Answered step by step

Verified Expert Solution

Question

1 Approved Answer

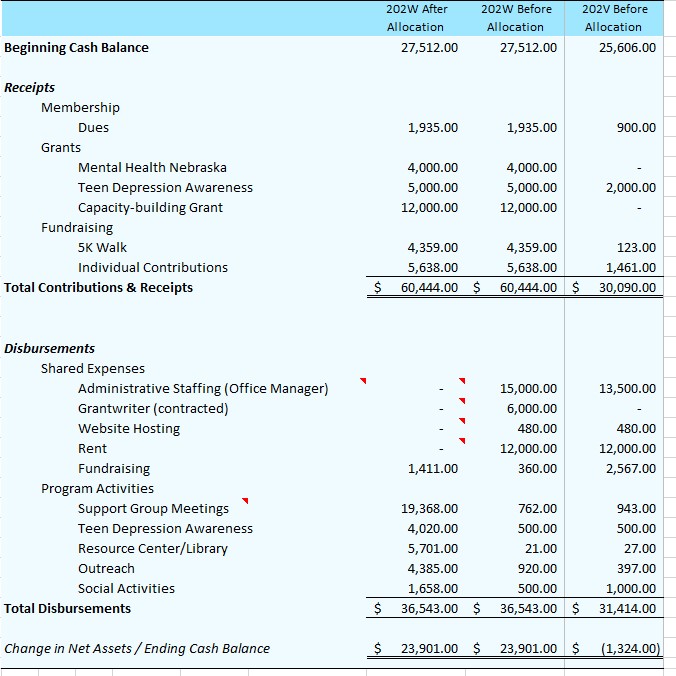

What do the line items in the disbursements indicate about the organization's priorities? should a different formula be reccommended for allocating the costs? Why or

- What do the line items in the disbursements indicate about the organization's priorities?

- should a different formula be reccommended for allocating the costs? Why or why not?

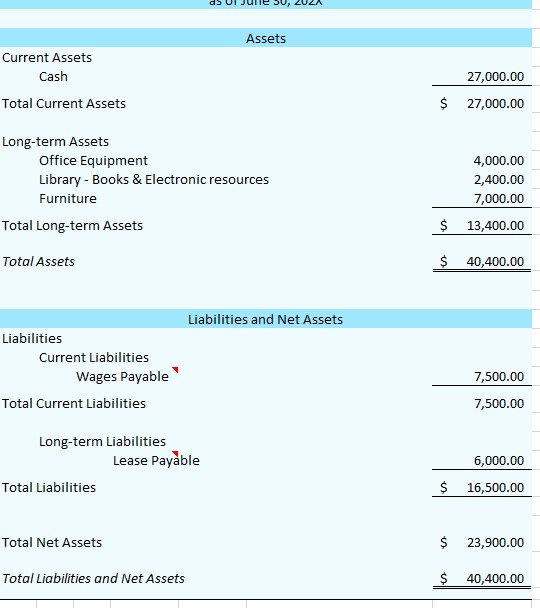

- Does the data in the Financial Report support the assertions they make in the Annual Report?what is the attribute in any disparities?

- Are they reporting ethically and transparently in both documents? What changes should one recommend? why?

Beginning Cash Balance Receipts Membership Dues Grants 202W After Allocation 27,512.00 202W Before Allocation 27,512.00 202V Before Allocation 25,606.00 1,935.00 1,935.00 900.00 Mental Health Nebraska 4,000.00 4,000.00 Teen Depression Awareness 5,000.00 5,000.00 2,000.00 Capacity-building Grant 12,000.00 12,000.00 Fundraising 5K Walk 4,359.00 4,359.00 123.00 Individual Contributions 5,638.00 5,638.00 1,461.00 Total Contributions & Receipts $ 60,444.00 $ 60,444.00 $30,090.00 Disbursements Shared Expenses Administrative Staffing (Office Manager) Grantwriter (contracted) 15,000.00 13,500.00 6,000.00 Website Hosting Rent 480.00 12,000.00 480.00 12,000.00 Fundraising Program Activities 1,411.00 360.00 2,567.00 Outreach Support Group Meetings Resource Center/Library Social Activities 19,368.00 762.00 943.00 Teen Depression Awareness 4,020.00 500.00 500.00 5,701.00 21.00 27.00 4,385.00 920.00 397.00 1,658.00 500.00 1,000.00 Total Disbursements $ 36,543.00 $ 36,543.00 $31,414.00 Change in Net Assets/Ending Cash Balance $ 23,901.00 $ 23,901.00 $ (1,324.00)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started