Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is a derivative, how does it differ from a stock or bond? 2. How do price limits work with futures? Do all futures

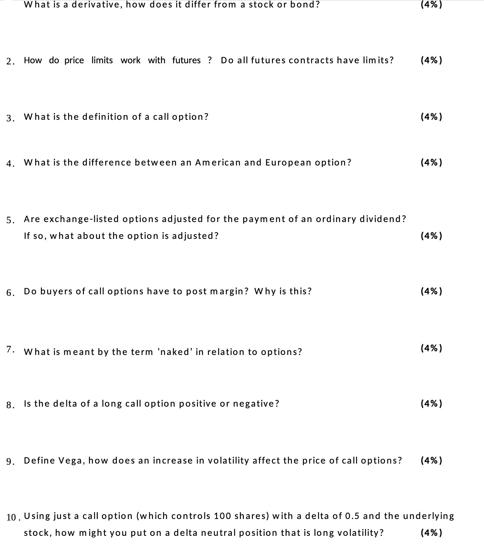

What is a derivative, how does it differ from a stock or bond? 2. How do price limits work with futures? Do all futures contracts have limits? 3. What is the definition of a call option? 4. What is the difference between an American and European option? 5. Are exchange-listed options adjusted for the payment of an ordinary dividend? If so, what about the option is adjusted? 6. Do buyers of call options have to post margin? Why is this? 7. What is meant by the term 'naked' in relation to options? 8. Is the delta of a long call option positive or negative? (4%) (4%) (4%) (4%) (4%) (4%) (4%) (4%) 9. Define Vega, how does an increase in volatility affect the price of call options? (4%) 10. Using just a call option (which controls 100 shares) with a delta of 0.5 and the underlying stock, how might you put on a delta neutral position that is long volatility? (4%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 A derivative is a financial instrument whose value is derived from an underlying asset such as stocks bonds commodities or indices Unlike stocks or bonds which represent ownership or debt in a compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started