Answered step by step

Verified Expert Solution

Question

1 Approved Answer

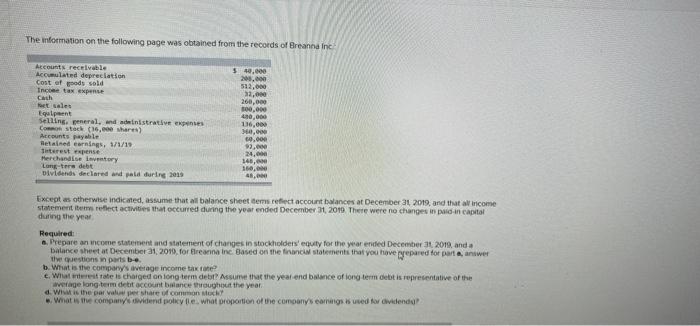

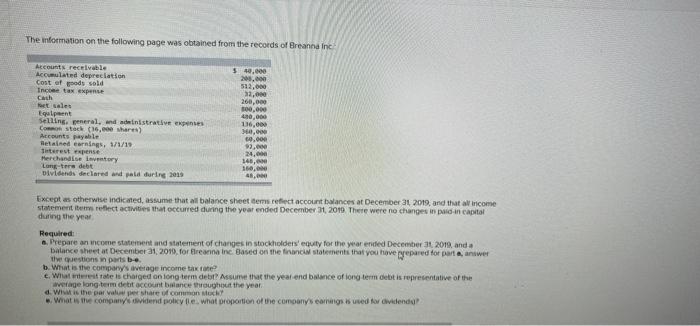

what I am doing wrong? The information on the following page was obtained from the records of Breanna Inc Accounts receivable Accumulated depreciation Cost of

what I am doing wrong?

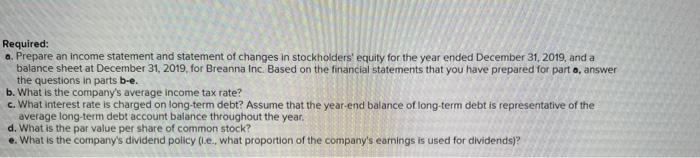

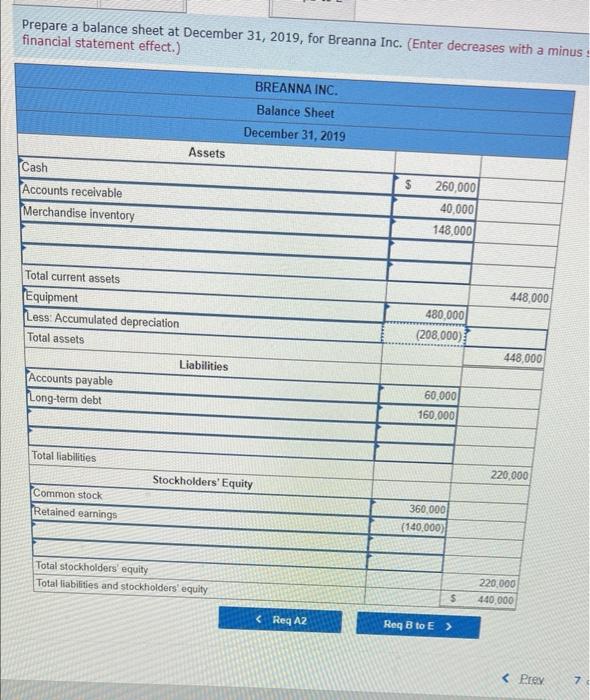

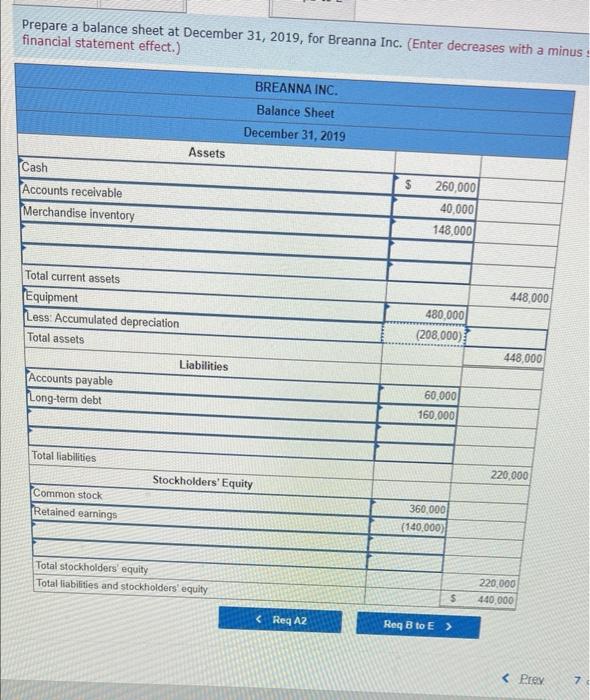

The information on the following page was obtained from the records of Breanna Inc Accounts receivable Accumulated depreciation Cost of goods sold Income tax expen Cach hot sales Egalipent Selling general, and administrative expenses Co stack (16,000 shares) Accounts payable Metained earnings 11/19 Tinterest expense Merchandise story Long-ter det Dividends declared and paid during 2015 $ 40,000 200.000 512.000 33.000 260,000 100.000 40,000 136,00 . 64.000 93. 24. 148, 160, 48.00 Except as otherwise indicated, assume that all balance sheetters reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019 There were no changes in pild-in capital during the year Required a. Prepare an income statement and statement of changes in stockholders' equily for the year ended December 31, 2019, and a balance sheet at December 31, 2019. for Breanna Inc Based on me financial statements that you have prepared for parte answer the questions in partsbe b. What is the company's average income taxe 1. What treate is charged on long term debit! Assume that the year and balance of long term debitis representative of the average long term debit account balance throughout the year d. Wis the par valer share of common och What is the company's dividend polylle. what proportion of the company's cargs is used for dividende Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a balance sheet at December 31, 2019, for Breanna Inc Based on the financial statements that you have prepared for parto, answer the questions in parts b-e. b. What is the company's average income tax rate? c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? e. What is the company's dividend policy (.e., what proportion of the company's eamings is used for dividends)? Prepare a balance sheet at December 31, 2019, for Breanna Inc. (Enter decreases with a minus financial statement effect.) BREANNA INC. Balance Sheet December 31, 2019 Assets Cash Accounts receivable Merchandise inventory 260,000 40,000 148,000 448.000 Total current assets (Equipment Less: Accumulated depreciation Total assets Liabilities Accounts payable Long-term debt 480,000 (208,000) 448,000 60.000 160.000 Total liabilities Stockholders' Equity 220.000 Common stock Retained earnings 360.000 (140.000) Total stockholders' equity Total liabilities and stockholders' equity 220.000 440 000 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started