Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What entry(ies) would the company need to make to change from a finance lease to an operating lease? Keep in mind that all the appropriate

What entry(ies) would the company need to make to change from a finance lease to an operating lease? Keep in mind that all the appropriate entries have been made for a finance lease. Using new IFRS

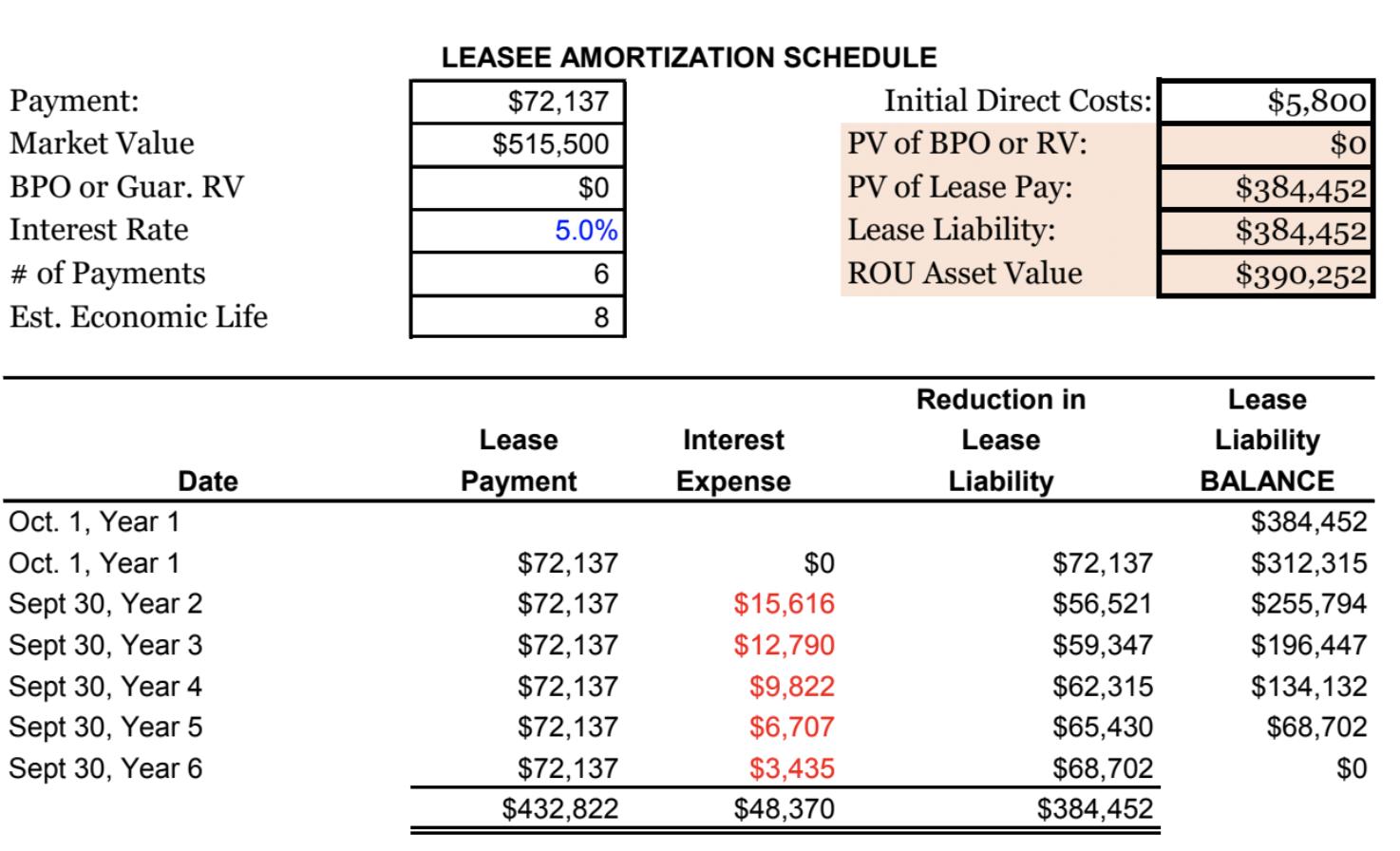

LEASEE AMORTIZATION SCHEDULE $5,800 $0 $384,452 $384,452 $390,252 Payment: $72,137 Initial Direct Costs: Market Value $515,500 PV of BPO or RV: PV of Lease Pay: Lease Liability: BPO or Guar. RV $0 Interest Rate 5.0% # of Payments ROU Asset Value Est. Economic Life 8. Reduction in Lease Lease Interest Lea Liability Date Payment Expense Liability BALANCE Oct. 1, Year 1 Oct. 1, Year 1 $384,452 $72,137 $0 $72,137 $312,315 Sept 30, Year 2 $72,137 $15,616 $56,521 $255,794 Sept 30, Year 3 $72,137 $12,790 $59,347 $196,447 Sept 30, Year 4 Sept 30, Year 5 Sept 30, Year 6 $72,137 $9,822 $62,315 $134,132 $72,137 $6,707 $65,430 $68,702 $72,137 $0 $3,435 $48,370 $68,702 $432,822 $384,452

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Asset value 390282 consider depreciation 8years straight line method per year depreciation caluculated 487815 Below is setup entry for each year Assum...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started