Answered step by step

Verified Expert Solution

Question

1 Approved Answer

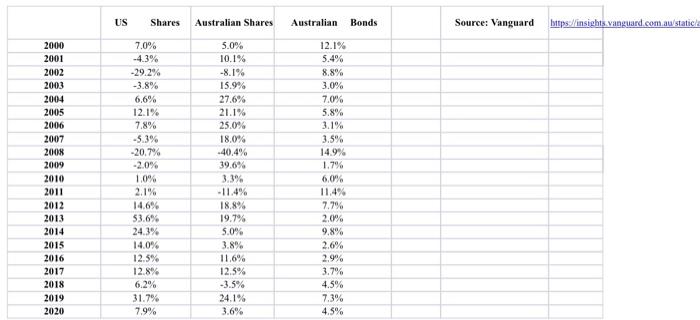

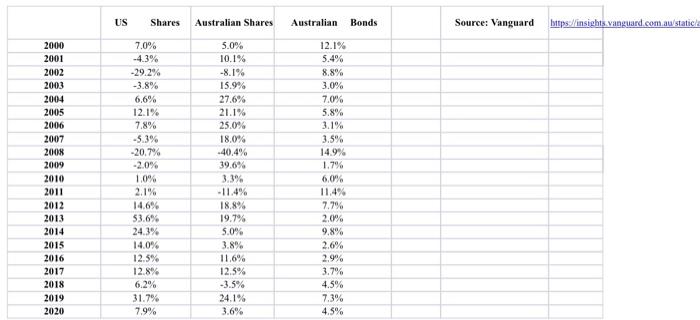

What if Matilda decided to split her money across U.S. shares and Australian shares. Estimate the return she would have got in each year if

What if Matilda decided to split her money across U.S. shares and Australian shares. Estimate the return she would have got in each year if she had a 50/50 split between the two. What happens to the risk that she loses money in any year in this portfolio? Why has this happened? You will need a calculation to support your answer. (150 words max) 10%

US Shares Australian Shares Australian Bonds Source: Vanguard Ittps://insights vanguard.com.au/static/ 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 7.0% -4.3% -29.2% -3.8% 6,6% 12.1% 7.8% -5.3% -20.7% -2.0% 1.0% 2.1% 14.6% 53.6% 24.3% 14.0% 12.5% 12.8% 6.2% 31.7% 7.9% 5.0% 10.1% -8.1% 15.9% 27.6% 21.1% 25.0% 18.0% .40.4% 39.6% 3.3% -11,4% 18.8% 19.7% 5.0% 3.8% 11,6% 12.5% -3.5% 24.1% 3.6% 12.1% 5.4% 8.8% 3.0% 7.0% 5.8% 3.1% 3.5% 14.9% 1.7% 6,0% 11.4% 7.7% 2.0% 9.8% 2.6% 2.9% 3.7% 4.5% 7.3% 4.5% US Shares Australian Shares Australian Bonds Source: Vanguard Ittps://insights vanguard.com.au/static/ 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 7.0% -4.3% -29.2% -3.8% 6,6% 12.1% 7.8% -5.3% -20.7% -2.0% 1.0% 2.1% 14.6% 53.6% 24.3% 14.0% 12.5% 12.8% 6.2% 31.7% 7.9% 5.0% 10.1% -8.1% 15.9% 27.6% 21.1% 25.0% 18.0% .40.4% 39.6% 3.3% -11,4% 18.8% 19.7% 5.0% 3.8% 11,6% 12.5% -3.5% 24.1% 3.6% 12.1% 5.4% 8.8% 3.0% 7.0% 5.8% 3.1% 3.5% 14.9% 1.7% 6,0% 11.4% 7.7% 2.0% 9.8% 2.6% 2.9% 3.7% 4.5% 7.3% 4.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started