Question

What changes can be measured to create a balanced scorecard outlining implemented changes? Measuring changes include: Measures that are linked to the objectives of the

What changes can be measured to create a balanced scorecard outlining implemented changes?

- Measuring changes include:

- Measures that are linked to the objectives of the change

- A balanced scorecard outlining the measures

- A description of how and when the measures will be implemented

Describe the environmental influences (e.g. the PESTEs) that appear to be affecting this organization.

Case Study: Building Community at Terra Nova Consulting

Ken Ogata Gary Spraakman York University

Three months after his appointment as president of Terra Nova Consulting, Terry O'Reilly faced his partners at their biennial conference over a weekend in February 2008. After the events of the past year, everyone at the partners' conference had anxiously awaited hearing his plans to turn Terra Nova Consulting around. With that in mind, he had begun to describe his plan to the partners:

Over the past forty years, Terra Nova has grown into a global firm, an elite firm within our industry, with offices on five continents. It's a firm each of you has had a hand in building, and it's a firm we can all be proud of. We've been successful, and we're respected for our technical excellence and innovative approaches, but now it's time for a change to meet the challenges of the future.

It's time to present a new image to our clients and employees. Something that recognizes our past excellence, while positioning Terra Nova Consulting for the future. It's time for a new name that will be recognizable internationally. While we are proud of our Canadian heritage and the Terra Nova name, I believe it is time to move forward under a new name that can transcend borders.

From now on, Terra Nova Consulting will be known as TNC. And to go with that new name, I propose a new slogan. One that reflects our experience and expertise in both geotechnical engineering and the environmental sciences. One that assures our clients that they have hired the very best. TNC will now be known for having "The greatest minds on earth."

And then Terry experienced the longest two seconds of his life. All he could feel from the podium was stunned silence. Then the room erupted. "Change our name? What the hell do you mean you want to change our name? We've put a lot of work into being recognized as Terra Nova Consulting! We're proud of our heritage!" And the slogan? Even though Terra Nova had won numerous accolades for its prowess in geotechnical (earth) engineering, the company portrayed a quiet confidence. "You can't say that we have the greatest minds on earth! How arrogant! We let our work speak for itself!" The partners as a group had let him know in no uncertain terms that this was too bold, too brash for their Terra Nova.

After that opening, his other ideas for change were summarily dismissed by the partners. Terry had based his ideas for change around rebranding the firm through a new name, logo, and slogan. He wanted Terra Nova to be regarded like McKinsey and Company, as the very best in the consulting industry. He had also hoped that rebranding the firm by shortening its name to an acronym (like IBM?International Business Machines) would present a fresh face to its clients and instill a new attitude among employees. Finally, he hoped that the rebranding initiative would help create a new sense of shared values and identity at Terra Nova, one that would rebuild the former collegial atmosphere.

What Terry didn't get a chance to tell the partners, but which the board of directors and his executive team knew, was that Terra Nova still faced significant financial challenges. Although interim president Matt Ferguson had been able to stabilize the slide in profitability, several projects were still suffering cost overruns and write-offs. An even greater risk involved the lack of investment in company shares. Too many of the junior professionals did not see a long-term future with Terra Nova, and had avoided making the financial commitment of buying shares. Other senior partners had sent a message to the executive team about their dissatisfaction with the company's direction by refusing to increase their stakes. The lack of new equity and working capital had been offset through more expensive bank financing, which had negatively affected profitability. But technical excellence and working harder were no longer enough for success.

While several partners had privately acknowledged to him that change was needed, and the board had chosen Terry as president because of his fresh perspective, his proposals were too much, too fast for the partners. Terry had unknowingly stepped upon a few organizational political land mines. Longtime partner and vice-president Doug Hunter pulled him aside later in the hospitality suite to remind him that this was not how things were done at Terra Nova.

You've got to start with the top senior people and work your way down through the organization. Any major initiative needs consensus among the shareholders, and particularly the senior shareholders. But consensus isn't simply a majority, it has to be a lot broader than that. You can probably get 50 percent of the people on board in relatively short order, and then 25 percent more sometime after that, and then the next 15 percent to get to around 90 percent, but it takes time, a long time. The process is time consuming. But you can't force change from the top down. The partners won't stand for that.

Doug reminded Terry that consultation was key to decision making at Terra Nova. While administrative matters were usually made in consultation with the senior executive and/or office manager teams, larger strategic decisions needed buy-in and support from the partners. Former interim president Matt Ferguson later echoed Doug's advice:

Terry, you can't change Terra Nova through an authoritarian top-down style. The senior guys will just ignore your ideas if they don't like them. You need to sell your ideas gradually among the most powerful and influential partners. But you can't force them. It's like herding cats. They will fight you every step of the way if they're so inclined. They need to be convinced to go along like it was their idea all along. Sometimes the best you can hope for is that they won't stand in the way.

