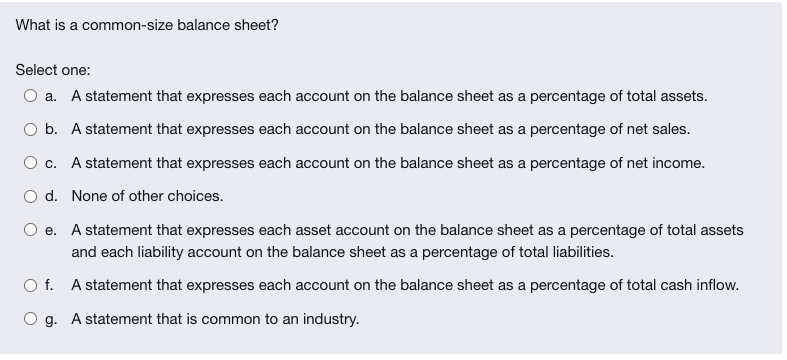

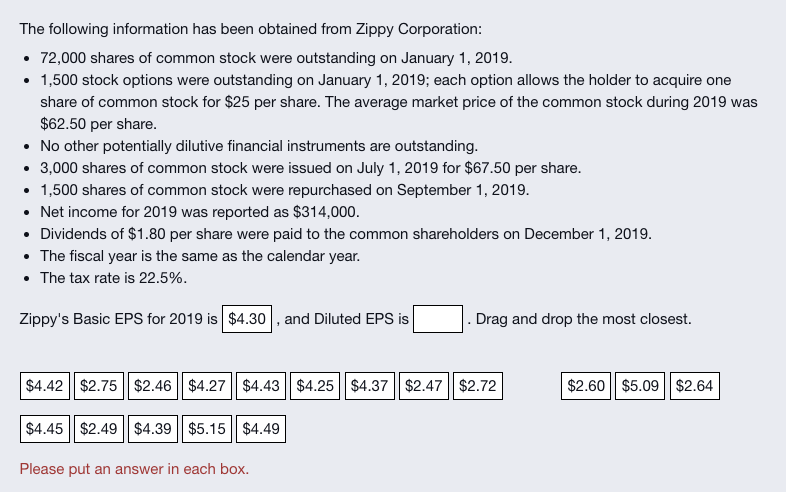

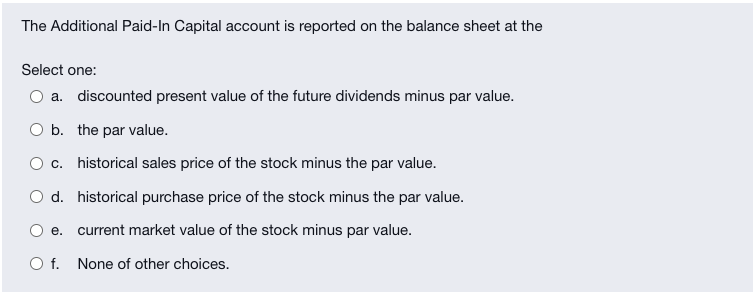

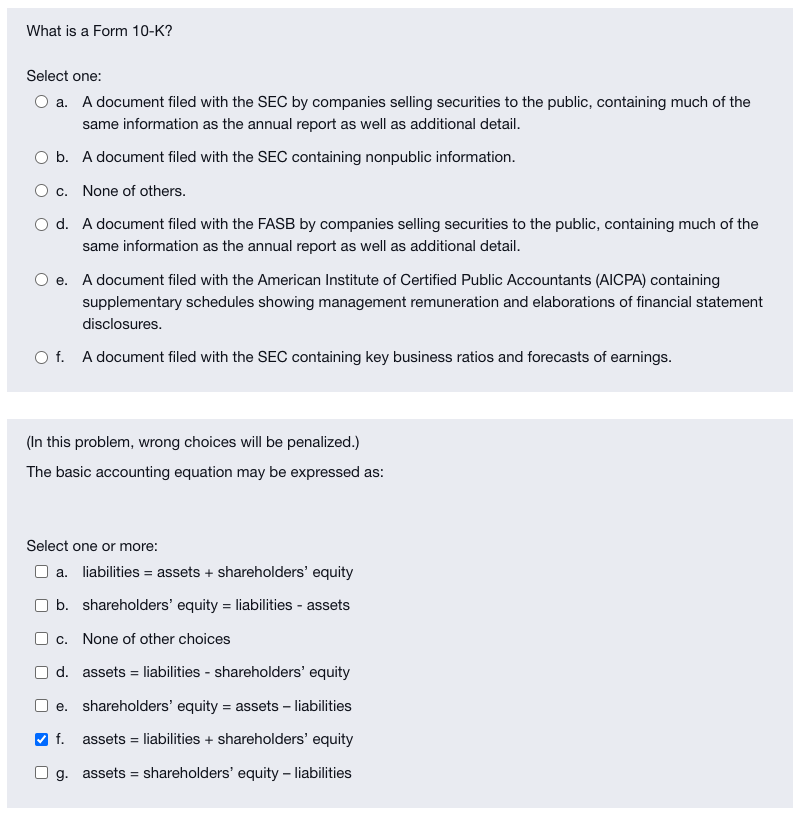

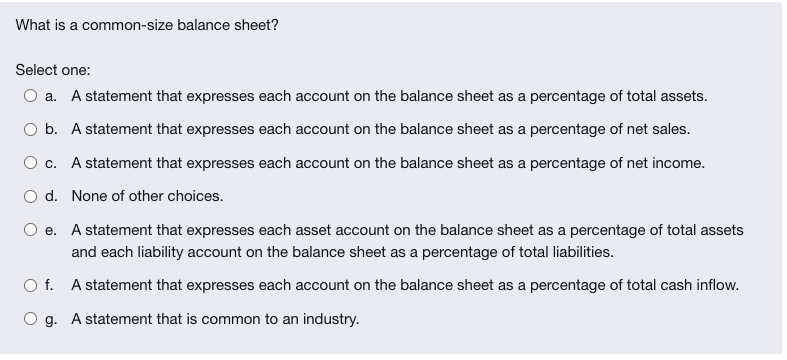

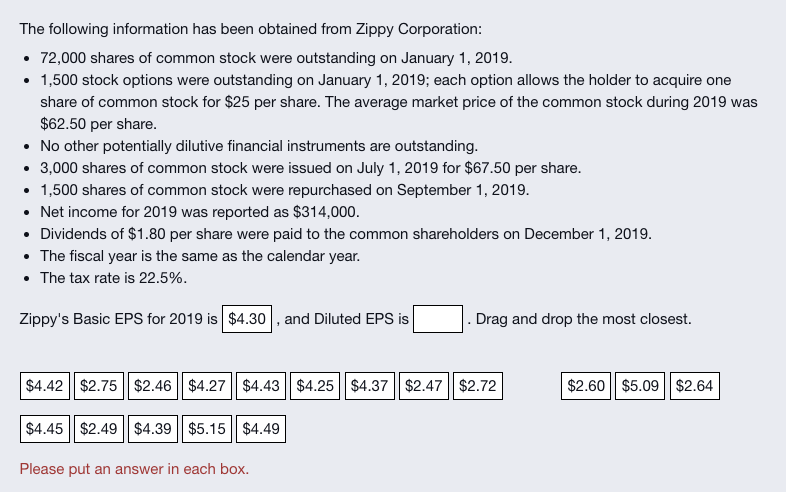

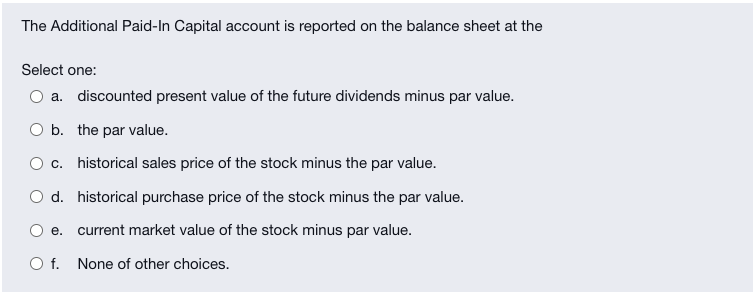

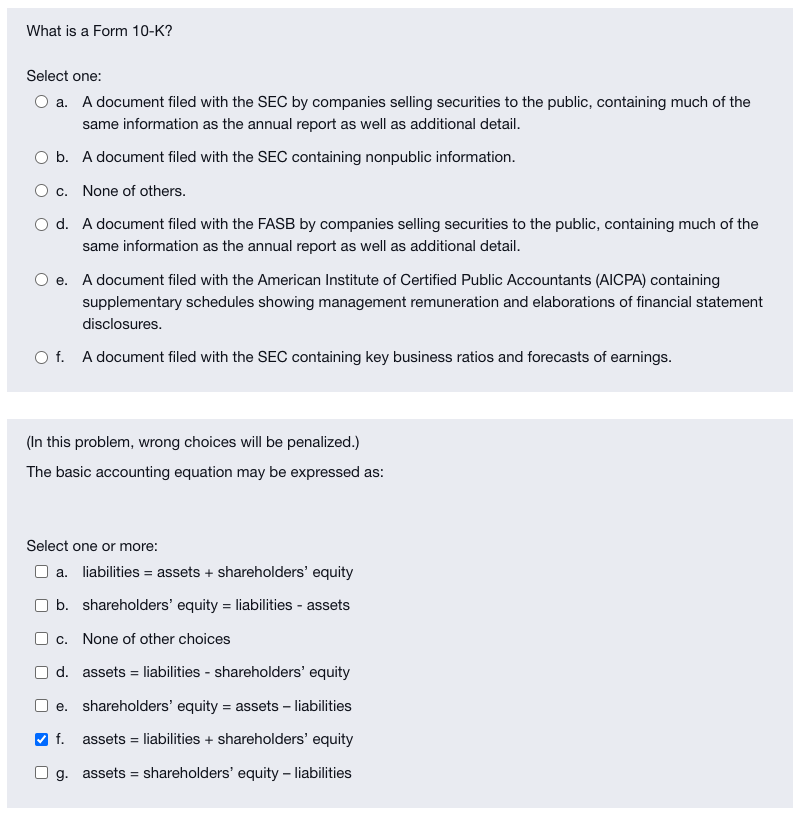

What is a common-size balance sheet? Select one: O a. A statement that expresses each account on the balance sheet as a percentage of total assets. Ob. A statement that expresses each account on the balance sheet as a percentage of net sales. O c. A statement that expresses each account on the balance sheet as a percentage of net income. d. None of other choices. Oe. A statement that expresses each asset account on the balance sheet as a percentage of total assets and each liability account on the balance sheet as a percentage of total liabilities. Of. A statement that expresses each account on the balance sheet as a percentage of total cash inflow. O g. A statement that is common to an industry. The following information has been obtained from Zippy Corporation: 72,000 shares of common stock were outstanding on January 1, 2019. 