Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What effect did the expansion have on sales, after-tax operating income, net operating working capital (NOWC), and net income? What effect did the company's

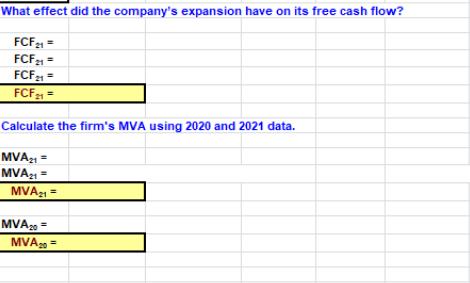

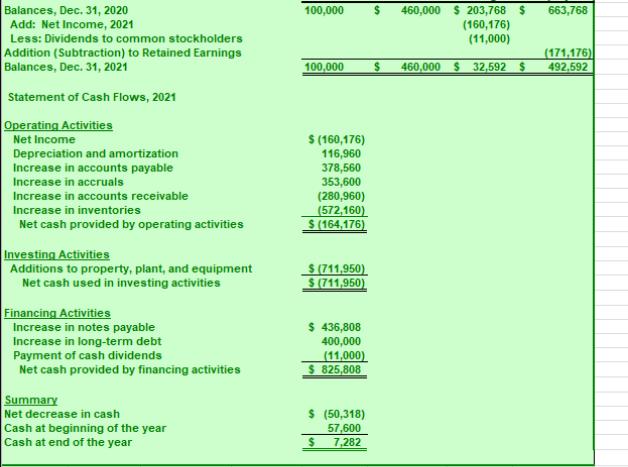

What effect did the expansion have on sales, after-tax operating income, net operating working capital (NOWC), and net income? What effect did the company's expansion have on its free cash flow? FCF21 = FCF1 = FCF21 = FCF 1 = Calculate the firm's MVA using 2020 and 2021 data. MVA1 = MVA1 = MVA1 = MVA 20 = MVA 20 = Balances, Dec. 31, 2020 Add: Net Income, 2021 Less: Dividends to common stockholders Addition (Subtraction) to Retained Earnings Balances, Dec. 31, 2021 Statement of Cash Flows, 2021 Operating Activities Net Income Depreciation and amortization Increase in accounts payable Increase in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in investing activities Financing Activities Increase in notes payable Increase in long-term debt Payment of cash dividends Net cash provided by financing activities Summary Net decrease in cash Cash at beginning of the year Cash at end of the year 100,000 100,000 $ (160,176) 116,960 378,560 353,600 (280,960) (572,160) $ (164,176) $(711,950) $(711,950) $ 436,808 400,000 (11,000) $825,808 $ (50,318) 57,600 $ 7,282 460,000 $203,768 $ 663,768 (160,176) (11,000) $ 460,000 $32,592 $ (171,176) 492,592

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer your questions lets go step by step QUESTION 1 What effect did the companys expans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started