Question: Bear Stearns & Co Answer the following 10 questions, using the financial statement data from Blockbuster Entertainment Corporation. Show your work (i.e., note what numbers

Bear Stearns & Co Answer the following 10 questions, using the financial statement data from Blockbuster Entertainment Corporation. Show your work (i.e., note what numbers you're using).

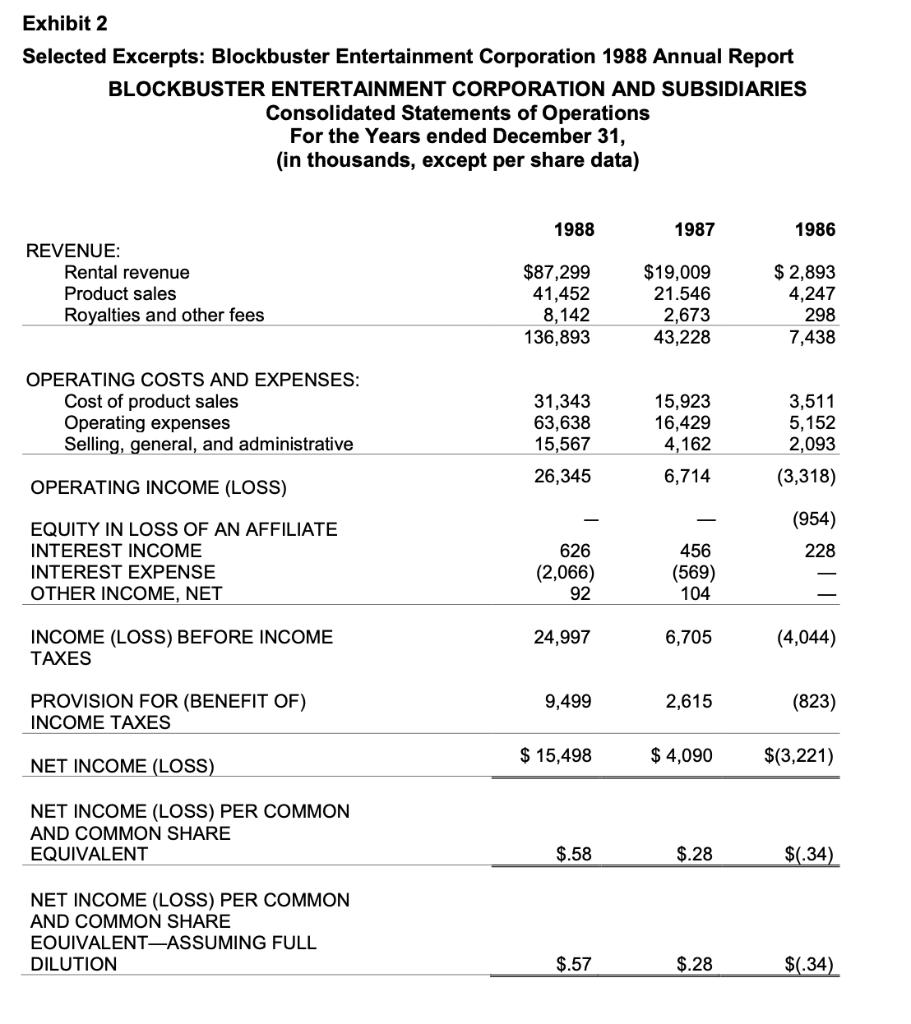

On May 9, 1989, Bear Stearns & Co. issued a report on Blockbuster Entertainment Corp., which is reproduced in part below. Blockbuster-Entertainment (Ticker symbol: BV, Price per share: $33 1⁄2) increased owned and franchised video stores from 19 at the end of 1986 to 415 at December 31, 1988. In the same period revenue jumped from $7.4 million to $136.9 million. Reported earnings also leaped; from $.34 per share in 1986 to $.57 per share in 1988. The stock carries a historical Price to Earnings ratio of 59, and there were 25,741,549 shares of common stock issued and outstanding as of 12/31/88.

1)

Some of Blockbuster's mergers with other video rental companies have been recorded as purchases. In a merger treated as a purchase, the price paid is first allocated to the fair values of assets that can be kicked, picked up or painted. Any excess paid for the company beyond these "fair values” becomes goodwill, which Blockbuster labels "intangible assets relating to acquired businesses." APB Opinion 17 requires that goodwill be amortized to income (expensed) over 40 years or less. In the past, many companies automatically adopted 40 year amortization. Current practice (which is usually required by the SEC) is to relate the amortization period to the nature of the business acquired. Thus in a typical hi-tech acquisition the SEC requires goodwill to be amortized over 5 to 7 years; in bank purchases, over 15 to 20 years. Other information: Eight of the eighty company-owned stores that appeared in the 1987 10-K (annual filing with the SEC) are not on the 1988 list. The maximum term of the company's franchise agreements is 25 years.

a) What is Blockbuster's amortization timetable? Do you think it is appropriate?

b) What would be the impact on Blockbuster's 1988 earnings per share if 5 year amortization were applied to this goodwill?

Exhibit 2 Selected Excerpts: Blockbuster Entertainment Corporation 1988 Annual Report BLOCKBUSTER ENTERTAINMENT CORPORATION AND SUBSIDIARIES Consolidated Statements of Operations For the Years ended December 31, (in thousands, except per share data) 1988 1987 1986 REVENUE: $87,299 41,452 8,142 136,893 $ 2,893 4,247 298 Rental revenue Product sales $19,009 21.546 Royalties and other fees 2,673 43,228 7,438 OPERATING COSTS AND EXPENSES: Cost of product sales Operating expenses Selling, general, and administrative 31,343 63,638 15,567 15,923 16,429 4,162 3,511 5,152 2,093 OPERATING INCOME (LOSS) 26,345 6,714 (3,318) EQUITY IN LOSS OF AN AFFILIATE (954) INTEREST INCOME 626 456 228 (2,066) 92 INTEREST EXPENSE (569) 104 OTHER INCOME, NET INCOME (LOSS) BEFORE INCOME 24,997 6,705 (4,044) TAXES PROVISION FOR (BENEFIT OF) 9,499 2,615 (823) INCOME TAXES $ 15,498 $ 4,090 $(3,221) NET INCOME (LOSS) NET INCOME (LOSS) PER COMMON AND COMMON SHARE EQUIVALENT $.58 $.28 $(.34) NET INCOME (LOSS) PER COMMON AND COMMON SHARE EOUIVALENT-ASSUMING FULL DILUTION $.57 $.28 $(.34)

Step by Step Solution

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts