Question

What interest rate exposure a financial institution would have if (i) it has a negative repricing gap and (ii) it has a positive repricing gap?

What interest rate exposure a financial institution would have if (i) it has a negative repricing gap and (ii) it has a positive repricing gap?

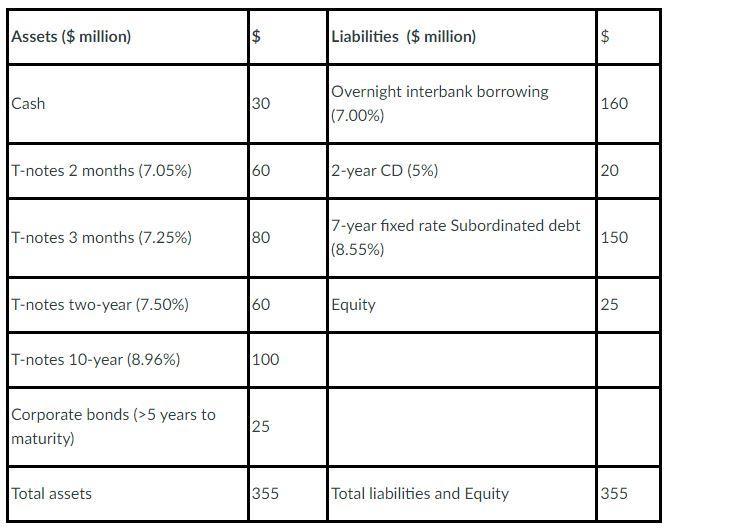

Assets ($ million) Cash T-notes 2 months (7.05%) T-notes 3 months (7.25%) T-notes two-year (7.50%) T-notes 10-year (8.96%) Corporate bonds (>5 years to maturity) Total assets $ +A 30 60 80 60 100 25 355 Liabilities ($ million) Overnight interbank borrowing (7.00%) 2-year CD (5%) 7-year fixed rate Subordinated debt (8.55%) Equity Total liabilities and Equity $ +A 160 20 150 25 355

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer Interest rate exposure refers to the sensitivity of a financial institutions earnings and economic value to changes in interest rates It can be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Brigham, Daves

10th Edition

978-1439051764, 1111783659, 9780324594690, 1439051763, 9781111783655, 324594690, 978-1111021573

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App