Answered step by step

Verified Expert Solution

Question

1 Approved Answer

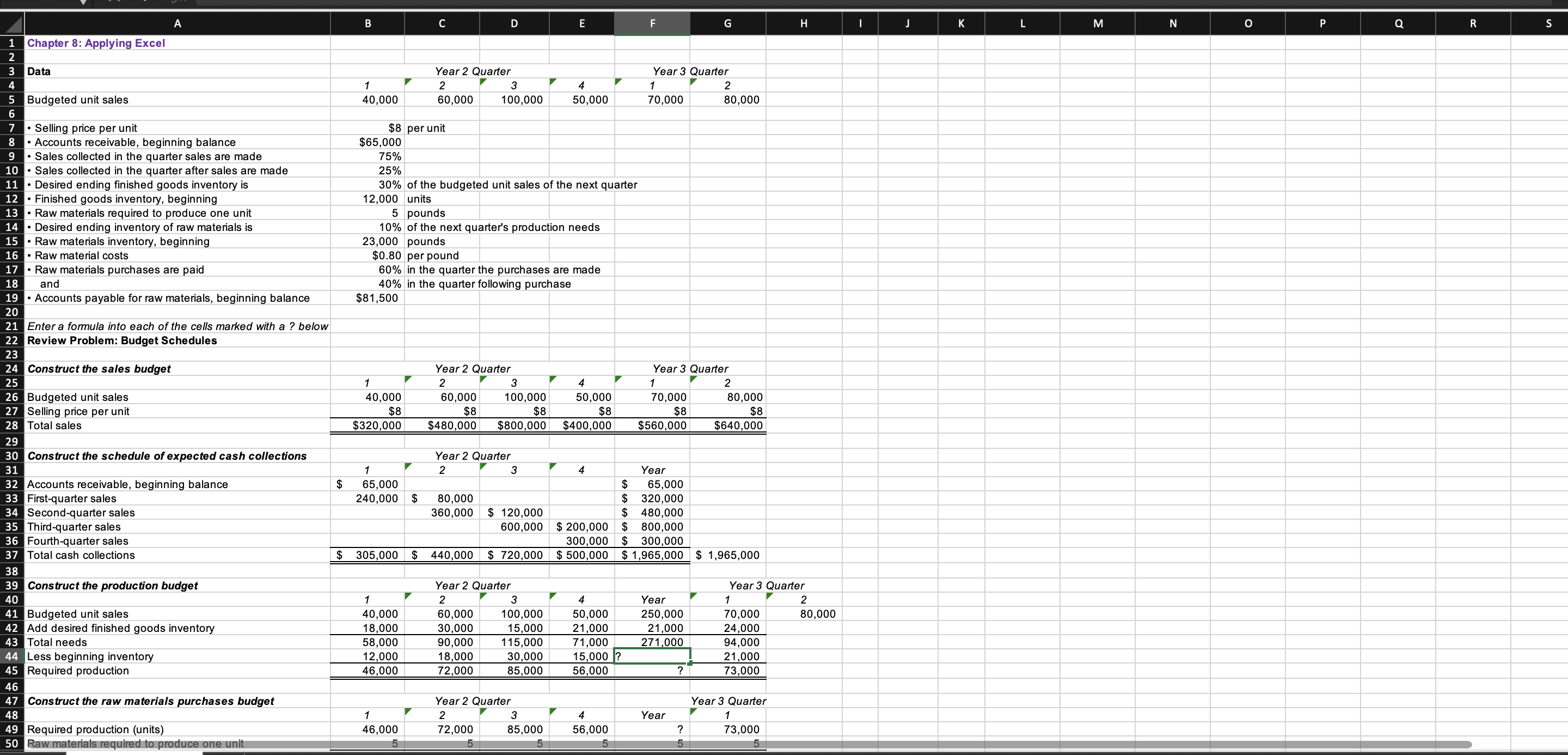

What excel formula do i need to put in F44? (Please tell me the formula and not just the number. Such as =blank) Chapter 8:

What excel formula do i need to put in F44? (Please tell me the formula and not just the number. Such as =blank)

