Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, 2020, Mendoza Company (a U.S.-based company) borrowed 560,000 euros for one year at an interest rate of 5 percent per annum.

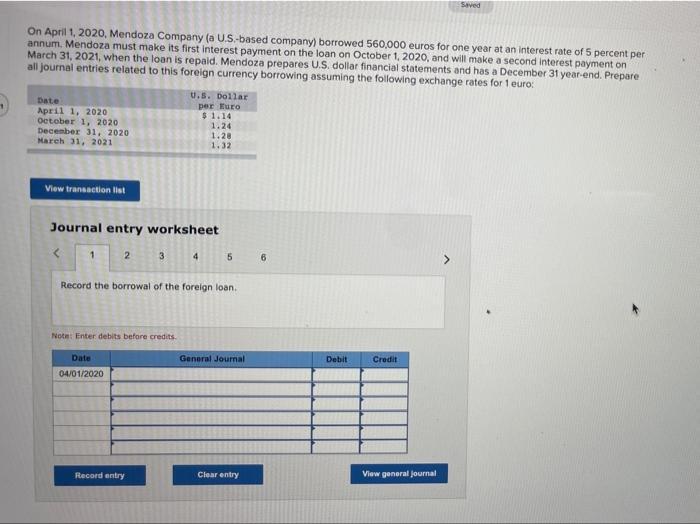

On April 1, 2020, Mendoza Company (a U.S.-based company) borrowed 560,000 euros for one year at an interest rate of 5 percent per annum. Mendoza must make its first interest payment on the loan on October 1, 2020, and will make a second interest payment on March 31, 2021, when the loan is repaid. Mendoza prepares U.S. dollar financial statements and has a December 31 year-end. Prepare all journal entries related to this foreign currency borrowing assuming the following exchange rates for 1 euro: Date April 1, 2020 October 1, 2020 December 31, 2020 March 31, 2021 View transaction list Journal entry worksheet < 1 2 U.S. Dollar per Euro $ 1.14 1.24 1.28 1.32 3 4 Note: Enter debits before credits. Date 04/01/2020 Record entry Record the borrowal of the foreign loan. 5 General Journal Clear entry 6 Debit Credit Saved View general journal

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started