Answered step by step

Verified Expert Solution

Question

1 Approved Answer

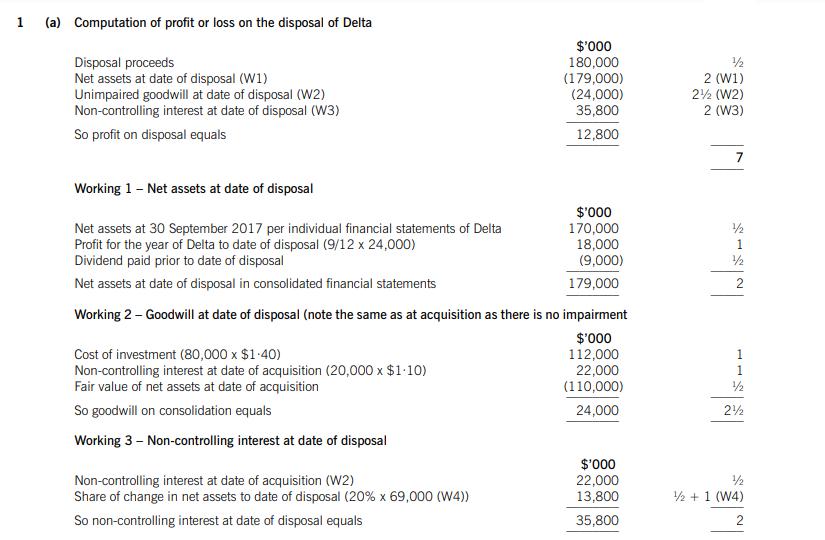

1 (a) Computation of profit or loss on the disposal of Delta Disposal proceeds Net assets at date of disposal (W1) Unimpaired goodwill at

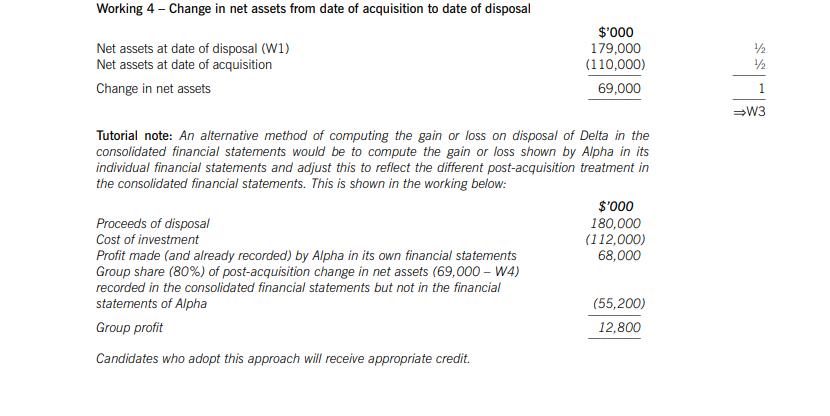

1 (a) Computation of profit or loss on the disposal of Delta Disposal proceeds Net assets at date of disposal (W1) Unimpaired goodwill at date of disposal (W2) Non-controlling interest at date of disposal (W3) So profit on disposal equals $'000 180,000 (179,000) 1/2 2 (W1) (24,000) 2 (W2) 35,800 2 (W3) 12,800 7 Working 1 - Net assets at date of disposal Net assets at 30 September 2017 per individual financial statements of Delta Profit for the year of Delta to date of disposal (9/12 x 24,000) $'000 170,000 18,000 1 Dividend paid prior to date of disposal (9,000) Net assets at date of disposal in consolidated financial statements 179,000 2 Working 2 - Goodwill at date of disposal (note the same as at acquisition as there is no impairment $'000 Cost of investment (80,000 x $1.40) 112,000 1 Non-controlling interest at date of acquisition (20,000 x $1-10) 22,000 1 Fair value of net assets at date of acquisition (110,000) 1/2 So goodwill on consolidation equals 24,000 212 Working 3 - Non-controlling interest at date of disposal $'000 Non-controlling interest at date of acquisition (W2) 22,000 1/2 Share of change in net assets to date of disposal (20% x 69,000 (W4)) 13,800 1/2+1 (W4) So non-controlling interest at date of disposal equals 35,800 Working 4 - Change in net assets from date of acquisition to date of disposal Net assets at date of disposal (W1) Net assets at date of acquisition Change in net assets $'000 179,000 (110,000) 69,000 1 Tutorial note: An alternative method of computing the gain or loss on disposal of Delta in the consolidated financial statements would be to compute the gain or loss shown by Alpha in its individual financial statements and adjust this to reflect the different post-acquisition treatment in the consolidated financial statements. This is shown in the working below: Proceeds of disposal Cost of investment Profit made (and already recorded) by Alpha in its own financial statements Group share (80%) of post-acquisition change in net assets (69,000 - W4) recorded in the consolidated financial statements but not in the financial statements of Alpha Group profit Candidates who adopt this approach will receive appropriate credit. $'000 180,000 (112,000) 68,000 (55,200) 12,800 W3

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Based on the detailed financial data you provided here are the values youre looking for To...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started