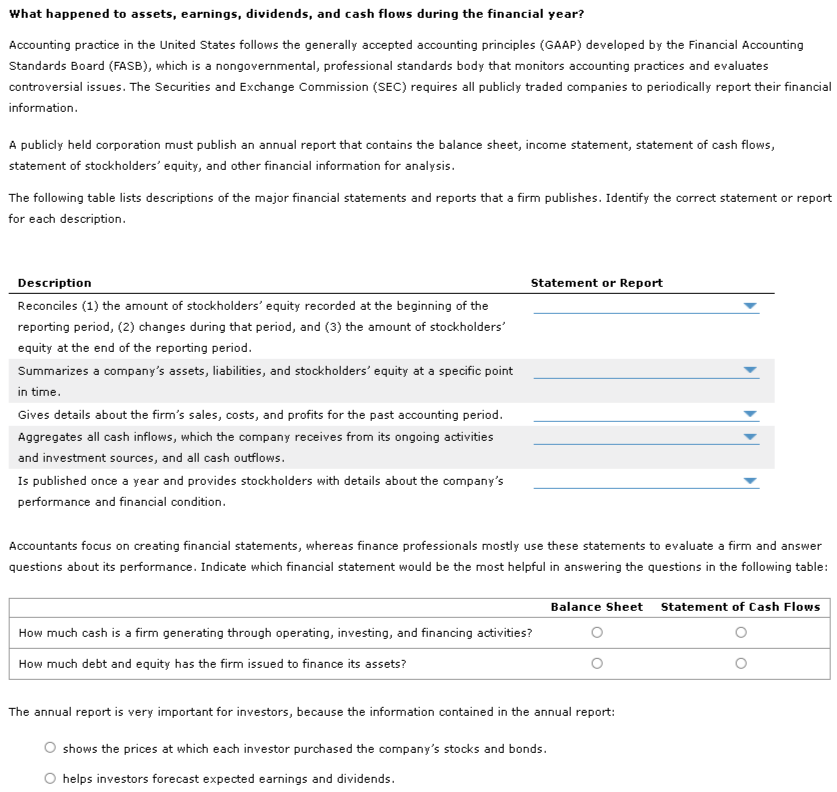

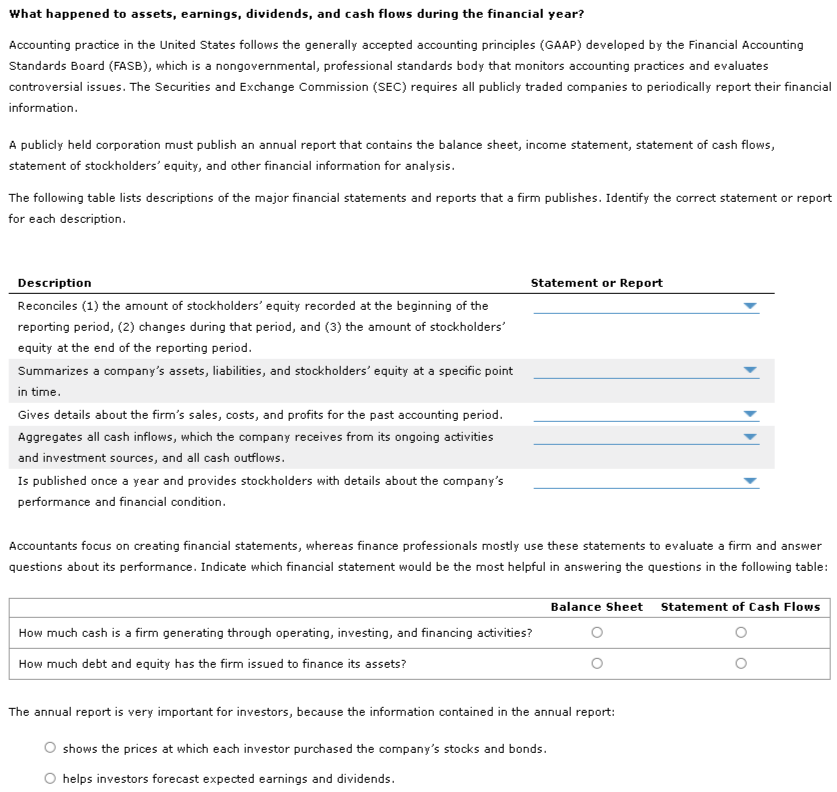

What happened to assets, earnings, dividends, and cash flows during the financial year? Accounting practice in the United States follows the generally accepted accounting principles (GAAP) developed by the Financial Accounting Standards Board (FASB), which is a nongovernmental, professional standards body that monitors accounting practices and evaluates controversial issues. The Securities and Exchange Commission (SEC) requires all publicly traded companies to periodically report their financial information A publicly held corporation must publish an annual report that contains the balance sheet, income statement, statement of cash flows, statement of stockholders' equity, and other financial information for analysis. The following table lists descriptions of the major financial statements and reports that a firm publishes. Identify the correct statement or report for each description Statement or Report Description Reconciles (1) the amount of stockholders' equity recorded at the beginning of the reporting period, (2) changes during that period, and (3) the amount of stockholders' equity at the end of the reporting period. Summarizes a company's assets, liabilities, and stockholders' equity at a specific point in time. Gives details about the firm's sales, costs, and profits for the past accounting period. Aggregates all cash inflows, which the company receives from its ongoing activities and investment sources, and all cash outflows. Is published once a year and provides stockholders with details about the company's performance and financial condition. Accountants focus on creating financial statements, whereas finance professionals mostly use these statements to evaluate a firm and answer questions about its performance. Indicate which financial statement would be the most helpful in answering the questions in the following table: Balance Sheet Statement of Cash Flows How much cash is a firm generating through operating, investing, and financing activities? How much debt and equity has the firm issued to finance its assets? The annual report is very important for investors, because the information contained in the annual report: shows the prices at which each investor purchased the company's stocks and bonds. helps investors forecast expected earnings and dividends