While Terry's ideas had not received a positive initial reaction, Matt had reminded him that part of Terra Nova's culture involved challenging new ideas to see if they could pass the test.

You've got to remember, Terry, that a lot of them come from very critical backgrounds in science and engineering. So the first thing whenever they see anything new, the first they look for is holes, and try to drive tanks through them. Part of that may be human nature, but I think it's stronger in our organization because of the nature of the staff that we've got.

Terra Nova ensured success by challenging new ideas. This was part of their quality assurance process. For Terry, surviving the initial challenge was only the first step. He needed to rework his ideas, and map out a plan, then convince the senior partners of the need for change.

Company History and Past Practices

Terra Nova, a premier engineering consulting firm, was founded in 1970 by a small group of ten engineers. The first office was located in a second floor apartment on King Street in Toronto, Canada. Terra Nova founder Adam Danyluk described the firm as starting as a boutique operation that specialized in geotechnical (earth) engineering consulting related to civil engineering projects. The firm had benefited from a series of major highway projects that required specialized ground engineering technical studies on soil conditions and rock formations. Terra Nova had subsequently expanded by providing engineering design work for other public works projects including subways, bridges, and dams.

In the 1980s, Terra Nova provided geotechnical services to the mining industry, involving ground control issues. Expertise in groundwater and hydrogeology was added to address contaminated soils and site remediation problems. Technical excellence and innovative solutions on these projects led clients and industry partners to regard Terra Nova as an elite firm within the industry. The firm continued to diversify its portfolio of services, and ventured into the biosciences including wildlife habitat, air engineering and modeling, and archaeology, to address the environmental impacts associated with development projects. But Terra Nova's engineering heritage remained its core.

Longtime partners tended to describe the firm as a place where one worked with friends rather than coworkers. Although Terra Nova was regarded as an elite firm, its compensation was only comparable to the industry average. As noted by former Terra Nova junior professional engineer Mark Davis:

Terra Nova was a great place to work in almost every aspect except pay. I was getting paid well below average for engineers in my graduating year initially. But although Terra Nova paid below average, there are worse companies in this industry . . . While I have no complaints about the management of the company or how I was treated there, I felt that I had to leave Terra Nova. I could not support my family in the long term with my existing and projected future salary. However, I wish to clarify that for its field (geotechnical and environmental consulting) there is no better place to work. I don't think there's a better company in this industry than Terra Nova.

What attracted staff to Terra Nova was the opportunity to be involved in challenging, innovative projects, which generally were only awarded to technically superior firms. Junior professional staff were given much greater opportunities and responsibilities as members of Terra Nova than their former peers now employed by competitors were given. In addition, they were able to work alongside some of the best engineers in the industry. This allowed them to develop their technical skills and knowledge in ways not possible elsewhere.

Many mid-career staff were attracted by the opportunity to share in the firm's success as shareholders. Several had come from competitors, where only senior partners were allowed to buy shares, and advancement to partner was tightly restricted. Terra Nova afforded them with greater opportunity to not only become owners, but also to reach the partner level. Finally, Terra Nova provided them with the opportunity to become experts within their fields and applauded entrepreneurial initiative to develop new lines of business. Partner and office manager Henry Cooper had briefed Terry about the firm's past as follows:

When this firm started, it was built around strong personalities that were basically sole practitioners in a technical area in a particular geographic location. So what happened was we moved into certain technical areas through the sheer power and motivation of individuals saying, "we're going to do that. I'm going to move into that area of business. I'm going to become the key guy in that area." So we got into rock mechanics through Josh Halladay in Vancouver. We got into the nuclear waste business through Jeremy Davis in Seattle. We got into the oil sands through Sid Anderson in Calgary. Just by the sheer weight and power of these individuals' personalities. It wasn't a group of people sitting around strategizing. There might have been an element of that, but it took one individual to actually be the champion and drive it.

The firm's growth strategy reflected its philosophy of seeking to meet clients' needs. Clients asked if Terra Nova could do related technical work (e.g., site remediation, environmental impact assessments). Not wanting to turn down additional work, Terra Nova project managers usually agreed, and then sought appropriate partner firms to subcontract the work. As demand in these areas grew, Terra Nova formalized these arrangements through mergers and acquisitions, bringing the relevant expertise in-house. This led the firm into a variety of new industries as different opportunities became available. As Terra Nova expanded and diversified its portfolio, it also employed an increasingly diverse mix of professionals and technical disciplines. Many members held graduate degrees within their respective disciplines (e.g., biology, geology, archeology, engineering), and the firm continued to seek out the top graduates.

