true the higher corporate tax rates will increase the interest tax shield, most firms will not tend to significantly increase their use of debt. Who is correct? Explain. (10 pts) Increasing debt will increase the financial leverage which in return will increase the company's ROE. Student A is correct Leveraging up a firm is value increasine due to the income tax shields C assaliated with interest payments 3 10. Company ABC is interested in acquiring Company XYZ, but the Board of XYZ is unwilling to negotiate with ABC because the Board believes the price offered is too low.XYZ believes that the firm is worth $60. Further, XYZ's Board is staggered (classified) and it has a poison pill provision in place that does not enable any person/firm to acquire more than 19.99% of the firm. XYZ is currently trading around $43 per share. Company ABC now has to decide on a course of action. You are the financial advisor to ABC and value XYZ between $50 - $57 per share. What course of action would you recommend and explain why? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started