what financing methods should they be using below.

Leasing arrangements

Long-term bonds

Debt with warrants

Friends or relatives

Common stock:nonrights

preferred stock (nonconvertible)

Common stock :rights offering

convertible debentures

factoring (factoring is the selling of a firms accounts receivable)

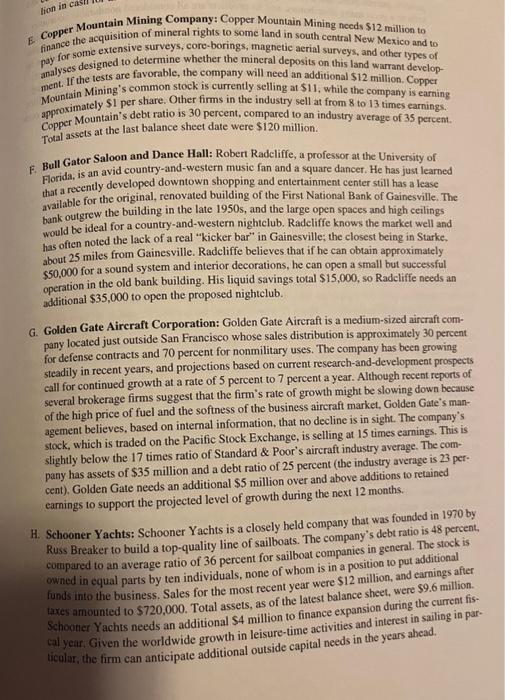

1. Teller Pen Corporation: Teller Pen is engaged in the manufacture of mechanical pens and pencils, porous pens, and a recently developed line of disposable lighters. Since the firm sells to a great many distributors, and its products are all considered nondurable consumer goods, sales are relatively stable. The current price of the company's stock, which is listed on the New York Stock Exchange, is \$25. The most recent earnings and dividends per share are $3.10 and $1.50, respectively. The rate of growth in sales, earnings, and dividends in the past few years has averaged 5 percent. Teller Pen has total assets of $400 million. Current liabilities, which consist primarily of accounts payable and accruals, are \$28 million; longterm debt is $83 million; and common equity totals $289 million. An additional $33 million of external funds is required to build and equip a new disposable-lighter manufacturing complex in central Ohio and to supply the new facility with working capital. E. Copper Mountain Mining Company: Copper Mountain Mining needs $12 million to finance the acquisition of mineral rights to some land in south central New Mexico and to pay for some extensive surveys, core-borings, magnetic acrial surveys, and other types of analyses designed to determine whether the mineral deposits on this land warrant development. If the tests are favorable, the company will need an additional $12 million. Copper Mountain Mining's common stock is currently selling at $11, while the company is earning approximately $1 per share. Other firms in the industry sell at from 8 to 13 times earnings. Copper Mountain's debt ratio is 30 percent, compared to an industry average of 35 percent. Total assets at the last balance sheet date were $120 million. F. Bull Gator Saloon and Dance Hall: Roben Radcliffe, a professor at the University of Florida, is an avid country-and-western music fan and a square dancer. He has just learned that a recently developed downtown shopping and entertainment center still has a lease available for the original, renovated building of the First National Bank of Gainesville. The bank outgrew the building in the late 1950s, and the large open spaces and high ceilings would be ideal for a country-and-western nightclub. Radeliffe knows the market well and has often noted the lack of a real "kicker bar" in Gainesville; the closest being in Starke, about 25 miles from Gainesville. Radeliffe believes that if he can obtain approximately $0,000 for a sound system and interior decorations, he can open a small but successful operation in the old bank building. His liquid savings total $15,000, so Radeliffe needs an additional $35,000 to open the proposed nightelub. G. Golden Gate Aircraft Corporation: Golden Gate Aircraft is a medium-sized aircraft company located just outside San Francisco whose sales distribution is approximately 30 percent for defense contracts and 70 percent for nonmilitary uses. The company has been growing steadily in recent years, and projections based on current research-and-development prospects call for continued growth at a rate of 5 percent to 7 percent a year. Although recent reports of several brokerage firms suggest that the firm's rate of growth might be slowing down because of the high price of fuel and the softness of the business aircraft market, Golden Gate's management believes, based on internal information, that no decline is in sight. The company's stock, which is traded on the Pacific Stock. Exchange, is selling at 15 times earnings. This is slightly below the 17 times ratio of Standard \& Poor's aircraft industry average. The company has assets of $35 million and a debt ratio of 25 percent (the industry average is 23 percent). Golden Gate needs an additional $5 million over and above additions to retained earnings to support the projected level of growth during the next 12 months. Scheoner Yachts is a closely held company that was founded in 1970 by Russ Breaker to build a top-quality line of sailboats. The company's