Chapter 8: Applying Excel A Data Budgeted unit sales - Selling price per unit - Accounts receivable, beginning balance - Sales collected in the quarter sales are made - Sales collected in the quarter after sales are made Desired ending finished goods inventory is - Finished goods inventory, beginning - Raw materials required to produce one unit - Desired ending inventory of raw materials is Raw materials inventory, beginning - Raw material costs - Raw materials purchases are paid and - Accounts payable for raw materials, beginning balance Enter a formula into each of the cells marked with a ? below Review Problem: Budget Schedules Construct the sales budget Budgeted unit sales Selling price per unit Total sales Construct the schedule of expected cash collections Accounts receivable, beginning balance First-quarter sales Second-quarter sales Third-quarter sales Fourth-quarter sales Total cash collections Construct the production budget Budgeted unit sales Add desired finished goods inventory Total needs Less beginning inventory Required production Construct the raw materials purchases budget Required production (units) $8 per unit $65,000 75% 30% of the budgeted unit sales of the next quarter 12,000 units 5 pounds 10% of the next quarter's production needs 23,000 pounds $0.80 per pound 60% in the quarter the purchases are made 40% in the quarter following purchase $81,500 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{5}{|c|}{ Year 2 Quarter } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year }} & \\ \hline & 1 & F & 2 & 3 & 4 & & & \\ \hline$ & 65,000 & & & & & $ & 65,000 & \\ \hline & 240,000 & $ & 80,000 & & & $ & 320,000 & \\ \hline & & & 360,000 & $120,000 & & $ & 480,000 & \\ \hline & & & & 600,000 & $200,000 & $ & 800,000 & \\ \hline & & & & & 300,000 & $ & 300,000 & \\ \hline$ & 305,000 & $ & 440,000 & $720,000 & $500,000 & & 1,965,000 & $1,965,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline & & & & & & \\ \hline \multicolumn{4}{|c|}{ Year 2 Quarter } & & \multicolumn{2}{|c|}{ Year 3 Quarter } \\ \hline 1 & 2 & 3 & & Year & & 2 \\ \hline 40,000 & 60,000 & 100,000 & 50,000 & 250,000 & 70,000 & 80,000 \\ \hline 18,000 & 30,000 & 15,000 & 21,000 & 21,000 & 24,000 & \\ \hline 58,000 & 90,000 & 115,000 & 71,000 & 271,000 & 94,000 & \\ \hline 12,000 & 18,000 & 30,000 & 15,000 & ? & 21,000 & \\ \hline 46,000 & 72,000 & 85,000 & 56,000 & ? & 73,000 & \\ \hline \multicolumn{4}{|c|}{ Year 2 Quarter } & \multicolumn{3}{|c|}{ Year 3 Quarter } \\ \hline 1 & & & 4 & Year & 1 & \\ \hline 46,000 & 72,000 & 85,000 & 56,000 & ? & 73,000 & \\ \hline \end{tabular} s Chapter 8: Applying Excel A Data Budgeted unit sales - Selling price per unit - Accounts receivable, beginning balance - Sales collected in the quarter sales are made - Sales collected in the quarter after sales are made Desired ending finished goods inventory is - Finished goods inventory, beginning - Raw materials required to produce one unit - Desired ending inventory of raw materials is Raw materials inventory, beginning - Raw material costs - Raw materials purchases are paid and - Accounts payable for raw materials, beginning balance Enter a formula into each of the cells marked with a ? below Review Problem: Budget Schedules Construct the sales budget Budgeted unit sales Selling price per unit Total sales Construct the schedule of expected cash collections Accounts receivable, beginning balance First-quarter sales Second-quarter sales Third-quarter sales Fourth-quarter sales Total cash collections Construct the production budget Budgeted unit sales Add desired finished goods inventory Total needs Less beginning inventory Required production Construct the raw materials purchases budget Required production (units) $8 per unit $65,000 75% 30% of the budgeted unit sales of the next quarter 12,000 units 5 pounds 10% of the next quarter's production needs 23,000 pounds $0.80 per pound 60% in the quarter the purchases are made 40% in the quarter following purchase $81,500 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{5}{|c|}{ Year 2 Quarter } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year }} & \\ \hline & 1 & F & 2 & 3 & 4 & & & \\ \hline$ & 65,000 & & & & & $ & 65,000 & \\ \hline & 240,000 & $ & 80,000 & & & $ & 320,000 & \\ \hline & & & 360,000 & $120,000 & & $ & 480,000 & \\ \hline & & & & 600,000 & $200,000 & $ & 800,000 & \\ \hline & & & & & 300,000 & $ & 300,000 & \\ \hline$ & 305,000 & $ & 440,000 & $720,000 & $500,000 & & 1,965,000 & $1,965,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline & & & & & & \\ \hline \multicolumn{4}{|c|}{ Year 2 Quarter } & & \multicolumn{2}{|c|}{ Year 3 Quarter } \\ \hline 1 & 2 & 3 & & Year & & 2 \\ \hline 40,000 & 60,000 & 100,000 & 50,000 & 250,000 & 70,000 & 80,000 \\ \hline 18,000 & 30,000 & 15,000 & 21,000 & 21,000 & 24,000 & \\ \hline 58,000 & 90,000 & 115,000 & 71,000 & 271,000 & 94,000 & \\ \hline 12,000 & 18,000 & 30,000 & 15,000 & ? & 21,000 & \\ \hline 46,000 & 72,000 & 85,000 & 56,000 & ? & 73,000 & \\ \hline \multicolumn{4}{|c|}{ Year 2 Quarter } & \multicolumn{3}{|c|}{ Year 3 Quarter } \\ \hline 1 & & & 4 & Year & 1 & \\ \hline 46,000 & 72,000 & 85,000 & 56,000 & ? & 73,000 & \\ \hline \end{tabular} sStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started