Terra Nova's office locations varied considerably in size from under thirty to over 200 personnel, and were typically in suburban, corporate office buildings. Entrance area walls were adorned with firm awards such as best employer, technical excellence, community service, or pictures of the firm's founders. Offices were professional looking, yet modest, with a combination of formal offices and cubicles. Individual offices averaged about 120 square feet in size. There was limited variation in office size between professional staff and partners, such that even retired founder Adam Danyluk did not have a window/corner office, nor was there an executive office suite area at the firm's head office.

Terra Nova generated revenue by charging the working time of its professional staff to competitively acquired projects. Since office chargeability was highly correlated with profitability, chargeability became the key organizational objective and measure of performance. Chargeability targets ranged from 80 percent for partners, 85 percent for project managers, to 90 percent for professional staff. For example, professional staff whose days and weeks were 100 percent charged to revenue-generating projects were deemed to contribute more to Terra Nova than those who were only 90 percent charged out. At the partner level, contribution to the firm was also measured in terms of winning new client projects and developing new lines of business.

Organizational Structure and Management Style

When Terry had joined Terra Nova through a merger five years ago, he had asked some of the other partners for an organizational chart. He discovered that no formal organizational chart existed because according to the other partners, "Terra Nova has a flat organizational structure." Partners, project managers, and professional staff were all assigned to various project teams that sometimes spanned multiple offices.

Terry had found Terra Nova's structure confusing at first. Partner designation was not based upon tenure, but upon technical excellence and contribution to the firm. In addition, owners of acquired firms who decided to stay were often made partners. Partner turnover due to retirement was often uncertain, as many elected to stay on after reaching the age of sixty-five. Accordingly, partners ranged in age from forty to seventy-two years old. Historically, Terra Nova's partnership numbers represented about 15 percent of total staff, while consultants represented about 80 percent of staff.

Partners served as project managers or office managers. Many partners avoided the office manager positions, preferring to be directly involved in project work. Thus, most but not all office managers were partners. Project teams could involve a mix of junior (less than five years experience) and senior professionals, in addition to partners, depending upon the scale, scope, and technical requirements of the project. Finally, shareholders could be found at any level, ranging from receptionist to board member, as ownership was not restricted by position.

Informally, Terry saw five levels at Terra Nova, starting with the board and partners who provided general oversight, then the president, executive team, and office managers, followed by project managers, professional staff (junior and senior by tenure), and administrative support staff. Ultimately, the partners were in charge, as they elected the board of directors. The board in turn appointed the president, and approved the firm's overall strategic direction. The president was responsible for managing the firm's strategic direction with the support of his executive team, and the office managers were responsible for day-to-day operations. Project managers and partners were responsible for identifying, winning, and managing projects, and generating profits by staying within budget and avoiding overruns. Partners tended to be the project managers for larger projects. Professional staff were assigned to one or more projects, and were sometimes responsible for smaller projects. Despite this hierarchy, all members from the newest professional staff person to the most experienced partner participated equally in projects based on their knowledge and skills.

Combined with this flat organizational structure was a small corporate head office. The president's executive team consisted of two vice-presidents, the controller (CFO), and head of HR. Although head office designation was based upon the president's location, several executive team members were located in other offices as their appointments were deemed temporary.1

Several partners stated that they had avoided creating organizational charts due to their implicit aversion to bureaucracy and formal management controls. However, many of the junior professionals did not share this view. Geologist Chris Barker had described his office's (Vancouver) management style as follows:

In the past, we did it the way Bob [partner] said because Bob's king. And it worked. The firm hired excellent people whom people trusted, and they didn't have a problem following Bob. But now in an office [Vancouver] where there are ten Bobs [partners], and no one is quite sure which one to listen to, you need some protocols in management. Toronto though is a very managed group. They have a lot of training, a lot more corporate structure, so a lot of the junior professionals get a good feeling when they go to Toronto and work there. You know what it's going to take to move up, whereas here in Vancouver it's a bit of sink or swim, struggle to the top.

In contrast to many of the partners, several junior professionals had suggested the need for more structure, including the codification of policies and procedures regarding things like professional development, equipment requests, and international assignments.

