What do I put for the T accounts?

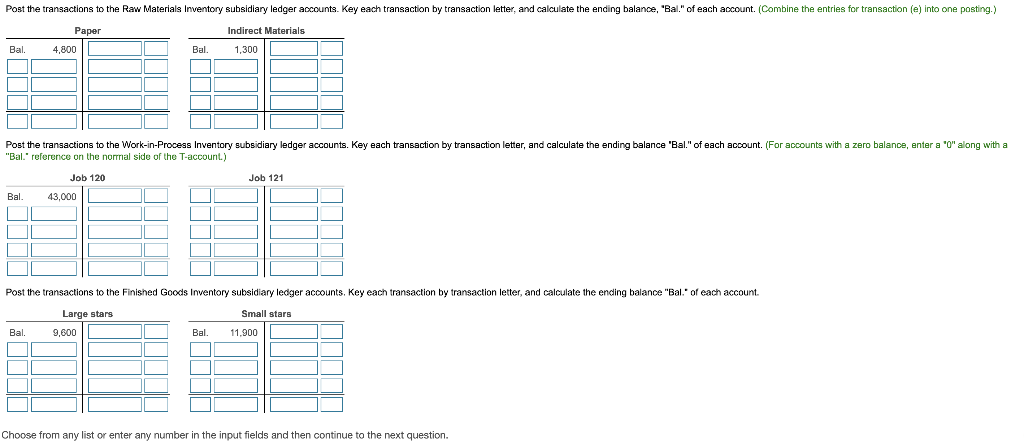

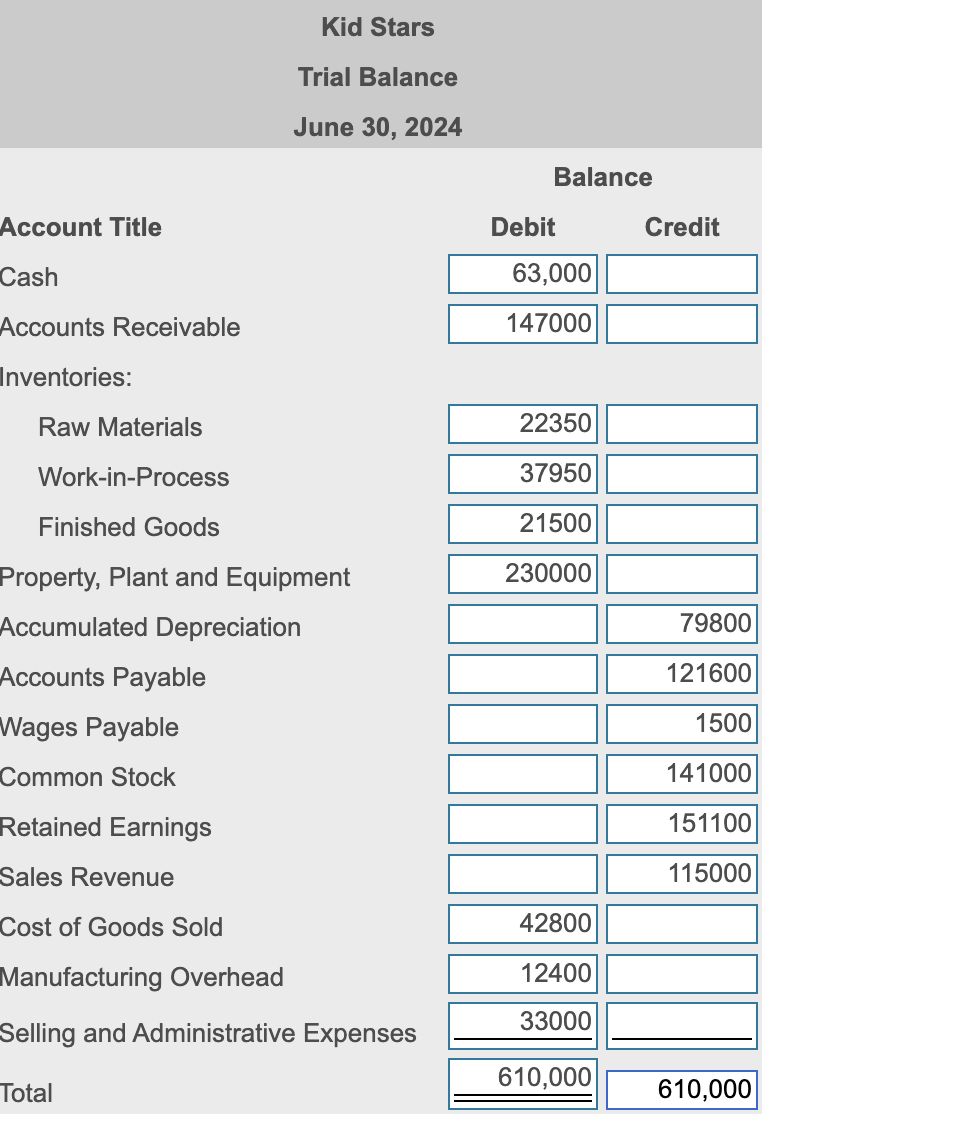

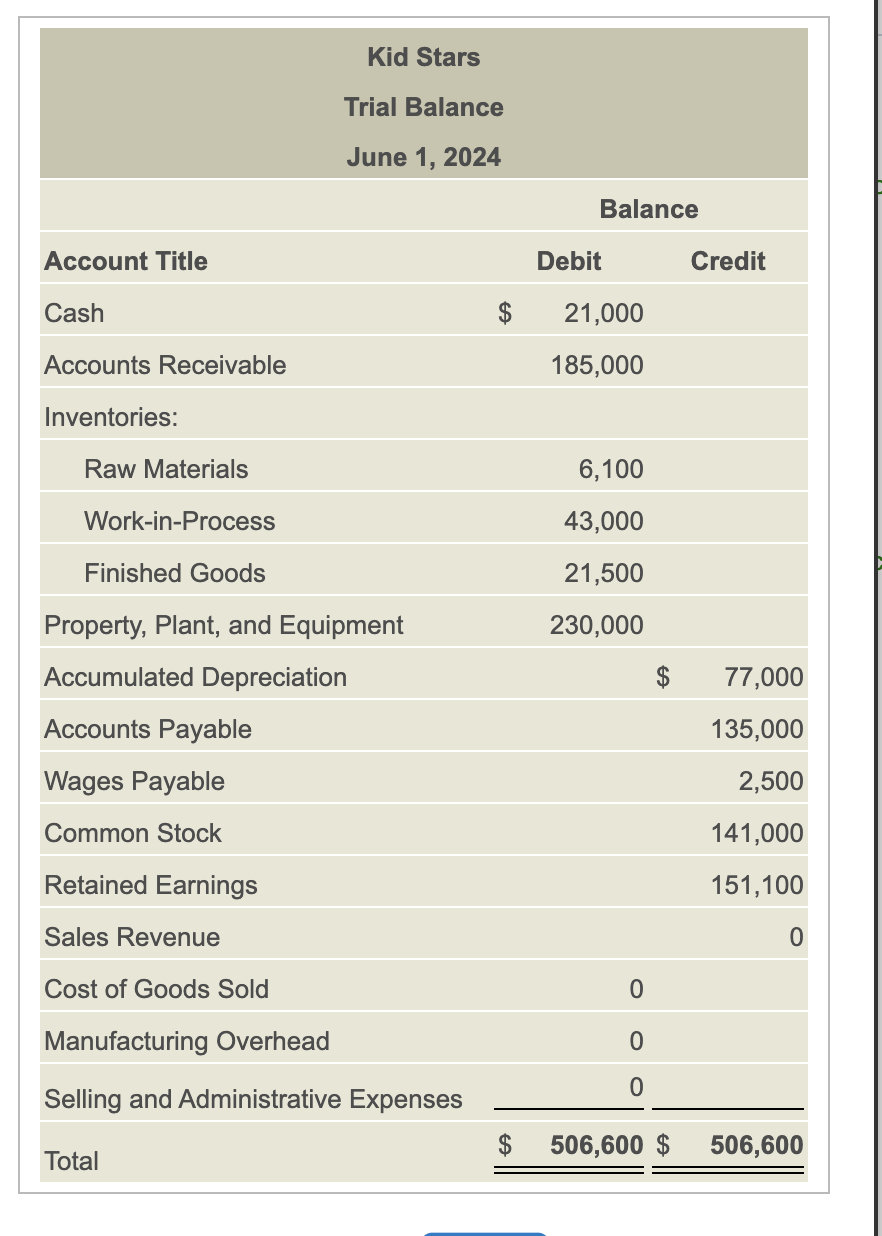

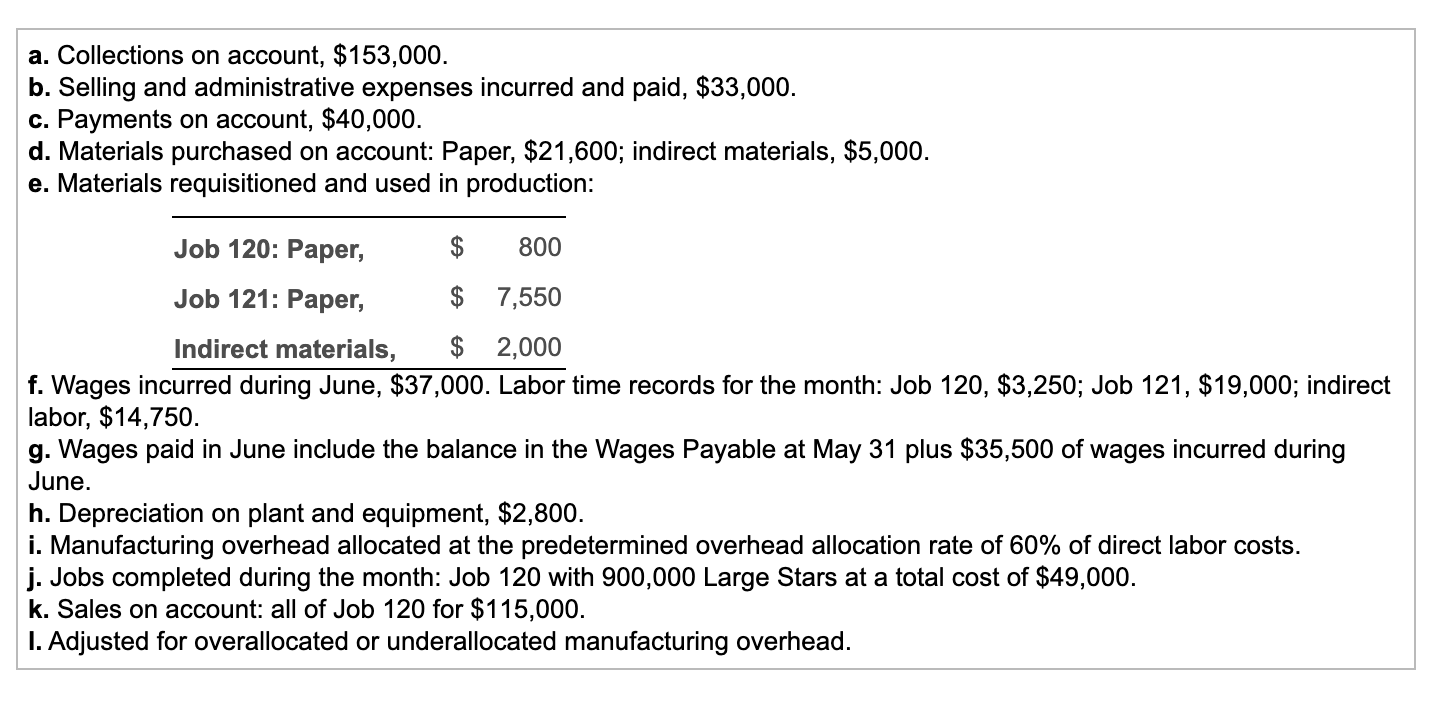

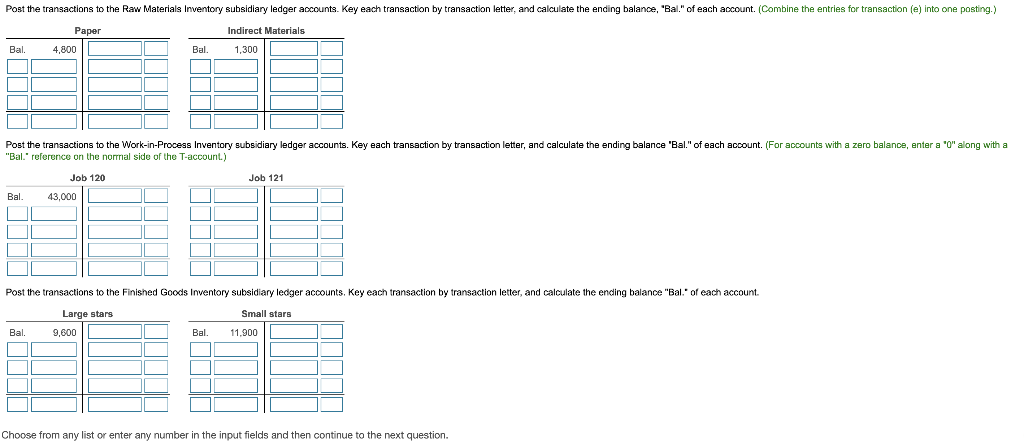

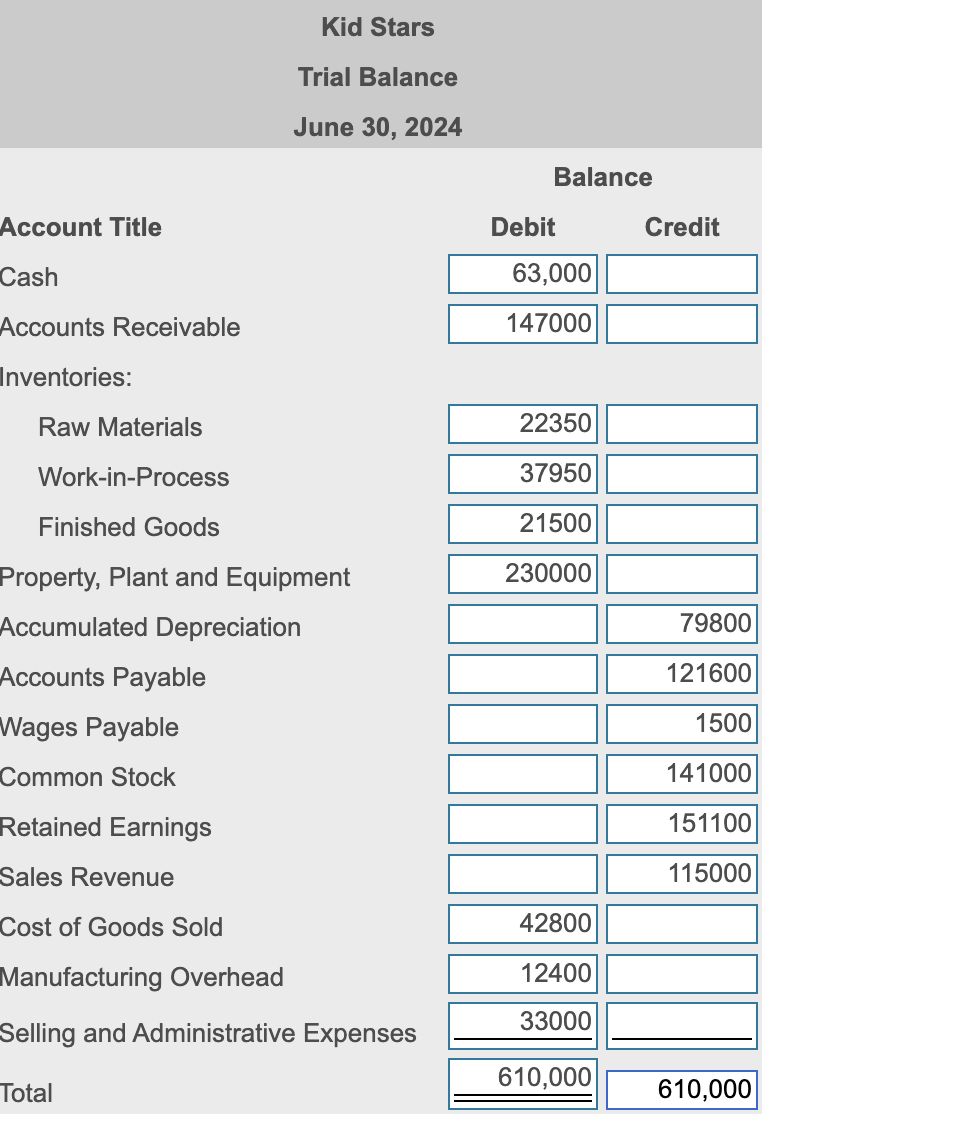

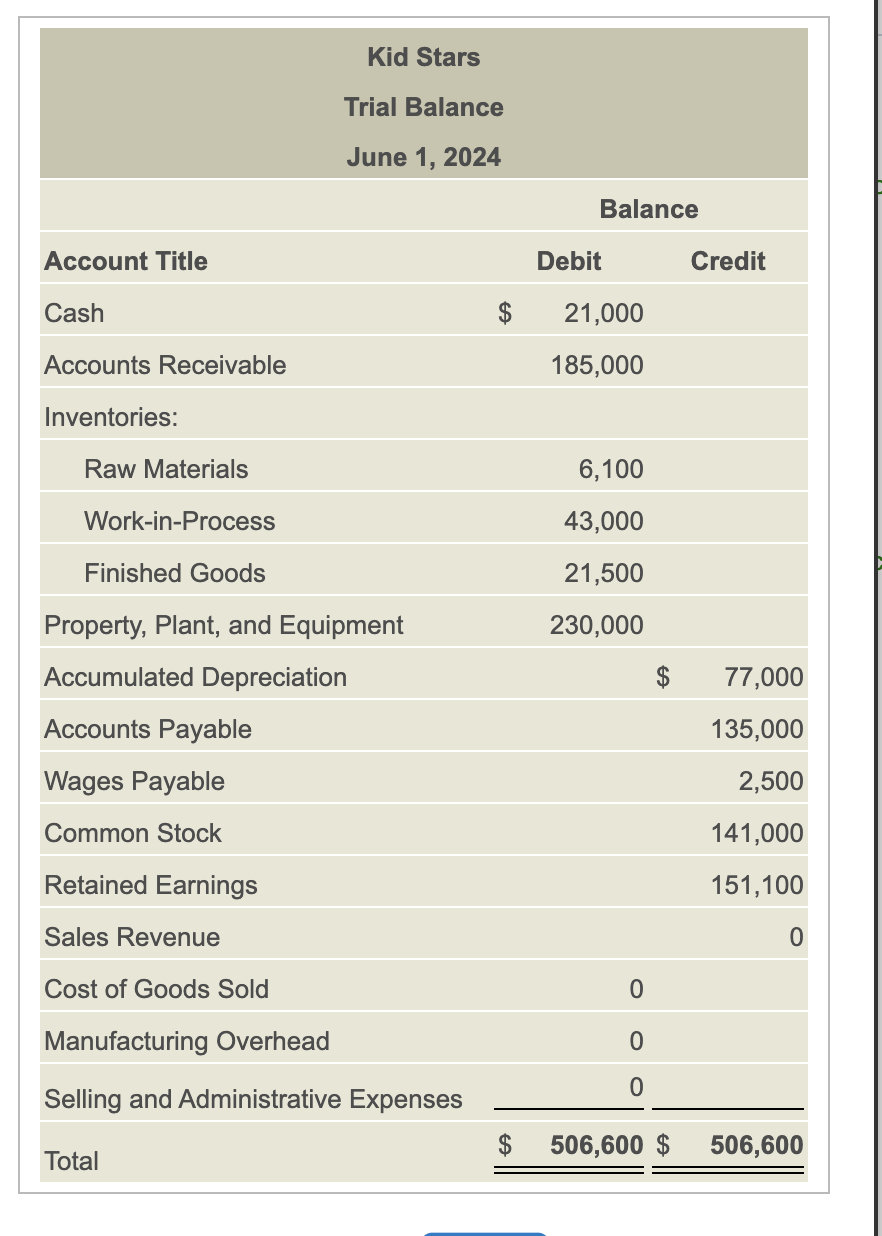

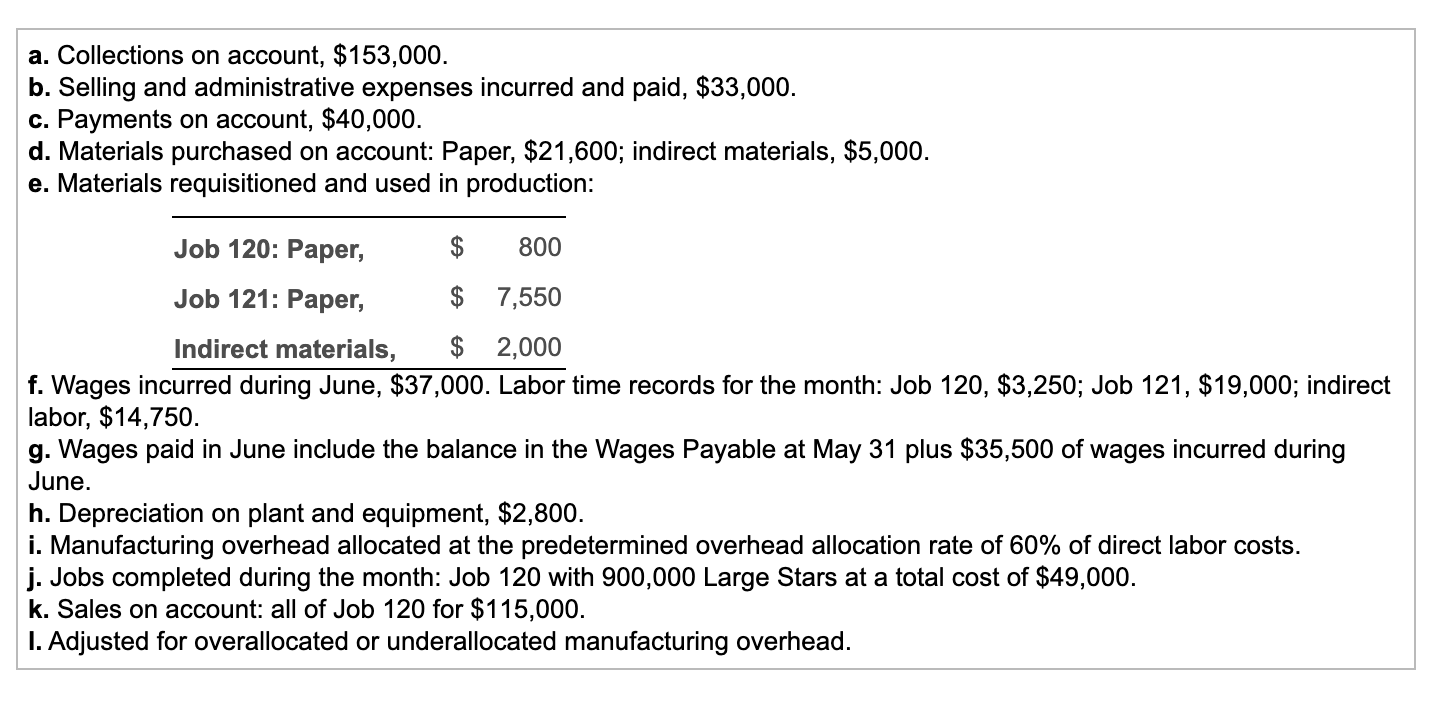

Post the transactions to the Raw Materials Inventory subsidiary ledger accounts. Key