Question

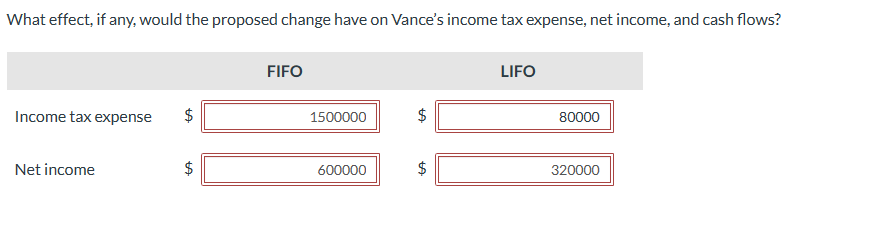

What effect, if any, would the proposed change have on Vance's income tax expense, net income, and cash flows? A FIFO 1500000 $ LIFO

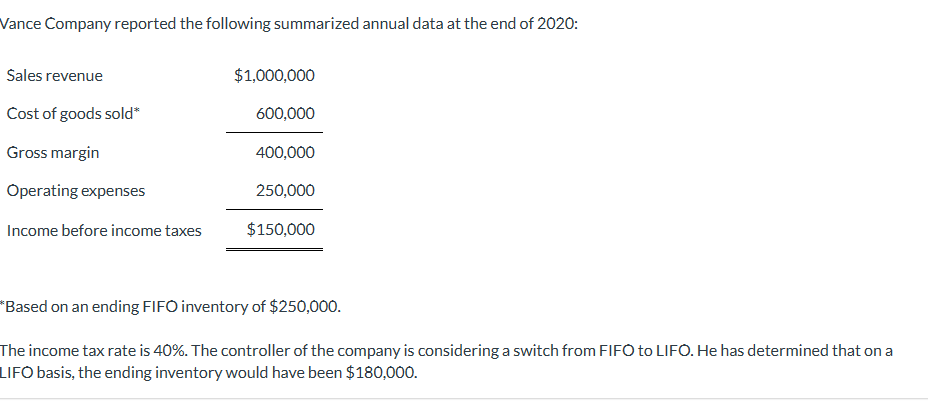

What effect, if any, would the proposed change have on Vance's income tax expense, net income, and cash flows? A FIFO 1500000 $ LIFO 80000 Income tax expense Net income 600000 +A +A $ 320000 Vance Company reported the following summarized annual data at the end of 2020: Sales revenue Cost of goods sold* Gross margin $1,000,000 600,000 400,000 Operating expenses 250,000 Income before income taxes $150,000 *Based on an ending FIFO inventory of $250,000. The income tax rate is 40%. The controller of the company is considering a switch from FIFO to LIFO. He has determined that on a LIFO basis, the ending inventory would have been $180,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Theory

Authors: William R. Scott

7th edition

132984660, 978-0132984669

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App