what is estimated time for the solution i can expect???

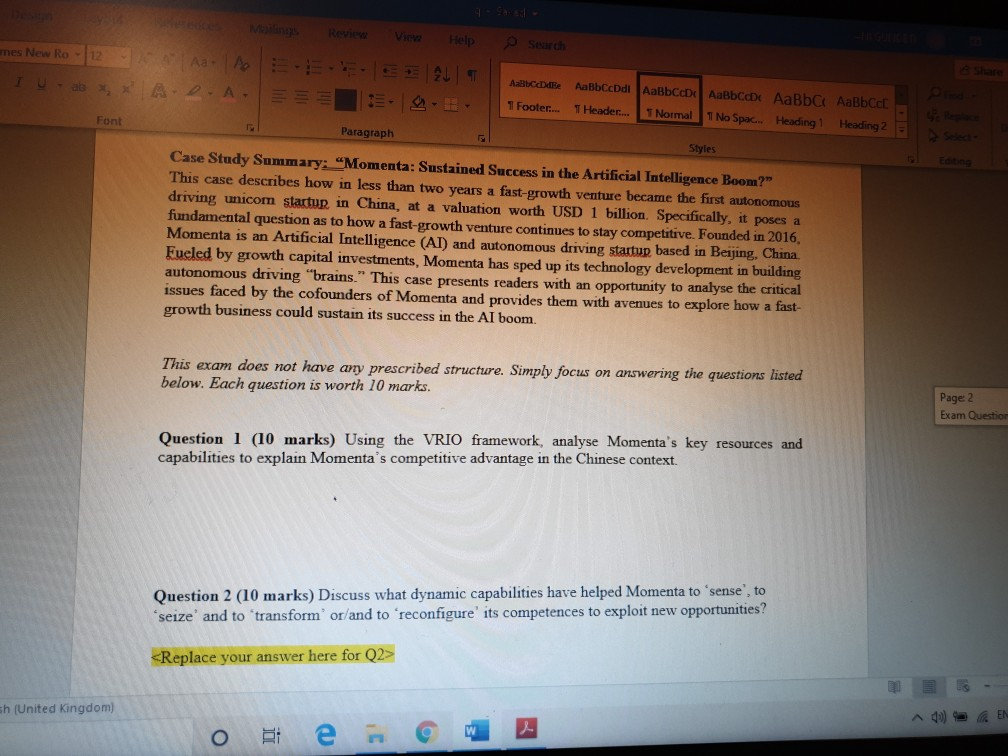

Review Help Search mes New Ro | 12 Tab UT ABECEDAE AaBbCcDdi AaBbcc AaBbc AaBbc Aabbcc. 1 Footer... 1 Header.... Normal 1 No Spac.. Heading Heading 2 Font Paragraph Styles Case Study Summary: "Momenta: Sustained Success in the Artificial Intelligence Boom?" This case describes how in less than two years a fast-growth venture became the first autonomous driving unicom startur in China, at a valuation worth USD 1 billion. Specifically, it poses a fundamental question as to how a fast-growth venture continues to stay competitive. Founded in 2016, Momenta is an Artificial Intelligence (AI) and autonomous driving startup based in Beijing, China. Fueled by growth capital investments, Momenta has sped up its technology development in building autonomous driving "brains." This case presents readers with an opportunity to analyse the critical issues faced by the cofounders of Momenta and provides them with avenues to explore how a fast- growth business could sustain its success in the AI boom. This exam does not have any prescribed structure. Simply focus on answering the questions listed below. Each question is worth 10 marks. Page 2 Exam Question Question 1 (10 marks) Using the VRIO framework, analyse Momenta's key resources and capabilities to explain Momenta's competitive advantage in the Chinese context. Question 2 (10 marks) Discuss what dynamic capabilities have helped Momenta to 'sense to seize and to transform' or/and to 'reconfigure' its competences to exploit new opportunities?