Typically, Terra Nova's partners had earned their stripes first as professional staff, then as project managers, and were then promoted through a peer-review process. Some partners had gained advanced standing by virtue of their former positions as senior managers at other firms prior to joining Terra Nova via acquisition. Terry had come to Terra Nova this way. Terry's former partners at RMO Environmental wanted to retire, and had elected to "merge" their firm with Terra Nova. RMO had been a fairly close knit group of about forty biologists, scientists, and hydrologists that specialized in environmental impact assessment studies. The firm had been very much under the control of the founding partners, who typically saw things eye to eye. In contrast, Terra Nova's participatory democracy allowed partners to become involved in corporate level issues such as culture, strategy, and business planning whenever they disagreed. When and why they chose to exercise this prerogative, Terry had yet to fully understand.

Doug Hunter, partner and vice-president, had told Terry that the cornerstone of the firm's operating philosophy was to provide innovative, high-quality technical solutions on behalf of its clients. Each office operated independently, specializing in certain services in a particular geographic market. Offices were expected to remain profitable by generating their own project revenues and controlling costs. However, offices also operated collectively under the Terra Nova banner, pooling their capabilities and expertise to win and undertake large projects. In this way, Terra Nova leveraged the capabilities and expertise of all employees across the firm, thereby reducing individual office duplication, while facilitating technical specialization, and enabling efficient utilization of available resources across the firm. This collaborative approach also strengthened the ties across offices and promoted a collective mind-set. It was not unusual to have visiting staff dropping in to borrow offices and meeting rooms.

Ownership Structure

Terra Nova was a private, 100 percent employee-owned firm. Unlike traditional partnerships, share ownership was not restricted to partners, but rather was broadly distributed. There was a high level of participation, with over 40 percent of all employees owning shares, resulting in no one owning more than 2 percent of the shares. As such, no single individual or small group of staff could dictate firm direction through a majority position. In accordance with board policies, partners held about 80 percent of the shares available, while other employees held the remaining 20 percent. Although partners had to meet certain minimum share-holding requirements, many partners held more than the minimum as they deemed it to be a good investment, as well as a sign of their commitmentto the firm. As noted by two partners, this principle of employee ownership was a central tenet of the firm:

Employee ownership is number one. I think that if anyone tried to change the employee ownership structure of the firm, then the firm would die, because a lot of people are here for that very reason. It's something we use to attract people, and people come for that reason. If we changed that structure, we would lose a lot of good people. There were rumors floating around about two years ago that the President [Michael Erikson] was going to try and take the firm public, but the partners put a stop to any chance of that happening.

Luis Carbonell (partner)

There's an emotional attachment to this firm that to a large extent transcends monetary value. I've heard several of the old guys saying, "We didn't build the firm to sell it." I mean every time anything other than employee ownership has been mentioned, nobody was interested in it. We wanted this firm to stay employee-owned.

Henry Cooper (partner and office manager)

Terra Nova employees were invited to purchase shares through an annual company-wide memorandum, which indicated the total number of shares available, the price per share (based on book value), and payment terms. The number of shares available in any given year varied, based upon how many treasury shares were available, and how many shares were being sold (due to retirement or termination of employment). Share allocations though, did not always match demand. First call on available shares was reserved for staff who had been promoted to partner but did not hold enough shares to meet their ownership requirement. The remaining shares were then prorated in response to requests. Financing for share purchases was not available from Terra Nova; nor was there a payroll deduction plan.

Several shareholders had expressed to Terry that employee ownership provided a sense of community, a common bond between employees as the firm expanded, and the basis for a philosophy of acting in the firm's best interest. It also allowed partners and others to "participate" in the firm's success through annual dividends. Finally, the acquisition of shares by staff helped finance the firm's operations, and reduced the need for more expensive external debt financing. However, many junior professionals had declined to commit financially to the firm, and even some of the partners were refusing to increase their stakes.

Without sufficient employee uptake, Terra Nova had to buy back and hold retiree shares, increasing the firm's debt financing requirements and reducing cash flow. The controller had suggested to Terry that the firm consider the idea of going public like other firms in the industry.2

Organizational Culture

Like many other professional service firms, management control was not exercised through traditional, top-down hierarchical command. Employees were expected to be self-managed and motivated, but to act in accordance with organizational values, norms, and objectives. Thus, communication, cooperation, socialization, and rigorous hiring practices took on added significance to ensure proper fit and alignment of employee actions with organizational goals.

