Answered step by step

Verified Expert Solution

Question

1 Approved Answer

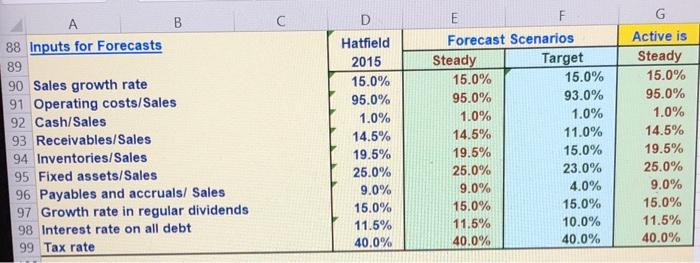

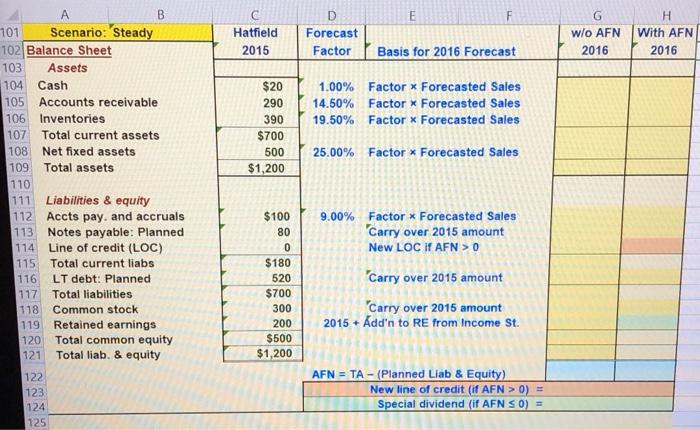

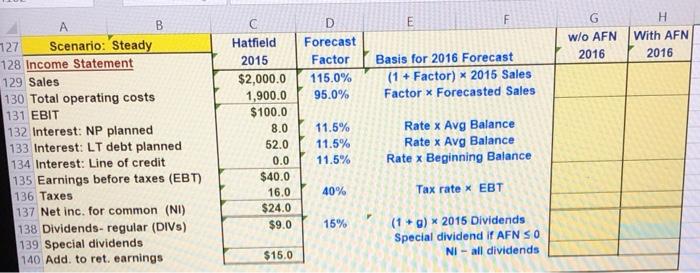

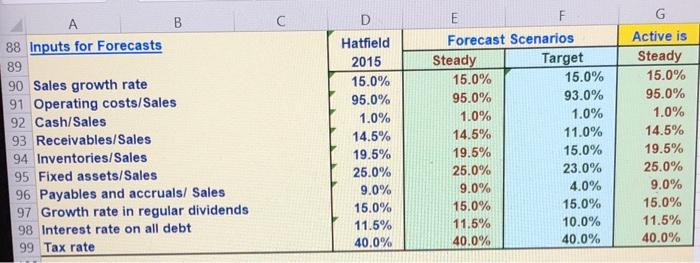

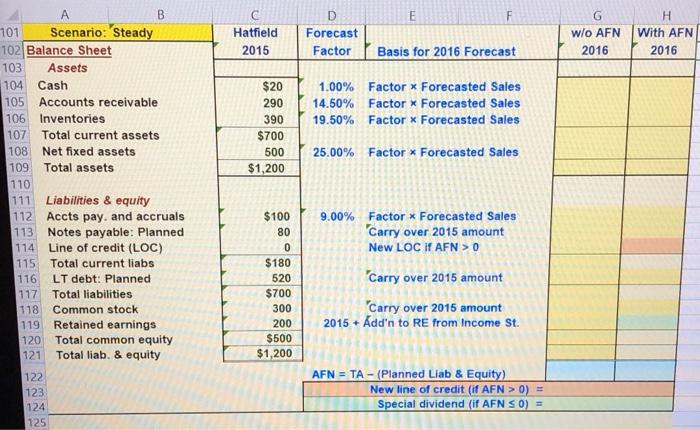

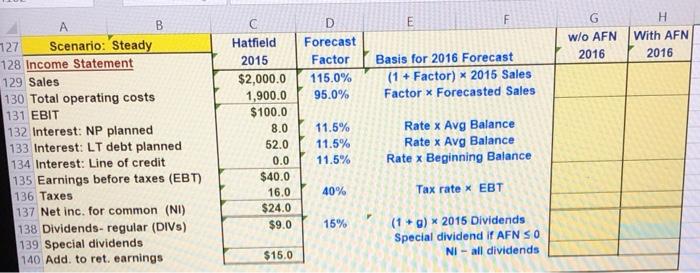

what goes in G104:G140 and H104:H140? using the inputs for forecasts, balance sheet, and income statement what goes in G104:G140 and H104:H140 A B 88

what goes in G104:G140 and H104:H140?

using the inputs for forecasts, balance sheet, and income statement what goes in G104:G140 and H104:H140