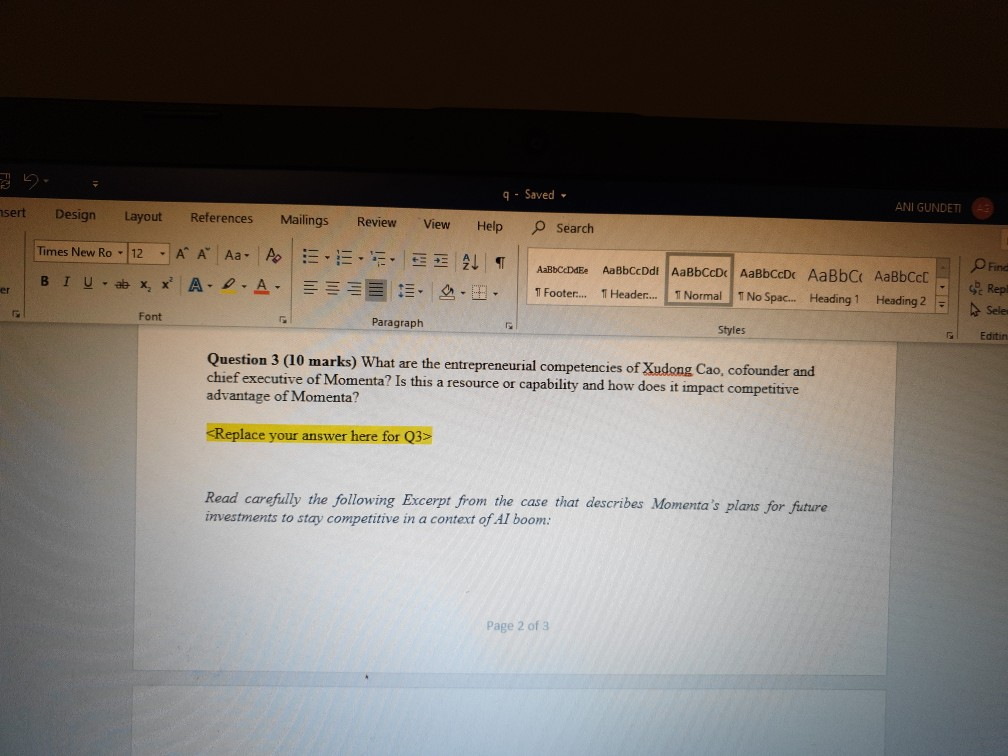

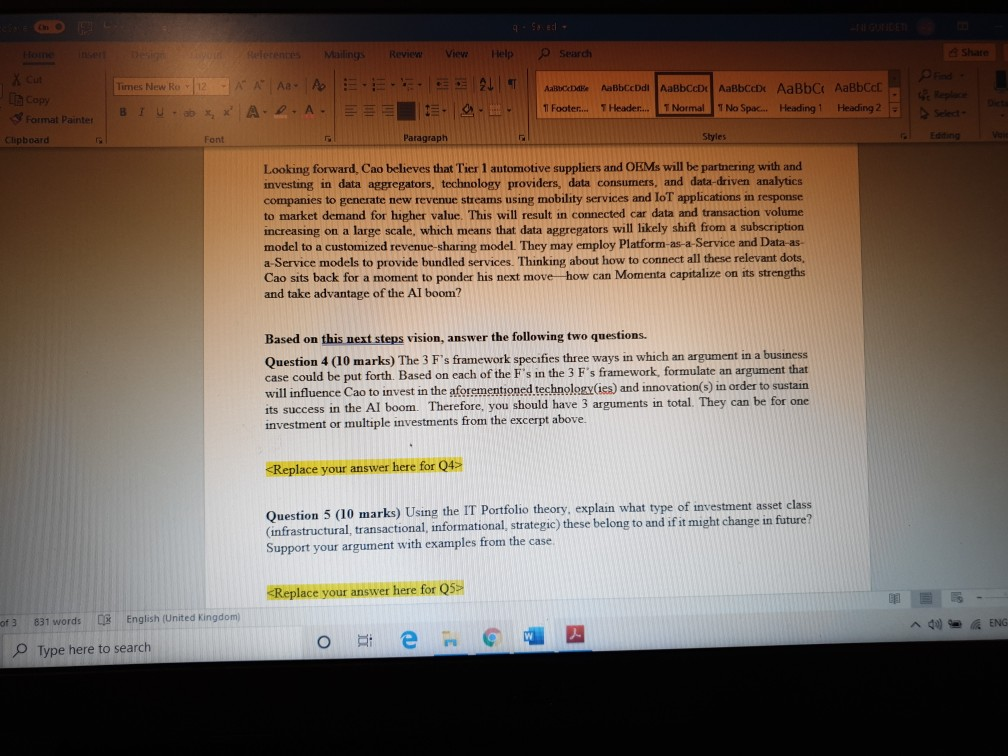

th (United Kingdom) 6 o e 9 - Saved, nsert ANI GUNDETI Design Layout References Mailings Review View Help O Search Times New Ro - 12 - A Aa- PoEEEEE AT A.D.A .... AaBbceDdE Find BIU - ab er X x AaBbCcDdt AalbCcDc AaBbCcDc AaBb C AaBbccc 11 Header... 1 Normal T No Spac... Heading 1 Heading 2 1 Footer.... Rep Sele Font Paragraph Styles Editin Question 3 (10 marks) What are the entrepreneurial competencies of Xudong Cao, cofounder and chief executive of Momenta? Is this a resource or capability and how does it impact competitive advantage of Momenta? Read carefully the following Excerpt from the case that describes Momenta's plans for future investments to stay competitive in a context of Al boom: Page 2 of 3 Mailings Review View Help Search Share Times New Ro | 12 1 AA AB A Cut LCopy Format Painter - 21 19. Akcie AaBbccdi AaBbcc AaBbcc AaBbc AaBbc 11 Footer... 1 Header.... T Normal T No Spac... Heading 1 Heading 2 BIU - ab * * A P.A. 2 Select- Clipboard Font Paragraph Styles Looking forward, Cao believes that Tier 1 automotive suppliers and OEMs will be partnering with and investing in data aggregators, technology providers, data consumers, and data-driven analytics companies to generate new revenue streams using mobility services and IoT applications in response to market demand for higher value. This will result in connected car data and transaction volume increasing on a large scale, which means that data aggregators will likely shift from a subscription model to a customized revenue sharing model. They may employ Platform-as-a-Service and Data-as- a-Service models to provide bundled services. Thinking about how to connect all these relevant dots, Cao sits back for a moment to ponder his next move how can Momenta capitalize on its strengths and take advantage of the AI boom? Based on this next steps vision, answer the following two questions. Question 4 (10 marks) The 3 F's framework specifies three ways in which an argument in a business case could be put forth. Based on each of the F's in the 3 F's framework, formulate an argument that will influence Cao to invest in the aforementioned technology(ies) and innovation(s) in order to sustain its success in the Al boom. Therefore, you should have 3 arguments in total. They can be for one investment or multiple investments from the excerpt above, Question 5 (10 marks) Using the IT Portfolio theory, explain what type of investment asset class (infrastructural transactional informational strategic) these belong to and if it might change in future? Support your argument with examples from the case, of 3 831 words * English (United Kingdom) A4 ENG o re Type here to search Review Help Search mes New Ro | 12 Tab UT ABECEDAE AaBbCcDdi AaBbcc AaBbc AaBbc Aabbcc. 1 Footer... 1 Header.... Normal 1 No Spac.. Heading Heading 2 Font Paragraph Styles Case Study Summary: "Momenta: Sustained Success in the Artificial Intelligence Boom?" This case describes how in less than two years a fast-growth venture became the first autonomous driving unicom startur in China, at a valuation worth USD 1 billion. Specifically, it poses a fundamental question as to how a fast-growth venture continues to stay competitive. Founded in 2016, Momenta is an Artificial Intelligence (AI) and autonomous driving startup based in Beijing, China. Fueled by growth capital investments, Momenta has sped up its