Terra Nova had traditionally sought like-minded individuals through existing personal contacts, hiring friends, work acquaintances, and referrals from trusted colleagues. In particular, the firm actively sought the best students from top universities. But with growth came the need for recruitment of cold contacts where there was no prior relationship or referral. Even potential merger and acquisition candidateswere screened for cultural similarity. Partner and office manager Henry Cooper explained,

Oh, the fit's everything. Every merger and acquisition that we've undertaken, the cultural fit with us was absolutely paramount. I mean if there's no cultural fit then it's pointless even embarking on the process. Is this firm's value system the same as ours? Are they interested in doing quality work for quality clients? Do their people have an ownership mentality? Are they going to be comfortable with Terra Nova's fairly flat, non-hierarchical structure? Are they comfortable with a culture of employee ownership? All these things are key. If the cultural fit isn't there then it's pointless proceeding, 'cause it won't work.

Terra Nova's official core values (seeExhibit 1), were described as reflective of the founders' personal values, and had been reinforced over time as part of "how we do business."

Exhibit 1Terra Nova Consulting Cultural Principles and Core Values

| Principle | Core Value |

|---|---|

| Employee ownership | Responsible participation in business success and ownership. Sustainability of financial return to shareholders. |

| Collegiality and self-actualization | Supportive of personal growth, learning, and risk taking. Integrity in relationships, commitments, and service. |

| Technical excellence | Reliable, innovative, cost-effective solutions. Professional, cultural, and business diversity. |

Source:Terra Nova Consulting

Notwithstanding this generally positive characterization of Terra Nova's culture, former president Matt Ferguson described Terra Nova's culture in the past as follows:

We used to joke that a new arrival was taken by the scruff of the neck and the seat of the pants and dropped into the deepest pool we could find while the senior people stood around and watched to see if he would sink or swim.

Corporate Financial Position

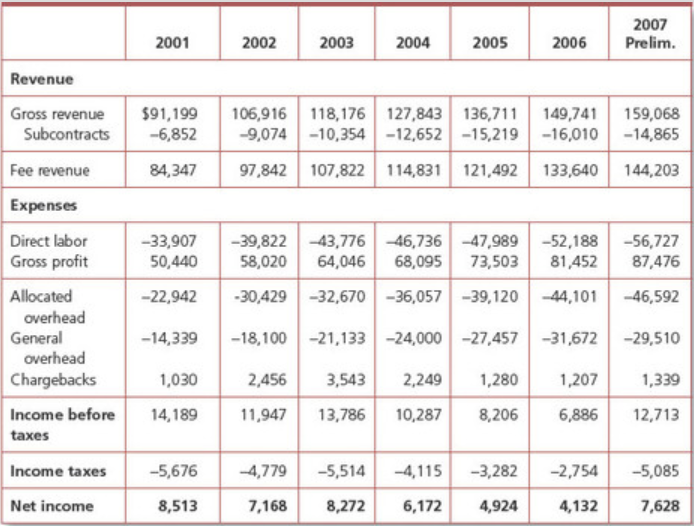

Terry thought back over the events of the past two years. It had begun in mid-2006 with Michael Erikson stepping down after ten years as president. Although the firm was still profitable, it had been suffering declining financial performance and reduced profitability. Traditionally, Terra Nova had enjoyed income before taxes as a percentage of fee revenue of 15 percent or more (seeExhibit 2). Even though fee revenues had continued to increase, project cost overruns, increased overhead, and billing and collection delays had negatively affected earnings. While the financials did not suggest that Terra Nova was in danger of bankruptcy (see Balance Sheet?Exhibit 3), Terry was still concerned as he regarded the decline in financial performance as reflective of deeper organizational problems.

The decline in profitability was beginning to restrict Terra Nova's operations. Net profit needed to be about 7-10 percent of fee revenue to fund normal growth. More troubling for Terra Nova though was the lack of interest among employees in purchasing shares. Many of the junior professionals were not prepared to invest and commit to the firm, while older employees recognized that Terra Nova was unlikely to produce the strong dividend returns of the past. Moreover, older partners needed to divest their shares as they approached retirement, but could not if there were no buyers. Without new investment, it would be difficult for Terra Nova to remain employee owned. Vice-president Doug Hunter explained:

I think what triggered it was that the firm had been going through a period of malaise for about two or three years, a sense that we had lost our direction. There was a sense that something was not right. Shares weren't selling very well at all. The employees were sending a strong message that they weren't interested in making that financial or emotional commitment to the firm. The quantity of shares that we had in trust was becoming a reasonably significant potential financial liability. How long we could let that go on before we had to bring in outside investment was unclear. But that would result in a huge shift in culture.

Exhibit 2Terra Nova Consulting Income Statements ($000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started