Answered step by step

Verified Expert Solution

Question

1 Approved Answer

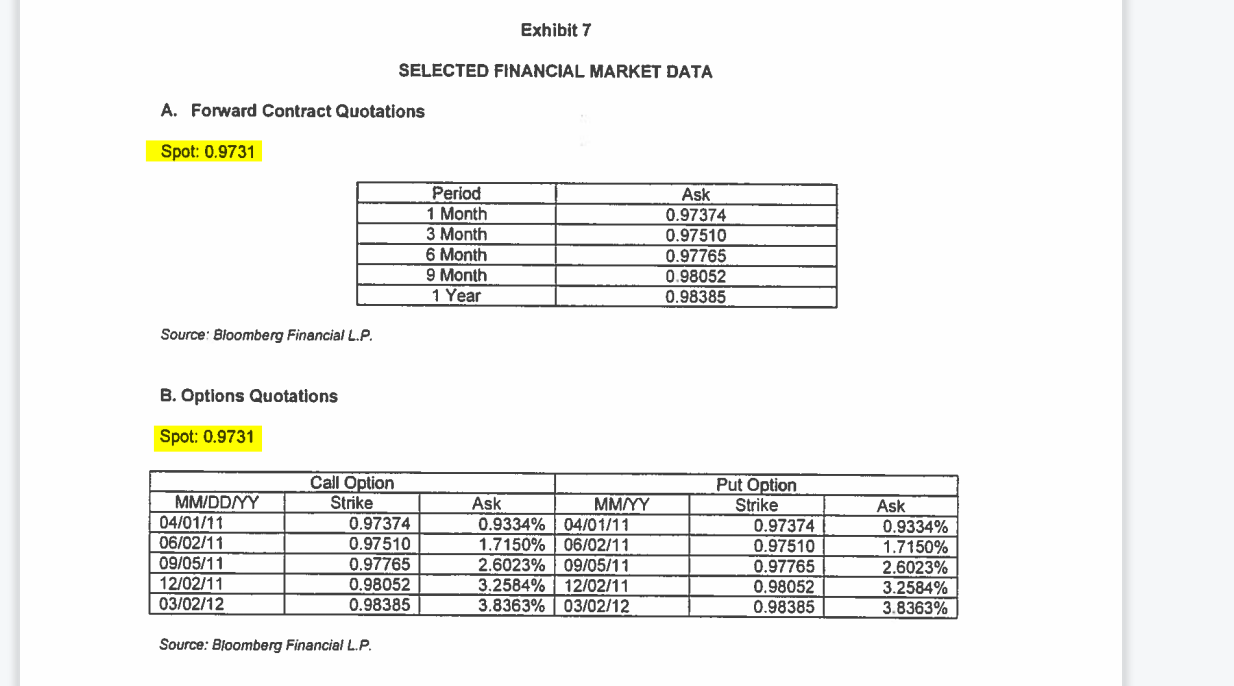

What does the numbers0.9334% etc. in the Ask column mean Assume the current spot rate is CAD 0.9702/$. If I buy a CAD 0,97374/$ put

What does the numbers(0.9334% etc.) in the Ask column mean?

Assume the current spot rate is CAD 0.9702/$. If I buy a CAD 0,97374/$ put option on 03/01/2011, and the spot rate on 04/01/2011 will be CAD 1/$. How much will I gain or loss?

Exhibit 7 SELECTED FINANCIAL MARKET DATA A. Forward Contract Quotations Spot: 0.9731 Period Ask 1 Month 0.97374 3 Month 0.97510 6 Month 0.97765 9 Month 0.98052 1 Year 0.98385 Source: Bloomberg Financial L.P. B. Options Quotations Spot: 0.9731 MM/DD/YY Call Option Strike Put Option 04/01/11 0.97374 06/02/11 0.97510 Ask MM/YY 0.9334% 04/01/11 1.7150% 06/02/11 Strike Ask 0.97374 0.9334% 0.97510 1.7150% 09/05/11 0.97765 2.6023% 09/05/11 0.97765 2.6023% 12/02/11 0.98052 3.2584% 12/02/11 0.98052 3.2584% 03/02/12 0.98385 3.8363% 03/02/12 0.98385 3.8363% Source: Bloomberg Financial L.P.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started