Answered step by step

Verified Expert Solution

Question

1 Approved Answer

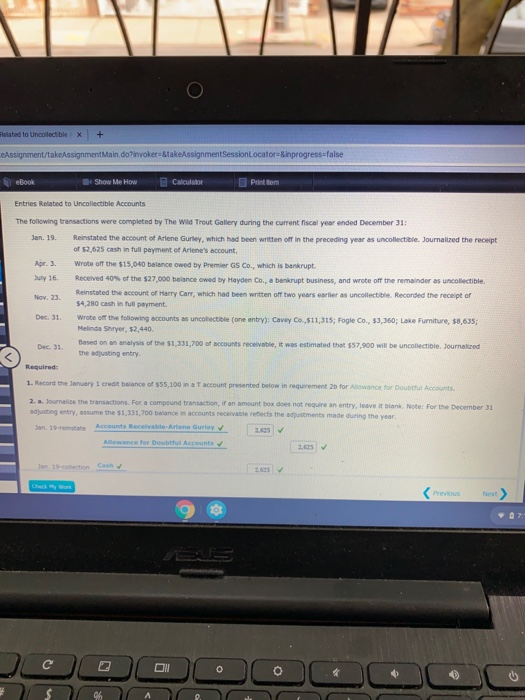

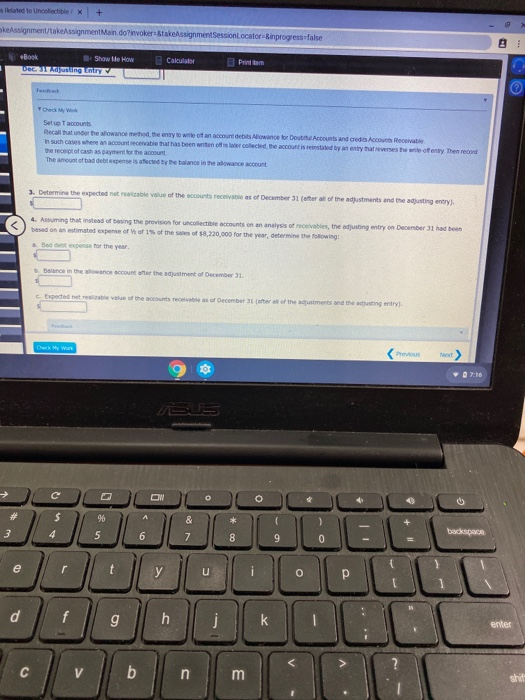

what is bad debt expense and allowance for dobtful accounts , adjusting entry and balance on Dec 31 and answer questions 3 and 4 thx

what is bad debt expense and allowance for dobtful accounts , adjusting entry and balance on Dec 31 and answer questions 3 and 4 thx

Related to Uncollectible X + Assignment/takeAssignment Main.do?invokerStakeAssignment Session Locator=&inprogress=false eBook Show Me How Calculator Pritom Entries Related to Uncollectible Accounts The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended December 31: Jan. 19, Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncollectible. Journalized the receipt of 52,625 cash in full payment of Arlene's account. Apr. 3. Wrote of the $15,040 balance owed by Premier GS Co., which is bankrupt. July 16, Received 40% of the $27,000 balance owed by Hayden Co., a bankrupt business, and wrote off the remainder as uncollectible Reinstated the account of Harry Carr, which had been written of two years earlier as uncollectible. Recorded the receipt of Nov. 23 54,280 cash in full payment Dec. 31 Wrote off the following accounts as unconecte (one entry): Cavey Co.,511,315; Fogle Co., 53,360, Lake Purniture, $8,635; Melinda Shryer, 52,440. Dec. 31 Based on an analysis of the 51,331,700 of accounts receivable, it was estimated that $57,900 will be uncollectible journalized the adjusting entry Required: 1. Record the January 1 credit balance of $55,100 in aT account presented below in requirement 2b for Allowance for Doubtful Account 2. a. Journalise the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. Note: For the December 31 adjusting entry, assume the $1,331,700 balance in accounts receivable rects the dustments made during the year. Jan 19 Accounts Receivable Arten Gurley Allowance for Douth Accounts 2.05 Ion 19-collection Cash & Previous ON O 96 Helated to collectible x + messignment/takeAssignment Main.do?invokerStakeAssignmentSessionLocator Binprogress false Book * Show Me How using Y Calculator Satu Taccounts Recall that under the slowance method, te entry to write of an account debits Allowance for Double Accounts and cred Accounts Receivable In such cases where accountable that has been written off we collected the account is reinstated by an entry that were the entry Then record the recepto cash as payment for the account The amount of bad debe pense is afected by the balance in the allowance cont Determine the expected netrable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry) 4. Assuming that instead of being the provision for collectible accounts on an analysis of receivables, the adjusting entry on December 31 had been based on an estimated expense of of 15 of these of $8,220,000 for the year, determine the following: Bedst expense for the year Balance in the went after the adjustment of December 31 Expected the value of the accounts receives of December 31(era of the austments and the adjusting entry) Next O 96 $ 4 MO00 3 backspace 9 0 e r y u d g h Ox0001 enter V bn m Related to Uncollectible X + Assignment/takeAssignment Main.do?invokerStakeAssignment Session Locator=&inprogress=false eBook Show Me How Calculator Pritom Entries Related to Uncollectible Accounts The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended December 31: Jan. 19, Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncollectible. Journalized the receipt of 52,625 cash in full payment of Arlene's account. Apr. 3. Wrote of the $15,040 balance owed by Premier GS Co., which is bankrupt. July 16, Received 40% of the $27,000 balance owed by Hayden Co., a bankrupt business, and wrote off the remainder as uncollectible Reinstated the account of Harry Carr, which had been written of two years earlier as uncollectible. Recorded the receipt of Nov. 23 54,280 cash in full payment Dec. 31 Wrote off the following accounts as unconecte (one entry): Cavey Co.,511,315; Fogle Co., 53,360, Lake Purniture, $8,635; Melinda Shryer, 52,440. Dec. 31 Based on an analysis of the 51,331,700 of accounts receivable, it was estimated that $57,900 will be uncollectible journalized the adjusting entry Required: 1. Record the January 1 credit balance of $55,100 in aT account presented below in requirement 2b for Allowance for Doubtful Account 2. a. Journalise the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. Note: For the December 31 adjusting entry, assume the $1,331,700 balance in accounts receivable rects the dustments made during the year. Jan 19 Accounts Receivable Arten Gurley Allowance for Douth Accounts 2.05 Ion 19-collection Cash & Previous ON O 96 Helated to collectible x + messignment/takeAssignment Main.do?invokerStakeAssignmentSessionLocator Binprogress false Book * Show Me How using Y Calculator Satu Taccounts Recall that under the slowance method, te entry to write of an account debits Allowance for Double Accounts and cred Accounts Receivable In such cases where accountable that has been written off we collected the account is reinstated by an entry that were the entry Then record the recepto cash as payment for the account The amount of bad debe pense is afected by the balance in the allowance cont Determine the expected netrable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry) 4. Assuming that instead of being the provision for collectible accounts on an analysis of receivables, the adjusting entry on December 31 had been based on an estimated expense of of 15 of these of $8,220,000 for the year, determine the following: Bedst expense for the year Balance in the went after the adjustment of December 31 Expected the value of the accounts receives of December 31(era of the austments and the adjusting entry) Next O 96 $ 4 MO00 3 backspace 9 0 e r y u d g h Ox0001 enter V bn m Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started