Answered step by step

Verified Expert Solution

Question

1 Approved Answer

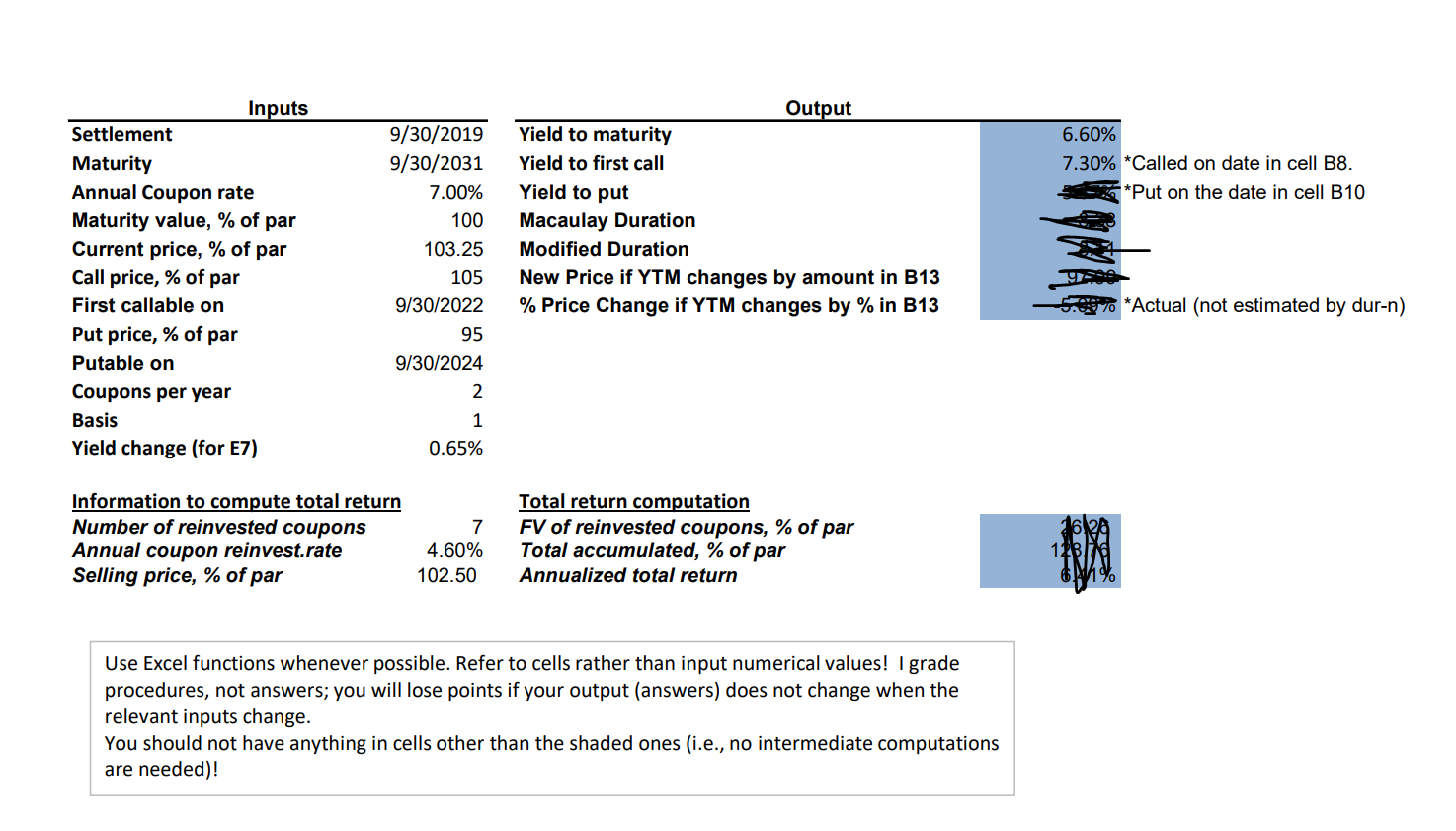

What excel functions are used to find the Yield to maturity and Yield to first call? Those are answers, just not sure how to get

What excel functions are used to find the Yield to maturity and Yield to first call? Those are answers, just not sure how to get them.

6.60% 7.30% *Called on date in cell B8. *Put on the date in cell B10 Inputs Settlement Maturity Annual Coupon rate Maturity value, % of par Current price, % of par Call price, % of par First callable on Put price, % of par Putable on Coupons per year Basis Yield change (for E7) 9/30/2019 9/30/2031 7.00% 100 103.25 105 9/30/2022 95 9/30/2024 Output Yield to maturity Yield to first call Yield to put Macaulay Duration Modified Duration New Price if YTM changes by amount in B13 % Price Change if YTM changes by % in B13 90 -58*Actual (not estimated by dur-n) 0.65% Information to compute total return Number of reinvested coupons Annual coupon reinvest.rate Selling price, % of par Total return computation FV of reinvested coupons, % of par Total accumulated, % of par Annualized total return 4.60% 102.50 Use Excel functions whenever possible. Refer to cells rather than input numerical values! I grade procedures, not answers; you will lose points if your output (answers) does not change when the relevant inputs change. You should not have anything in cells other than the shaded ones (i.e., no intermediate computations are needed)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started