technology development in building autonomous driving "brains." This case presents readers with an opportunity to analyse the critical issues faced by the cofounders of Momenta and provides them with avenues to explore how a fast- growth business could sustain its success in the AI boom. This exam does not have any prescribed structure. Simply focus on answering the questions listed below. Each question is worth 10 marks. Page 2 Exam Question Question 1 (10 marks) Using the VRIO framework, analyse Momenta's key resources and capabilities to explain Momenta's competitive advantage in the Chinese context. Question 2 (10 marks) Discuss what dynamic capabilities have helped Momenta to 'sense to seize and to transform' or/and to 'reconfigure' its competences to exploit new opportunities? th (United Kingdom) 6 o e 9 - Saved, nsert ANI GUNDETI Design Layout References Mailings Review View Help O Search Times New Ro - 12 - A Aa- PoEEEEE AT A.D.A .... AaBbceDdE Find BIU - ab er X x AaBbCcDdt AalbCcDc AaBbCcDc AaBb C AaBbccc 11 Header... 1 Normal T No Spac... Heading 1 Heading 2 1 Footer.... Rep Sele Font Paragraph Styles Editin Question 3 (10 marks) What are the entrepreneurial competencies of Xudong Cao, cofounder and chief executive of Momenta? Is this a resource or capability and how does it impact competitive advantage of Momenta? Read carefully the following Excerpt from the case that describes Momenta's plans for future investments to stay competitive in a context of Al boom: Page 2 of 3 Mailings Review View Help Search Share Times New Ro | 12 1 AA AB A Cut LCopy Format Painter - 21 19. Akcie AaBbccdi AaBbcc AaBbcc AaBbc AaBbc 11 Footer... 1 Header.... T Normal T No Spac... Heading 1 Heading 2 BIU - ab * * A P.A. 2 Select- Clipboard Font Paragraph Styles Looking forward, Cao believes that Tier 1 automotive suppliers and OEMs will be partnering with and investing in data aggregators, technology providers, data consumers, and data-driven analytics companies to generate new revenue streams using mobility services and IoT applications in response to market demand for higher value. This will result in connected car data and transaction volume increasing on a large scale, which means that data aggregators will likely shift from a subscription model to a customized revenue sharing model. They may employ Platform-as-a-Service and Data-as- a-Service models to provide bundled services. Thinking about how to connect all these relevant dots, Cao sits back for a moment to ponder his next move how can Momenta capitalize on its strengths and take advantage of the AI boom? Based on this next steps vision, answer the following two questions. Question 4 (10 marks) The 3 F's framework specifies three ways in which an argument in a business case could be put forth. Based on each of the F's in the 3 F's framework, formulate an argument that will influence Cao to invest in the aforementioned technology(ies) and innovation(s) in order to sustain its success in the Al boom. Therefore, you should have 3 arguments in total. They can be for one investment or multiple investments from the excerpt above, Question 5 (10 marks) Using the IT Portfolio theory, explain what type of investment asset class (infrastructural transactional informational strategic) these belong to and if it might change in future? Support your argument with examples from the case, of 3 831 words * English (United Kingdom) A4 ENG o re Type here to search