Answered step by step

Verified Expert Solution

Question

1 Approved Answer

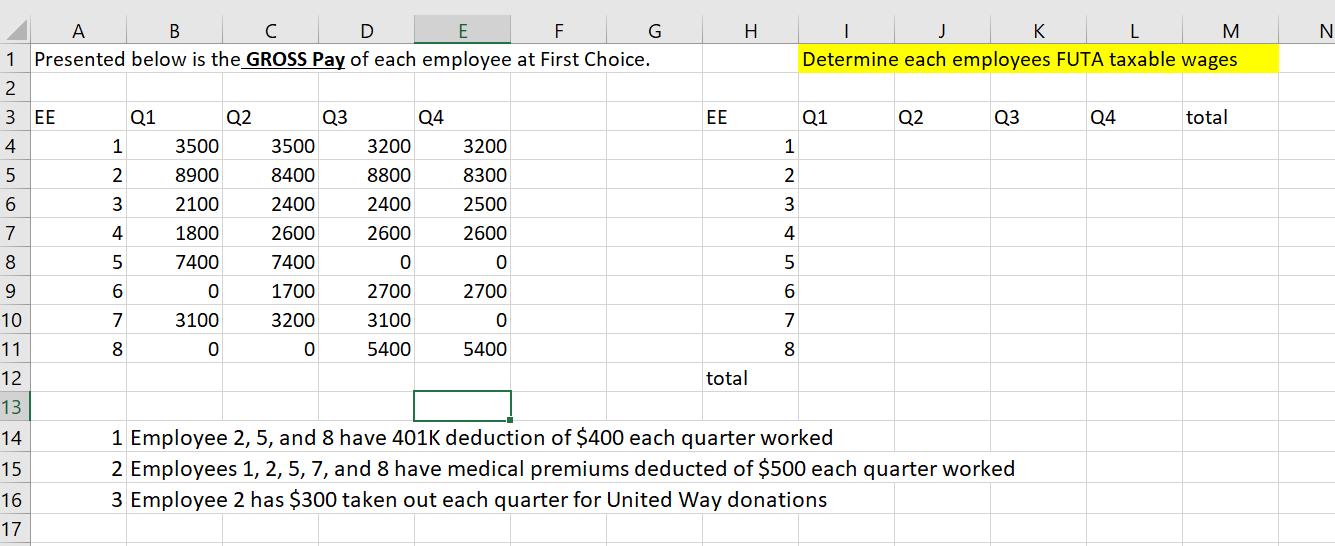

What is employee #1 taxable FUTA wages for quarter 3? What is employee #1 taxable FUTA wages for quarter 4 ? What is employee #7

What is employee #1 taxable FUTA wages for quarter 3?

What is employee #1 taxable FUTA wages for quarter 4?

What is employee #7 taxable FUTA wages for quarter 2?

What is employee #7 taxable FUTA wages for quarter 3?

What is line 3 of Form 940?

What is line 6 of Form 940?

What is line 8 of Form 940?

For year 2020, what is line 11 of Form 940?

What is line 16a of Form 940?

What is line 16d of Form 940?

A B D E F 1 Presented below is the GROSS Pay of each employee at First Choice. 2 MANNEN 67 3 EE 4 5 6 7 8 9 10 11 12 13 14 15 16 17 1 2 3 4 5 6 7 8 Q1 3500 8900 2100 1800 7400 0 3100 0 Q2 3500 8400 2400 2600 7400 1700 3200 0 Q3 3200 8800 2400 2600 0 2700 3100 5400 Q4 3200 8300 2500 2600 0 2700 0 5400 G EE H total 1 2 3 4 5 6 7 8 L M J Determine each employees FUTA taxable wages Q1 1 Employee 2, 5, and 8 have 401K deduction of $400 each quarter worked Q2 3 Employee 2 has $300 taken out each quarter for United Way donations Q3 2 Employees 1, 2, 5, 7, and 8 have medical premiums deducted of $500 each quarter worked K Q4 total N

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

What is employee 1 taxable FUTA wages for quarter 3 3200 Explanation Employee 1 earned a gross pay of 3200 in Quarter 3 and had 500 deducted for medical premiums and 400 deducted for a 401K resulting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started