Answered step by step

Verified Expert Solution

Question

1 Approved Answer

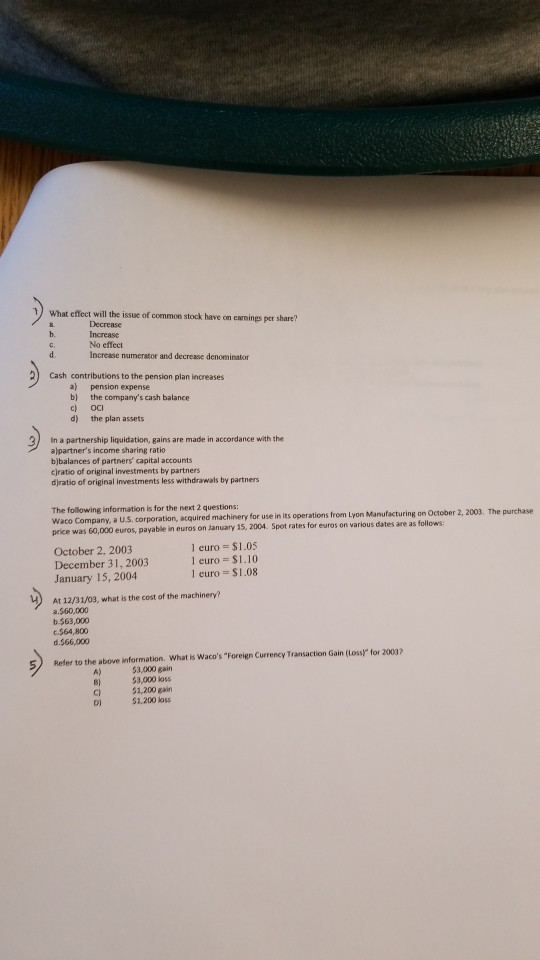

What effect will the issue of common stock have on camines per share? Decrease Increase No effect Increase numerator and decrease denominator Cash contributions to

What effect will the issue of common stock have on camines per share? Decrease Increase No effect Increase numerator and decrease denominator Cash contributions to the pension plan increases a) pension expense b) the company's cash balance c) OCI d) the plan assets In a partnership liquidation, gains are made in accordance with the alpartner's income sharing ratio bbalances of partners' capital accounts cratio of original investments by partners djratio of original investments less withdrawals by partners The following information is for the next 2 questions: Waco Company, a U.S. corporation, acquired machinery for use in its operations from Lyon Manufacturing on October 2, 2003. The purchase price was 60,000 euros, payable in euros on January 15, 2004. Spot rates for euros on various dates are as follows: October 2. 2003 1 euro = $1.05 December 31, 2003 1 euro = $1.10 January 15, 2004 1 euro = $1.08 At 12/31/03, what is the cost of the machinery? a $60,000 b.$63,000 c.564,800 d.566,000 Refer to the above information. What is Waco's Foreign Currency Transaction Gain (low $3.000 gain $3,000 loss C) $1,200 Bain DI $1.200 loss for 2001

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started