Answered step by step

Verified Expert Solution

Question

1 Approved Answer

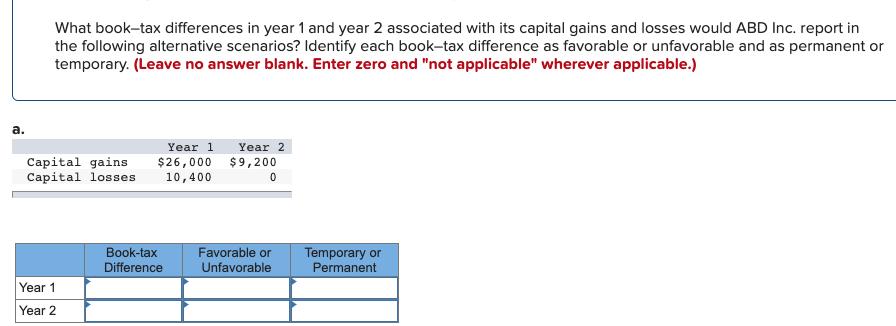

What book-tax differences in year 1 and year 2 associated with its capital gains and losses would ABD Inc. report in the following alternative

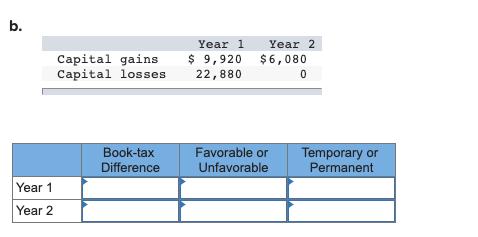

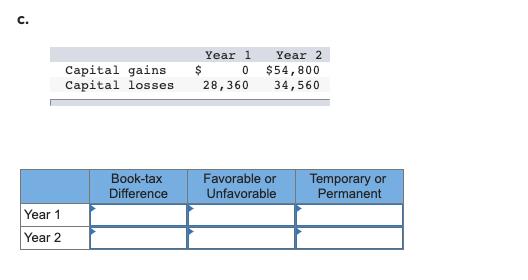

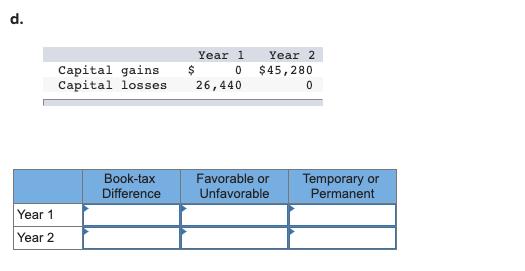

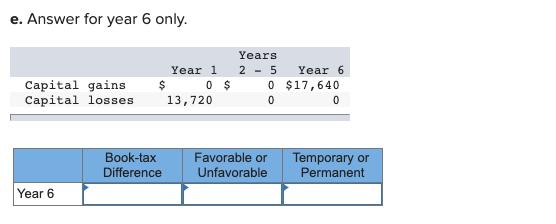

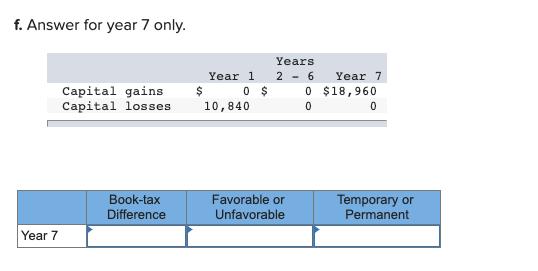

What book-tax differences in year 1 and year 2 associated with its capital gains and losses would ABD Inc. report in the following alternative scenarios? Identify each book-tax difference as favorable or unfavorable and as permanent or temporary. (Leave no answer blank. Enter zero and "not applicable" wherever applicable.) . Year 1 Year 2 Capital gains Capital losses $26,000 10,400 $9,200 Book-tax Difference Favorable or Unfavorable Temporary or Permanent Year 1 Year 2 b. Year 1 Year 2 $ 9,920 Capital gains Capital losses $6,080 22,880 Book-tax Difference Temporary or Permanent Favorable or Unfavorable Year 1 Year 2 Year 1 Year 2 Capital gains 2$ $54,800 Capital losses 28,360 34,560 Book-tax Difference Favorable or Unfavorable Temporary or Permanent Year 1 Year 2 d. Year 1 Year 2 Capital gains Capital losses $45,280 26,440 Book-tax Difference Favorable or Unfavorable Temporary or Permanent Year 1 Year 2 e. Answer for year 6 only. Years Year 1 2 - 5 Year 6 $ 0 $ 0 $17,640 Capital gains Capital losses 13,720 Book-tax Difference Favorable or Unfavorable Temporary or Permanent Year 6 f. Answer for year 7 only. Years Year 1 2 - 6 Year 7 $ 0 $ O $18,960 Capital gains Capital losses 10,840 Book-tax Difference Favorable or Temporary or Permanent Unfavorable Year 7

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a No booktax differences in either year b In year 1 There is a 12960 unfavorable adjustment b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started