debt ratio is 48 percent. compared to an average ratio of 36 percent for sailboat companies in general. The stock is owned in equal parts by ten individuals, none of whom is in a position to put additional fyods into the business. Sales for the most recent year were $12 million, and earnings after tuxes amounted to $720,000. Total assets, as of the latest balance sheet, were $9.6 million. Scheonor Yachts needs an additional \$4 million to finance expansion during the current fiscal year. Given the worldwide growth in leisure-time activities and interest in sailing in parbicular. the firm can anticipate additional outside capital needs in the years ahead. E. Copper Mountain Mining Company: Copper Mountain Mining needs $12 million to finance the acquisition of mineral rights to some land in south central New Mexico and to pay for some extensive surveys, core-borings, magnetic aerial surveys, and other types of analyses designed to determine whether the mineral deposits on this land warrant development. If the tests are favorable, the company will need an additional $12 million. Copper Mountain Mining's common stock is currently selling at $11, while the company is earning spproximately $1 per share. Other firms in the industry sell at from 8 to 13 times earnings. Copper Mountain's debt ratio is 30 percent, compared to an industry average of 35 percent. Total assets at the last balance sheet date were $120 million. F. Bull Gator Saloon and Dance Hall: Robert Radeliffe, a professor at the University of Florida, is an avid country-and-western music fan and a square dancer. He has just learned that a recently developed downtown shopping and entertainment center still has a lease available for the original, renovated building of the First National Bank of Gainesville. The bank outgrew the building in the late 1950s, and the large open spaces and high ceilings would be ideal for a country-and-western nightclub. Radeliffe knows the market well and has often noted the lack of a real "kicker bar" in Gainesville; the closest being in Starke, about 25 miles from Gainesville. Radeliffe believes that if he can obtain approximately $50,000 for a sound system and interior decorations, he can open a small but successful operation in the old bank building. His liquid savings total $15,000, so Radeliffe needs an adtitional $35,000 to open the proposed nightclub. G. Golden Gate Aircraft Corporation: Golden Gate Aireraft is a medium-sized aircraft company located just outside San Francisco whose sales distribution is approximately 30 percent for defense contracts and 70 percent for nonmilitary uses. The company has been growing steadily in recent years, and projections based on current research-and-development prospects eall for continued growth at a rate of 5 percent to 7 percent a year. Although recent reports of several brokerage firms suggest that the firm's rate of growth might be slowing down because of the high price of fuel and the softness of the business aircraft market, Golden Gate's management believes, based on internal information, that no decline is in sight. The company's stock, which is traded on the Pacific Stock Exchange, is selling at 15 times earnings. This is slightly below the 17 times ratio of Standard \& Poor's aircraft industry average. The company has assets of $35 million and a debt ratio of 25 percent (the industry average is 23 percent). Golden Gate needs an additional \$5 million over and above additions to retained earnings to support the projected level of growth during the next 12 months. Schooner Yachts: Schooner Yachts is a closely beld company that was founded in 1970 by Russ Breaker to build a top-quality line of sailboats. The company's debt ratio is 48 percent, Russ Breaker to build a top-quality line of sailboats. The company's debt ratio is 48 percen is compared to an average ratio of 36 percent for sailboat companies in geacral. The siock is owned in equal parts by ten individuals, none of whom is in a position to put additional funds into the business. Sales for the most recent year were $12 milion, and carnings after. taxes amounted to $720,000. Total assets, as of the latest balance shcet, were $9.6 milion. Schooner Yachts needs an additional $4 million to finance expansion during the curreat fiscal yeur, Given the worldwide growth in leisure-time activities and interest in saiting