each transaction by transaction letter, and calculate the ending balance, "Bal." of each account. (Combine the entries for transaction (e) into one posting.) Paper Indirect Materials 1,300 Bal. 4,800 Bal. Post the transactions to the Work-in-Process Inventory subsidiary ledger accounts. Key each transaction by transaction letter, and calculate the ending balance 'Bal." of each account. (For accounts with a zero balance, enter a "0" along with a "Bal." reference on the normal side of the T-account.) Job 121 Job 120 43.000 Bal. Post the transactions to the Finished Goods Inventory subsidiary ledger accounts, Key each transaction by transaction letter, and calculate the ending balance "Bal." of each account. Large stars Small stars Bal. 9,600 Bal 11.900 Choose from any list or enter any number in the input fields and then continue to the next question. Kid Stars Trial Balance June 30, 2024 Balance Account Title Debit Credit Cash 63,000 Accounts Receivable 147000 Inventories: Raw Materials 22350 Work-in-Process 37950 Finished Goods 21500 230000 79800 Property, Plant and Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock 121600 1500 141000 Retained Earnings 151100 Sales Revenue 115000 Cost of Goods Sold 42800 Manufacturing Overhead 12400 33000 Selling and Administrative Expenses 610,000 Total 610,000 Kid Stars Trial Balance June 1, 2024 Balance