Question

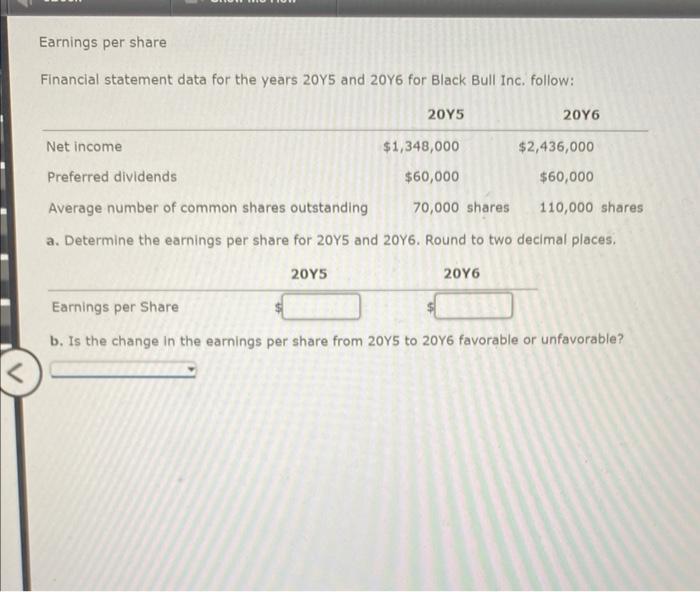

Earnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: Net income 20Y5 $1,348,000 $60,000 70,000 shares

Earnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: Net income 20Y5 $1,348,000 $60,000 70,000 shares 20Y6 $2,436,000 $60,000 110,000 shares Preferred dividends Average number of common shares outstanding a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Y6 Earnings per Share b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable?

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Earnings per share Formula Net i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Karen W. Braun, Wendy M. Tietz

3rd edition

132890542, 978-0132890540

Students also viewed these Organizational Behavior questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App