Answered step by step

Verified Expert Solution

Question

1 Approved Answer

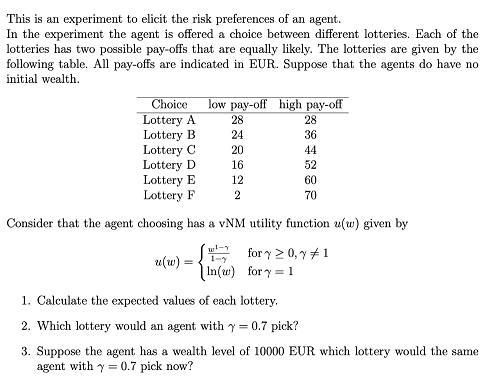

This is an experiment to elicit the risk preferences of an agent. In the experiment the agent is offered a choice between different lotteries.

This is an experiment to elicit the risk preferences of an agent. In the experiment the agent is offered a choice between different lotteries. Each of the lotteries has two possible pay-offs that are equally likely. The lotteries are given by the following table. All pay-offs are indicated in EUR. Suppose that the agents do have no initial wealth. Choice low pay-off high pay-off Lottery A Lottery B 28 24 u(w) Lottery C Lottery D Lottery E Lottery F Consider that the agent choosing has a VNM utility function (w) given by wl-y for y 0, y = 1 fory=1 1-y In(w) 20 16 12 2 28 36 44 52 60 70 1. Calculate the expected values of each lottery. 2. Which lottery would an agent with y = 0.7 pick? 3. Suppose the agent has a wealth level of 10000 EUR which lottery would the same agent with y 0.7 pick now?

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Calculate the expected values of each lottery Lottery A ELottery A 28 28 56 Lottery B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started