Answered step by step

Verified Expert Solution

Question

1 Approved Answer

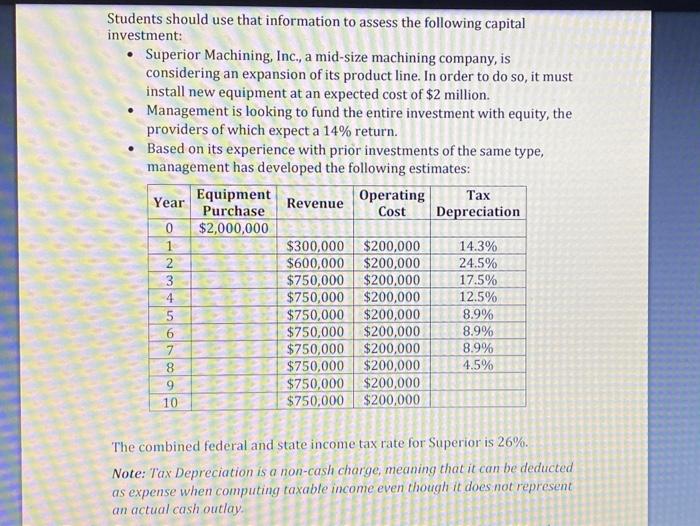

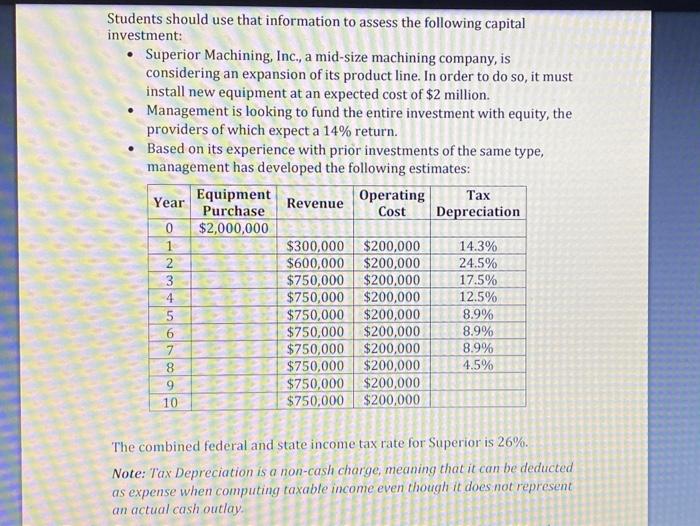

What is a discounted cash flow for the years listed below? Students should use that information to assess the following capital investment: Superior Machining, Inc.,

What is a discounted cash flow for the years listed below?

Students should use that information to assess the following capital investment: Superior Machining, Inc., a mid-size machining company, is considering an expansion of its product line. In order to do so, it must install new equipment at an expected cost of $2 million. Management is looking to fund the entire investment with equity, the providers of which expect a 14% return. Based on its experience with prior investments of the same type, management has developed the following estimates: Year Equipment Tax Operating Purchase Revenue Cost Depreciation 0 $2,000,000 1 $300,000 $200,000 14.3% 2 $600,000 $200,000 24.5% 3 $750,000 $200,000 17.5% 4 $750,000 $200,000 12.5% 5 $750,000 $200,000 8.9% 6 $750,000 $200,000 8.9% 7 $750,000 $200,000 8.9% 8 $750,000 $200,000 4.5% 9 $750,000 $200,000 10 $750,000 $200,000 WN The combined federal and state income tax rate for Superior is 26%. Note: Tax Depreciation is a non-cash charge, meaning that it can be deducted as expense when computing taxable income even though it does not represent an actual cash outlay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started