Account Title Debit Credit Cash 21,000 Accounts Receivable 185,000 Inventories: Raw Materials 6,100 Work-in-Process 43,000 Finished Goods 21,500 Property, Plant, and Equipment 230,000 Accumulated Depreciation $ 77,000 Accounts Payable 135,000 Wages Payable 2,500 Common Stock 141,000 Retained Earnings 151,100 Sales Revenue Cost of Goods Sold 0 Manufacturing Overhead 0 0 Selling and Administrative Expenses $ 506,600 $ 506,600 Total a. Collections on account, $153,000. b. Selling and administrative expenses incurred and paid, $33,000. c. Payments on account, $40,000. d. Materials purchased on account: Paper, $21,600; indirect materials, $5,000. e. Materials requisitioned and used in production: Job 120: Paper, 800 Job 121: Paper, $ 7,550 Indirect materials, $ 2,000 f. Wages incurred during June, $37,000. Labor time records for the month: Job 120, $3,250; Job 121, $19,000; indirect labor, $14,750. g. Wages paid in June include the balance in the Wages Payable at May 31 plus $35,500 of wages incurred during June. h. Depreciation on plant and equipment, $2,800. i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 60% of direct labor costs. j. Jobs completed during the month: Job 120 with 900,000 Large Stars at a total cost of $49,000. k. Sales on account: all of Job 120 for $115,000. 1. Adjusted for overallocated or underallocated manufacturing overhead