Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is an approximate risk free rate in market risk premium? what is the cost of equity for this project? what is the cost of

what is an approximate risk free rate in market risk premium?

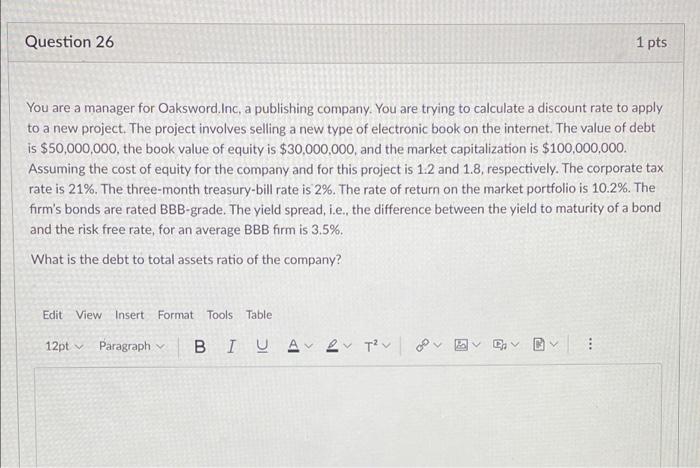

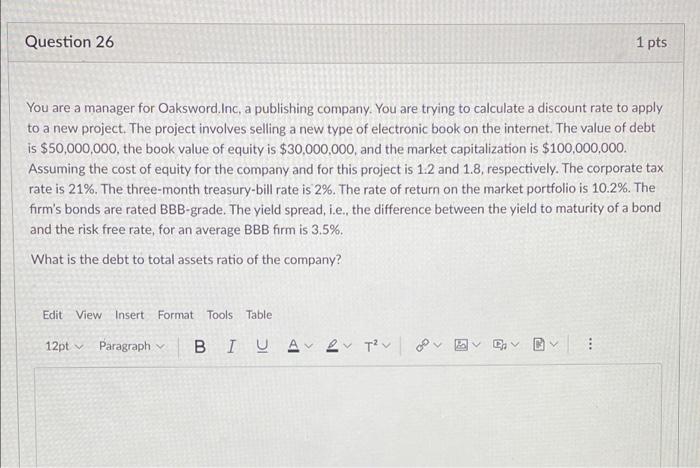

Question 26 1 pts You are a manager for Oaksword.Inc, a publishing company. You are trying to calculate a discount rate to apply to a new project. The project involves selling a new type of electronic book on the internet. The value of debt is $50,000,000, the book value of equity is $30,000,000, and the market capitalization is $100,000,000. Assuming the cost of equity for the company and for this project is 1.2 and 1.8, respectively. The corporate tax rate is 21%. The three-month treasury-bill rate is 2%. The rate of return on the market portfolio is 10.2%. The firm's bonds are rated BBB-grade. The yield spread, i.e., the difference between the yield to maturity of a bond and the risk free rate for an average BBB firm is 3.5%. What is the debt to total assets ratio of the company? Edit View Insert Format Tools Table 12ptv Paragraph BIU A ev T voo. ABY BY what is the cost of equity for this project?

what is the cost of debt for this project?

what is the weighted average cost of capital that should be applied to the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started