A B 88 Inputs for Forecasts 89 90 Sales growth rate 91 Operating costs/Sales 92 Cash/Sales 93 Receivables/Sales 94 Inventories/Sales 95 Fixed assets/Sales 96 Payables and accruals/ Sales 97 Growth rate in regular dividends 98 Interest rate on all debt 99 Tax rate Hatfield 2015 15.0% 95.0% 1.0% 14.5% 19.5% 25.0% 9.0% 15.0% 11.5% 40.0% E F Forecast Scenarios Steady Target 15.0% 15.0% 95.0% 93.0% 1.0% 1.0% 14.5% 11.0% 19.5% 15.0% 25.0% 23.0% 9.0% 4.0% 15.0% 15.0% 11.5% 10.0% 40.0% 40.0% G Active is Steady 15.0% 95.0% 1.0% 14.5% 19.5% 25.0% 9.0% 15.0% 11.5% 40.0% B E F C Hatfield 2015 D Forecast Factor G w/o AFN 2016 H With AFN 2016 Basis for 2016 Forecast $20 290 390 $700 1.00% Factor Forecasted Sales 14.50% Factor * Forecasted Sales 19.50% Factor * Forecasted Sales 500 25.00% Factor * Forecasted Sales $1,200 A B 101 Scenario: Steady 102 Balance Sheet 103 Assets 104 Cash 105 Accounts receivable 106 Inventories 107 Total current assets 108 Net fixed assets 109 Total assets 110 111 Liabilities & equity 112 Accts pay. and accruals 113 Notes payable: Planned 114 Line of credit (LOC) 115 Total current liabs 116 LT debt: Planned 117 Total liabilities 118 Common stock 119 Retained earnings 120 Total common equity 121 Total liab. & equity 122 123 124 125 $100 80 0 $180 520 $700 300 200 $500 $1,200 9.00% Factor * Forecasted Sales Carry over 2015 amount New LOC if AFN > 0 Carry over 2015 amount "Carry over 2015 amount 2015 + Add'n to RE from Income St. AFN = TA - (Planned Liab & Equity) New line of credit (if AFN > 0) = Special dividend (If AFN SO) = D E F G W/O AFN 2016 H With AFN 2016 Forecast Factor 115.0% 95.0% Basis for 2016 Forecast (1 + Factor) * 2015 Sales Factor * Forecasted Sales A B 727 Scenario: Steady 128 Income Statement 129 Sales 130 Total operating costs 131 EBIT 132 Interest: NP planned 133 Interest: LT debt planned 134 Interest: Line of credit 135 Earnings before taxes (EBT) 136 Taxes 137 Net inc. for common (NI) 138 Dividends- regular (DIVS) 139 Special dividends 140 Add to ret. earnings Hatfield 2015 $2,000.0 1,900.0 $100.0 8.0 52.0 0.0 $40.0 16.0 $24.0 $9.0 11.5% 11.5% 11.5% Rate x Avg Balance Rate x Avg Balance Rate x Beginning Balance 40% Tax rate * EBT 15% (1 + g) * 2015 Dividends Special dividend if AFN SO NI - all dividends $15.0 A B 88 Inputs for Forecasts 89 90 Sales growth rate 91 Operating costs/Sales 92 Cash/Sales 93 Receivables/Sales 94 Inventories/Sales 95 Fixed assets/Sales 96 Payables and accruals/ Sales 97 Growth rate in regular dividends 98 Interest rate on all debt 99 Tax rate Hatfield 2015 15.0% 95.0% 1.0% 14.5% 19.5% 25.0% 9.0% 15.0% 11.5% 40.0% E F Forecast Scenarios Steady Target 15.0% 15.0% 95.0% 93.0% 1.0% 1.0% 14.5% 11.0% 19.5% 15.0% 25.0% 23.0% 9.0% 4.0% 15.0% 15.0% 11.5% 10.0% 40.0% 40.0% G Active is Steady 15.0% 95.0% 1.0% 14.5% 19.5% 25.0% 9.0% 15.0% 11.5% 40.0% B E F C Hatfield 2015 D Forecast Factor G w/o AFN 2016 H With AFN 2016 Basis for 2016 Forecast $20 290 390 $700 1.00% Factor Forecasted Sales 14.50% Factor * Forecasted Sales 19.50% Factor * Forecasted Sales 500 25.00% Factor * Forecasted Sales $1,200 A B 101 Scenario: Steady 102 Balance Sheet 103 Assets 104 Cash 105 Accounts receivable 106 Inventories 107 Total current assets 108 Net fixed assets 109 Total assets 110 111 Liabilities & equity 112 Accts pay. and accruals 113 Notes payable: Planned 114 Line of credit (LOC) 115 Total current liabs 116 LT debt: Planned 117 Total liabilities 118 Common stock 119 Retained earnings 120 Total common equity 121 Total liab. & equity 122 123 124 125 $100 80 0 $180 520 $700 300 200 $500 $1,200 9.00% Factor * Forecasted Sales Carry over 2015 amount New LOC if AFN > 0 Carry over 2015 amount "Carry over 2015 amount 2015 + Add'n to RE from Income St. AFN = TA - (Planned Liab & Equity) New line of credit (if AFN > 0) = Special dividend (If AFN SO) = D E F G W/O AFN 2016 H With AFN 2016 Forecast Factor 115.0% 95.0% Basis for 2016 Forecast (1 + Factor) * 2015 Sales Factor * Forecasted Sales A B 727 Scenario: Steady 128 Income Statement 129 Sales 130 Total operating costs 131 EBIT 132 Interest: NP planned 133 Interest: LT debt planned 134 Interest: Line of credit 135 Earnings before taxes (EBT) 136 Taxes 137 Net inc. for common (NI) 138 Dividends- regular (DIVS) 139 Special dividends 140 Add to ret. earnings Hatfield 2015 $2,000.0 1,900.0 $100.0 8.0 52.0 0.0 $40.0 16.0 $24.0 $9.0 11.5% 11.5% 11.5% Rate x Avg Balance Rate x Avg Balance Rate x Beginning Balance 40% Tax rate * EBT 15% (1 + g) * 2015 Dividends Special dividend if AFN SO NI - all dividends $15.0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started