1,500 stock options were outstanding on January 1, 2019; each option allows the holder to acquire one share of common stock for $25 per share. The average market price of the common stock during 2019 was $62.50 per share. No other potentially dilutive financial instruments are outstanding. 3,000 shares of common stock were issued on July 1, 2019 for $67.50 per share. 1,500 shares of common stock were repurchased on September 1, 2019. Net income for 2019 was reported as $314,000. Dividends of $1.80 per share were paid to the common shareholders on December 1, 2019. The fiscal year is the same as the calendar year. The tax rate is 22.5%. Zippy's Basic EPS for 2019 is $4.30, and Diluted EPS is Drag and drop the most closest. $4.42 | $2.75 | $2.46 || $4.27 | $4.43 || $4.25 $4.37 || $2.47 || $2.72 $2.60 || $5.09 | $2.64 $4.45 || $2.49 ||$4.39 | $5.15 || $4.49 Please put an answer in each box. The Additional Paid-In Capital account is reported on the balance sheet at the Select one: a. discounted present value of the future dividends minus par value. b. the par value. c. historical sales price of the stock minus the par value. d. historical purchase price of the stock minus the par value. e. current market value of the stock minus par value. Of. None of other choices. What is a Form 10-K? Select one: O a. A document filed with the SEC by companies selling securities to the public, containing much of the same information as the annual report as well as additional detail. O b. A document filed with the SEC containing nonpublic information. O C. None of others. d. A document filed with the FASB by companies selling securities to the public, containing much of the same information as the annual report as well as additional detail. e. A document filed with the American Institute of Certified Public Accountants (AICPA) containing supplementary schedules showing management remuneration and elaborations of financial statement disclosures. Of. A document filed with the SEC containing key business ratios and forecasts of earnings. (In this problem, wrong choices will be penalized.) The basic accounting equation may be expressed as: Select one or more: a. liabilities = assets + shareholders' equity b. shareholders' equity = liabilities - assets c. None of other choices U d. assets = liabilities - shareholders' equity e. shareholders' equity = assets - liabilities f. assets = liabilities + shareholders' equity Og. assets = shareholders' equity - liabilities